(Bloomberg) — As equity markets sink around the world, Morgan Stanley and Citigroup Inc. strategists say a perfect storm looks to be gathering.

“Downside risk remains most acute over the next 6-8 weeks,” Morgan Stanley’s Michael Wilson wrote in a note to clients. “We are firmly in the grasp of a bear market that is incomplete in both time and price.”

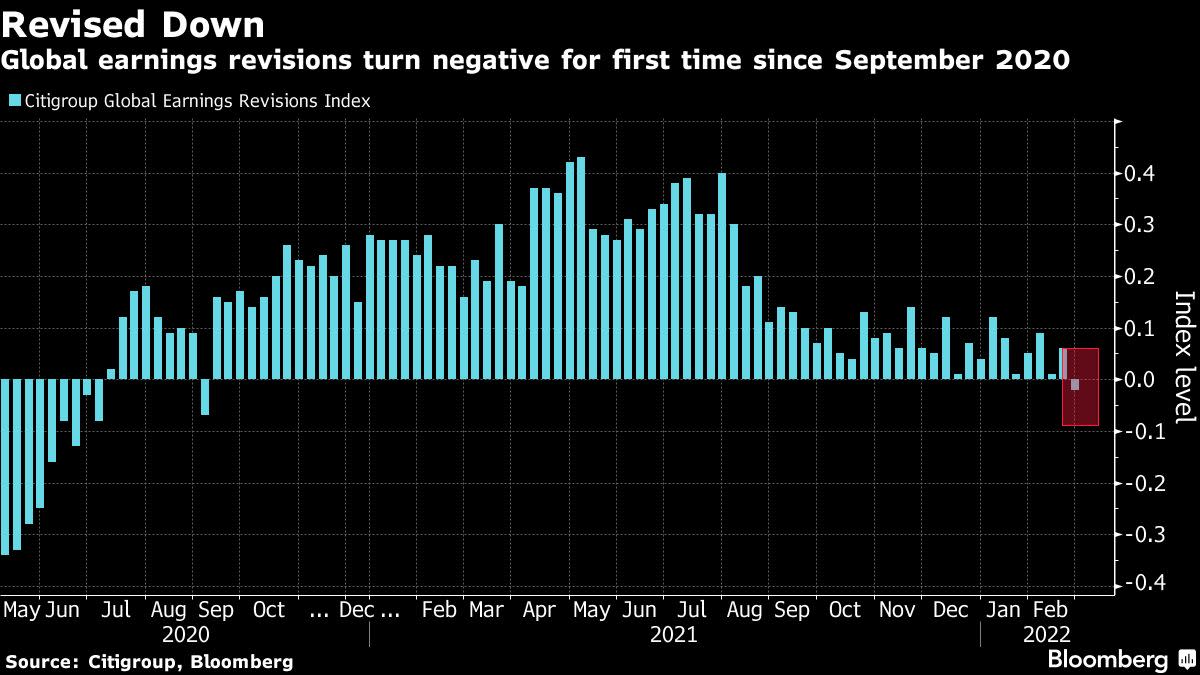

Separately, Citi strategists led by Jamie Fahy said a global gauge tracking analyst estimates on corporate profits has turned negative for the first time since September 2020. This is a potential “game-changer,” eroding their conviction on the prospects of risk assets, they wrote.

Earnings delivery is “paramount” at a time when liquidity is being sucked out by central banks across the world, the Citi strategists said. “Removing this support could leave some indices floating on air.”

A ferocious rally in developed market stocks came to an abrupt end at the start of this year amid concerns that record inflation readings will cause central banks to aggressively tighten policy. Russia’s invasion of Ukraine triggered another spike in commodity prices, adding to fears that economies are heading to a stagflationary shock.

Several major benchmark gauges across Europe have dropped more than 20% from their recent highs, while the S&P 500 is hovering around a 10% correction. With gas and oil prices soaring, Citi and Morgan Stanley strategists say “demand destruction” may now be unavoidable.

Optimists Wavering

“Any relief should be sold,” said Wilson. “We recommend staying defensively oriented by running less risk than normal and searching for companies with superior operational efficiency and earnings stability.”

While the Morgan Stanley strategist has consistently been one of Wall Street’s most outspoken bears, even optimists are now wavering.

UBS Global Wealth Management downgraded global and euro-area equities to neutral on Monday, saying Russia’s invasion of Ukraine “has broadened the probability of distribution to equity market outcomes.”

©2022 Bloomberg L.P.