(Bloomberg) — Traders piled into options that oil could surge even further after rising to the highest since 2008, with some even placing low-cost bets that futures will rise above $200 before the end of March.

Prices to buy call options for higher crude prices surged Monday as the market assessed the possibility of a supply cut-off from Russia, one of the world’s biggest exporters. At least 200 contracts for the option to buy May Brent futures at $200 a barrel traded on Monday, according to ICE Futures Europe data. The options expire March 28, three days before the contract settles. The price to buy them jumped 152% to $2.39 a barrel.

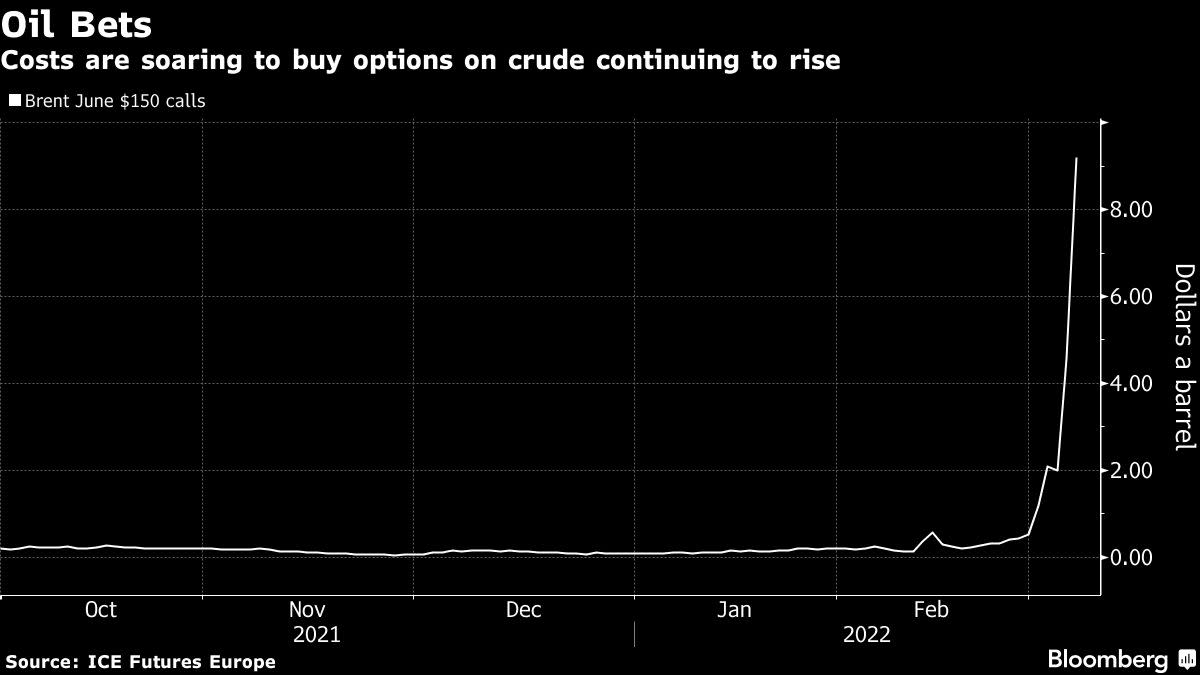

A $150-a-barrel call option for the June Brent contract doubled from Friday, according to ICE, while the cost of $180 call options jumped 110%. The front-month May contract for Brent surged dramatically early on Monday as traders panicked over talks of a Russian crude ban amid Libyan supply disruptions and delays to expected progress in Iranian nuclear talks.

JPMorgan Chase & Co said last week that Brent crude could end the year at $185 a barrel should Russian supplies continue to be disrupted, while Australia & New Zealand Banking Group Ltd. saw around 5 million barrels a day of pipeline and seaborne oil supplies being impacted by new sanctions.

Russia is the world’s third-largest oil producer behind the U.S. and Saudi Arabia. The OPEC+ member exported 7.8 million barrels a day of crude, condensate and oil products in December last year, according to the International Energy Agency, supplying key fuels such as diesel, fuel oil, vacuum gasoil and a petrochemical feedstock known as naphtha to buyers across Europe, the U.S. and Asia.

©2022 Bloomberg L.P.