(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Federal Reserve Chair Jerome Powell must strike a delicate balance before Congress in the coming week as he aims to reassure Americans the central bank will confront high inflation at the same time war in Ukraine clouds the economic outlook.

Powell will likely endorse recent signals from his colleagues that the Fed remains on track to raise interest rates in March. Still, Russia’s invasion of its neighbor has injected a dose of uncertainty as the conflict contributes to additional price pressures that risk cooling demand.

While acknowledging the precarious situation, Fed policy makers speaking since the conflict began have played down the grounds for delaying rate liftoff at their March 15-16 meeting — including at least least one who favors a half-point hike if the economic data keep coming in too hot. Investors agree, with a quarter-point move fully priced in for next month.

Data on Friday showed the Fed’s preferred gauge of price pressures jumped 6.1% in January from a year ago, three times the central bank’s 2% target and the most since 1982. Officials get another important piece of evidence on March 4 with the February jobs report.

U.S. employers probably added another 400,000 jobs, while average hourly earnings growth accelerated to 5.8% from a year earlier, based on median projections in a Bloomberg survey of economists. Surveys on manufacturing and services activity are among other key data on the agenda.

Powell, who’s nomination for a second four-year term has been stalled by Republican opposition to President Joe Biden’s selection of Sarah Bloom Raskin for vice chair of supervision, testifies Wednesday before House lawmakers and a day later to senators.

What Bloomberg Economics Says:

“We expect Powell to sound vigilant on inflation, but ultimately favor the gradualist approach to rate hikes due to elevated market uncertainty from the Russia-Ukraine crisis. He will not provide an explicit endorsement of a 50-basis-point hike for the March meeting, in our view.”

–Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger. For full analysis, click here

Elsewhere, global policy makers and investors will be watching developments in Ukraine and their potential to derail an economic recovery already challenged by the omicron wave. The Bank of Canada is expected to start a rate-hiking cycle on Wednesday, and central bankers in Australia, Malaysia, Sri Lanka, Hungary and in Ukraine itself also meet.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Europe, Middle East, Africa

The euro area’s inflation reading for February, due Wednesday, is set to show yet another record number: economists predict the rate hit 5.4%. Price pressures are set to continue with Russia’s invasion of Ukraine having sent oil prices above $100 a barrel for the first time since 2014, threatening an economy that’s also suffering from supply shortages and lingering pandemic curbs.

That jumbles the situation for the European Central Bank, which is expected to chart its policy course at a March 10 meeting. Officials including President Christine Lagarde, Vice President Luis de Guindos, Chief Economist Philip Lane, and Bundesbank President Joachim Nagel may offer some clues when they speak at the start of the week, before the ECB’s quiet period sets in on Thursday, when the account of the February meeting is published.

While rate setters have indicated that the conflict in Ukraine may delay policy normalization, money markets only pared tightening wagers by a whisker, maintaining pricing for a quarter-point hike by October and a 40-basis-point increase by year-end.

That’s all driven by inflation concerns, with one market gauge of euro-area HICP having risen to the highest since the the global financial crisis in 2008.

“Given our expectations for strong labor market and inflation data in coming months, we still see the ECB exit timetable broadly on track for second-half normalization,” wrote Goldman Sachs analysts led by Jari Stehn. But due to the elevated uncertainty, they see risks that their forecast for two 25-basis-point rate hikes this year may be delayed.

Belgian central bank chief Pierre Wunsch said in an interview published Saturday that he agrees with the expectation that the ECB will halt bond purchases in the third quarter and raise rates at the end of this year or early in 2023.

The Bank of England’s next policy meeting isn’t until March 17, when investors expect another 25-basis-point increase. Four BOE policy makers are scheduled to speak Tuesday and Wednesday.

Kenya and Turkey report inflation readings and PMI data across the region are also due.

Asia

Production and retail figures from Japan at the start of the week should offer clues to how serious the omicron variant hit will be for the world’s third-largest economy this quarter. Capital spending data out Wednesday, meanwhile, will be used to revise last quarter’s GDP and will show how buoyant companies were before omicron hit.

Geopolitical concerns will likely add to the cautious stance of the Reserve Bank of Australia when it meets Tuesday, ahead of fourth quarter GDP figures that are also expected to show building momentum in the economy before the variant wave.

South Korea reports February trade Tuesday for February, with preliminary data suggesting continued resilience in global commerce. Prices are expected to keep rising above 3% as flagged by the Bank of Korea at its February meeting.

