(Bloomberg) — Democratic lawmakers are risking the ire of voters inflamed by this year’s tax-filing season, as the stalling of President Joe Biden’s priority economic package leaves them bereft of promised benefits.

Embedded in the Build Back Better package were two provisions that Democrats designed so that the effects would be felt immediately by key constituencies: lower-income families, along with wealthier voters in areas with high local taxes, critical to a number of swing districts.

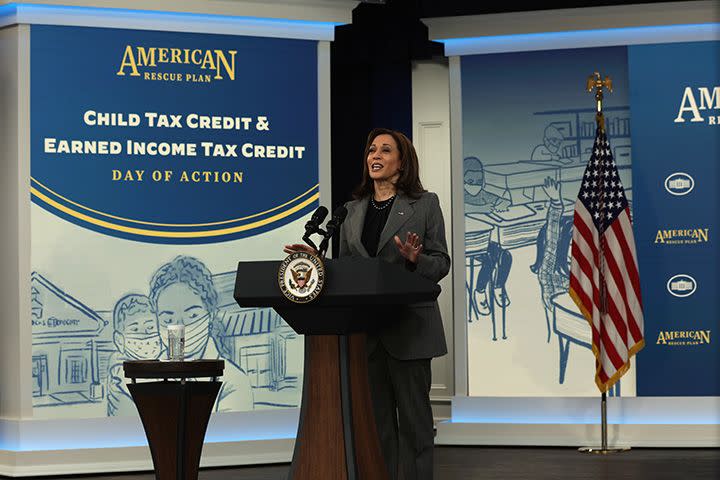

One of the plan’s components was an extension of the monthly child tax credit of up to $300 per kid that Biden included in his March 2020 aid package. The benefit already lapsed last month. Another component was an expansion of the federal deduction for state and local taxes, or SALT, and it was supposed to be retroactive to 2021 — meaning tax refunds would now be flowing as Americans file their returns.

Against a backdrop of surging living costs and a chaotic tax season with little expectation of help from hard-pressed IRS staff, the Democrats’ legislative disappointment risks turning into an electoral one. Analysts see high risk of the party losing its House majority in the November midterm ballots.

“The worst thing you can do in American politics is to give people something and then take it away,” said Brad Bannon, a Democratic strategist who’s worked on electoral politics for almost four decades. “The failure to pass Build Back Better has a negative effect on a lot of families.”

Smaller Refunds

Amid refunds delayed from an Internal Revenue Service that’s been chronically underfunded and working through a backlog of millions of returns, some taxpayers are also finding that the amounts coming back are smaller than anticipated. That’s because of the Biden administration’s switch-over in mid-2021 to monthly child tax credit distributions.

The idea was to help families better match their expenses with their income. But it will mean that the tax credit applied to 2021 returns will be less than it would otherwise have been — something some households might not be fully aware of.

This year’s challenges only compound the fears and anxieties people have about interacting with the IRS and paying their taxes, said Patrice Onwuka, who directs the Center for Economic Opportunity at the Independent Women’s Forum.

Meantime, voters in critical swing districts in the Northeast and in Southern California are still stuck with the $10,000 cap on SALT deductions imposed by President Donald Trump’s 2017 tax overhaul. A group of Democratic lawmakers pledging “No SALT, no deal” had won pledges from top negotiators that the benefit would be made more generous in whatever final package was agreed upon.

Plug Pulled

But moderate Democratic Senator Joe Manchin pulled the plug on Build Back Better in December, with no clear outlook for its resuscitation, most likely in smaller pieces, in the coming months.

The impact of the lapsed tax promises isn’t certain, and some Democrats argue that by fighting for the broad range of measures in the Biden plan, voters will be energized. The package spans strengthened childcare and health-care assistance, along with elder care and a major investment in clean energy.

“The best politics is good policy,” Senate Finance Committee Chairman Ron Wyden told reporters. “And the good policy in this space is making sure you are doing as much as you can for middle class folks who work hard, play by the rules and deserve a fair shake and that affluent people pay their fair share.”

Polls haven’t shown overwhelming support for the expanded, monthly child tax credit, also potentially insulating Democrats from voter ire at its expiration.

Public Indifference

While it was particularly appealing to people who hadn’t had access to it before — because it wasn’t previously available to those families who didn’t owe federal taxes — “overall it was less popular than people had hoped,” said Erica York, an economist at the Tax Foundation.

An NPR/Marist poll from December found that 16% of registered voters said the payments helped them a little, while only 4% said it helped a lot and 76% said they didn’t benefit.

To address voters who are inflamed by their tax situation, there’s always the age-old political trick of blaming political opponents.

“Democrats have to turn that around and say basically the reason we don’t have Build Back Better is that every single Republican member of Congress would have voted against it,” Bannon said.

©2022 Bloomberg L.P.