(Bloomberg) — Farmers in Brazil, the world’s top fertilizer importer, are rushing to secure crop nutrients as the Russian attack on Ukraine spreads fears of a global shortage.

“Farmers are scared, rushing to buy potash,” said Jose Marcos Magalhaes, president of the Minasul co-operative, Brazil’s second-largest coffee exporter.

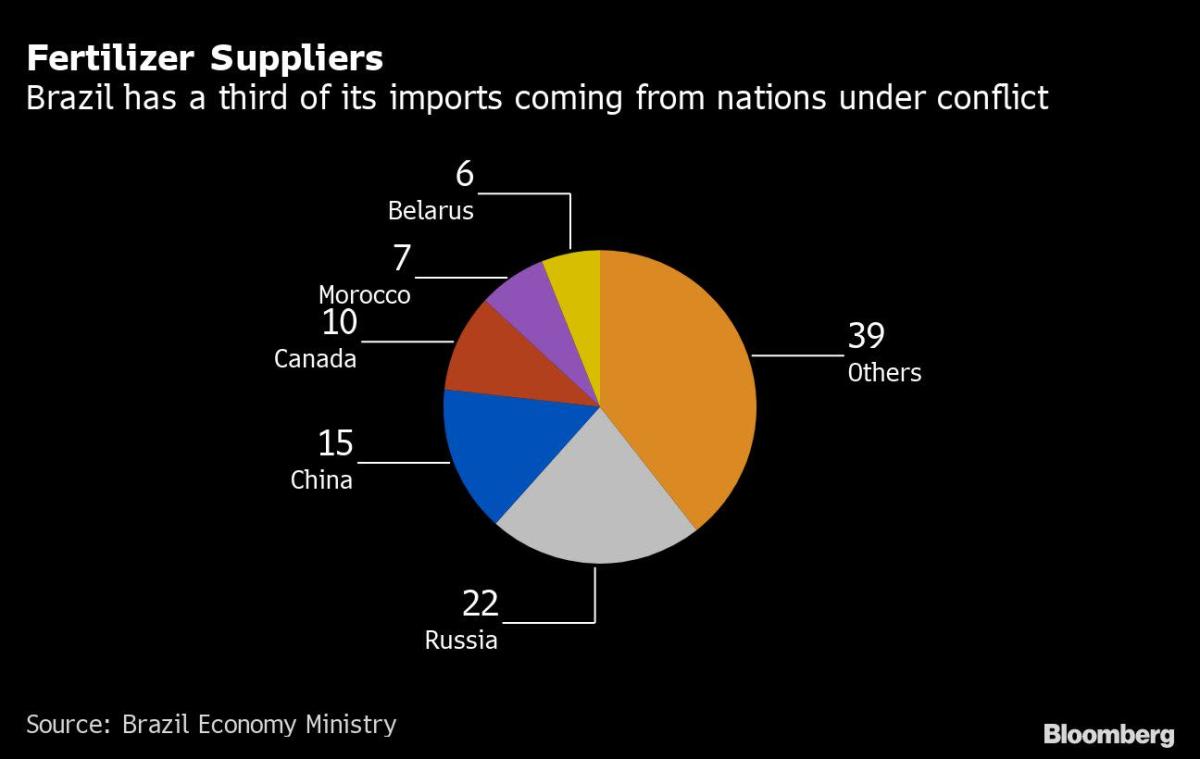

The rush to ensure crop nutrients in Brazil illustrates the shock waves the invasion of Ukraine is sending through agricultural, metal and energy markets. Russia is a key supplier of potash and other crop additives, as well as a major exporter of aluminum, grains, crude oil and natural gas. Brazil, an agriculture powerhouse that leads production of soybeans, coffee and sugar, imports around 80% of its fertilizer needs.

Minasul, which has farm-supplies stores in the southeastern state of Minas Gerais, saw its daily sales of agriculture inputs jump to about 20 million reais ($4 million) on Thursday, from the usual 2 to 3 million reais.

“We made half of February sales in the past couple of days,” Magalhaes said, adding it’s so far been able to meet the surge in demand thanks to its stockpiles.

In Brazil’s far west, farmers haven’t been so lucky. Some grain producers in Mato Grosso state, the nation’s biggest soybean grower, haven’t even been able to get price quotes and delivery estimates from their fertilizer dealerships in the past three days. Importers haven’t received price lists from their overseas suppliers either, according to Jeferson Souza, fertilizer analyst for Agrinvest Commodities.

“Fertilizer prices in the Brazilian market were thrown into uncertainty by Russia’s invasion of Ukraine and may remain unstable into early March,” Marina Cavalcante, an analyst for Bloomberg’s Green Markets, wrote Friday in a report.

Following price increases early in the week, fertilizer suppliers suspended price lists, according to Cavalcante. Market participants are cautious about new negotiations, concerned that further trade restrictions may be imposed, she said.

Brazilian soybean farmers are buying fertilizers for planting that starts in September and are likely to pay higher prices than U.S. producers who have already bought their nutrients, according to Souza.

The group representing fertilizer companies in Brazil, known as Anda, says it’s monitoring the risks of disruptions in the global fertilizer supply chain, including in Brazil.

“Any economic sanctions on Russia will affect fertilizer pricing and availability,” Cavalcante said.

©2022 Bloomberg L.P.