China’s PMI reports for February will be closely scrutinized as a pulse check on the factory to the world, with regional reports shedding further light on the health of manufacturing as supply chain headaches linger.

Malaysia sets interest rates on Thursday and Sri Lanka does so on Friday.

Latin America

Mexico posts a flurry of month-end data including unemployment, outstanding loans and international reserves before the central bank delivers its quarterly inflation report. Policy makers’ new forecasts and scenarios, reflecting the mid-February jump in headline and core inflation further above the 3% target, are keenly anticipated.

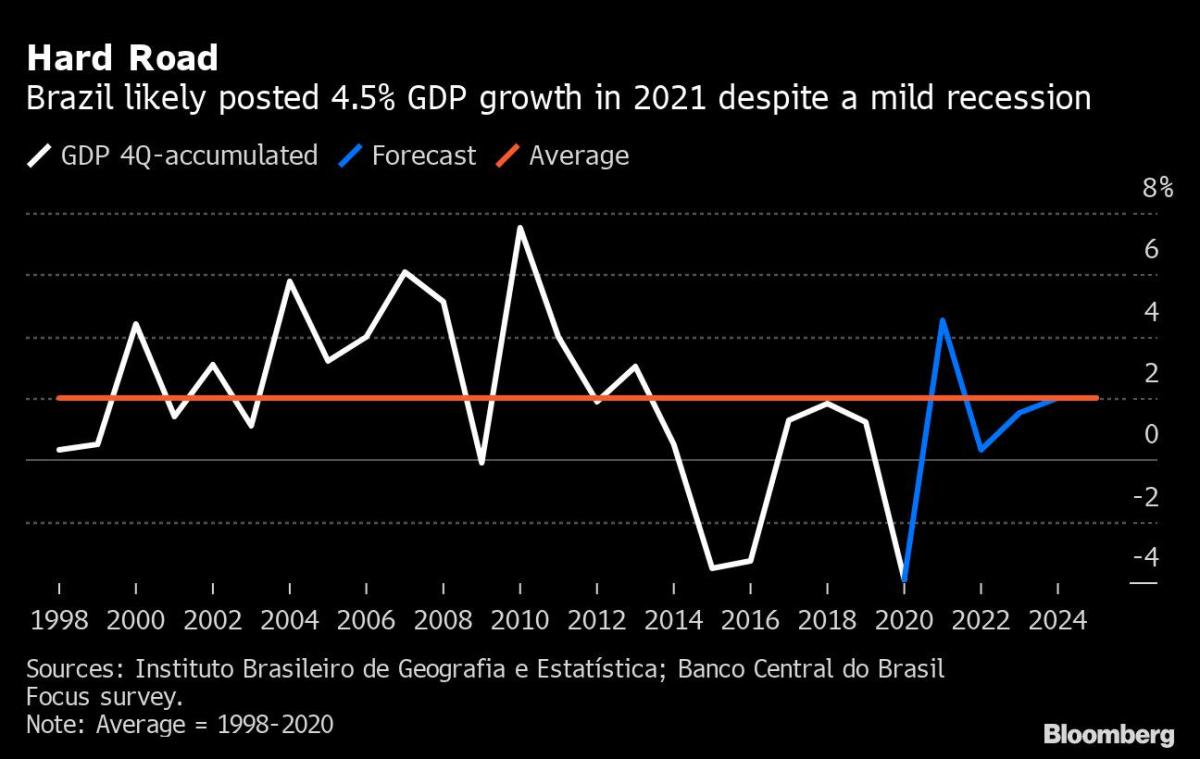

Brazil will report job creation and trade figures before Friday’s posting of fourth-quarter output data that’s expected to show Latin America’s biggest economy narrowly avoiding a third straight quarterly contraction. Analysts forecast just 0.3% growth in 2022 after a comparatively modest expansion of 4.5% in 2021.

While Colombia’s economy is widely seen outperforming regional peers in 2022, that strength has yet to buoy the labor market, prompting forecasts for a 38th straight double-digit unemployment reading in January.

The highlight of Chile’s week is the economic activity indicator for January, given expectations that 2022 growth will decelerate dramatically after a forecast 12% expansion in 2021. Manufacturing and industrial production have already come off the boil, retail sales have posted 10 consecutive double-digit readings, and unemployment has fallen back to pre-pandemic levels.

Peru’s February consumer price data may show a move back up after January’s sharp decline, mirroring the re-acceleration seen in Mexico and Brazil.

©2022 Bloomberg L.P.