(Bloomberg) — Asian stocks and U.S. equity futures climbed Monday, while Treasures fell, as traders weighed inflation risks from commodity-supply disruptions and braced for the Federal Reserve to hike interest rates this week.

Japanese shares rose along with S&P 500, Nasdaq 100 and European contracts, providing some respite from selloffs spurred by Russia’s invasion of Ukraine. Investors were parsing efforts at diplomacy to tackle the conflict, as well as comments from a U.S. official that Russia asked China for military equipment.

Treasuries extended a rout, taking the five-year U.S. yield above 2% for the first time since May 2019. The Fed on Wednesday is expected to begin a cycle of rate increases to tame inflation, starting with a 25 basis-points move.

Price pressures were already high before the war in Ukraine, and the isolation of resource-rich Russia, stoked commodity costs. Brent crude shed about 2% but remained near $110 a barrel.

The dollar was steady and the yen slipped. Russia’s ruble was indicated slightly stronger versus the greenback. Gold retreated further from $2,000 an ounce.

Last week’s plunge in U.S.-listed Chinese shares threatens to sap the mood in Hong Kong. The Nasdaq Golden Dragon China Index sank 10% on Friday.

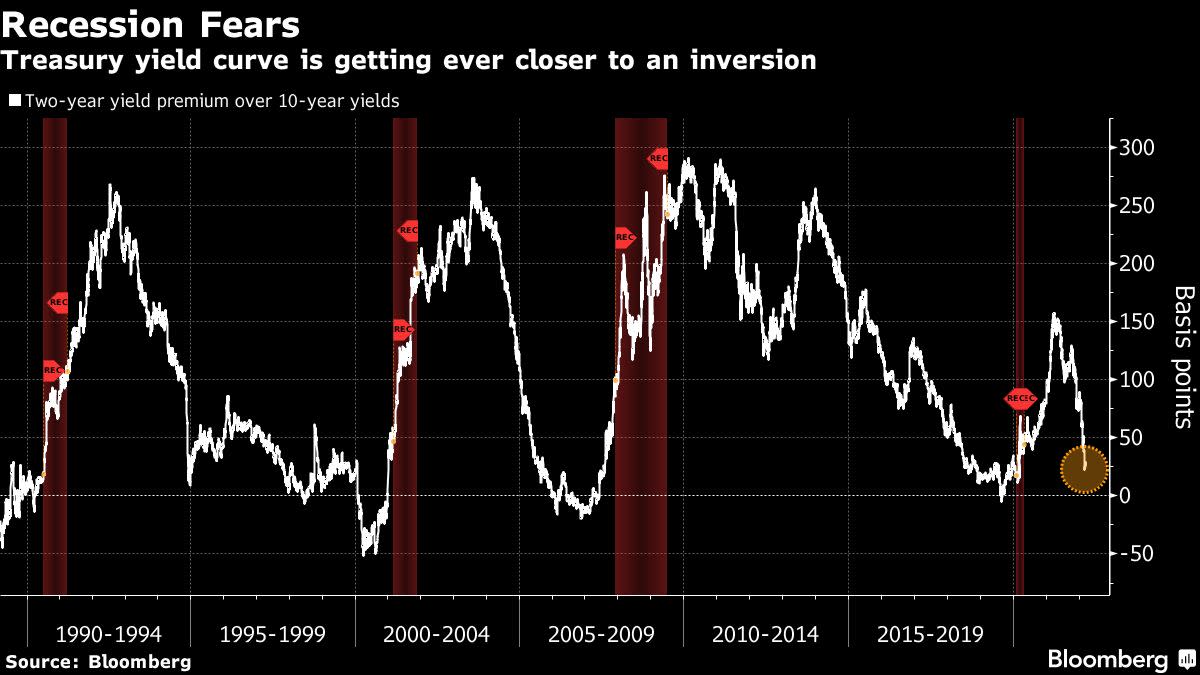

The flattening U.S. Treasury yield curve, and a 12% drop in global stocks this year, signal worries that receding stimulus and elevated energy, grain and metal costs may choke the world economic recovery. Investors are also waiting to see if Russia defaults on its international debt after losing access to almost half of its foreign exchange reserves.

“We are experiencing extraordinary volatility in global equities compounded by wavering market sentiment, and the risk of recession intensifies on spiraling commodity prices,” Louise Dudley, portfolio manager for global equities at Federated Hermes, wrote in a note. “We expect ongoing swings in the short term as geopolitical uncertainty over Russian crude persists.”

The Fed is the drawcard among eight Group of 20 members whose monetary officials are due this week to assess economic prospects.

‘Stuck’ Fed

The Fed “are really stuck between the real economy and the financial economy,” Karen Harris, Bain & Co. global head of macro research, said on Bloomberg Television. “You have mainstream struggling with inflation — that’s why we are set to see these rises coming in March. On the other side we are trying not to prick the financial economy. Either path is deflationary, recessionary.”

Meanwhile, senior U.S. and China officials are set to meet Monday to discuss Ukraine. Russian missiles hit a military training facility in western Ukraine close to Poland, raising new concerns about the conflict potentially spilling over Ukraine’s borders.

China and Hong Kong are also contending with rising Covid cases. Authorities have put the southern city of Shenzhen into a lockdown. The outbreak and disappointing bank lending data have stirred expectations of more policy easing to support China’s economy.

In cryptocurrencies, Bitcoin fell and was trading below $38,000.

Here are some key events to watch this week:

- China one-year medium-term lending facility rate, economic activity data, Tuesday

- EIA crude oil inventory report, Wednesday

- FOMC rate decision and Fed Chair Jerome Powell news conference, Wednesday

- Bank of England rate decision, Thursday

- ECB President Christine Lagarde, Executive Board member Isabel Schnabel, Governing Council member Ignazio Visco and Chief Economist Philip Lane speak at a conference, Thursday

- Bank of Japan rate decision, Friday

For more markets news, follow our Markets Live blog.

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.8% as of 9:33 a.m. in Tokyo. The S&P 500 fell 1.3% Friday

- Nasdaq 100 contracts rose 0.7%. The Nasdaq 100 fell 2.1% Friday

- Japan’s Topix index gained 1%

- Australia’s S&P/ASX 200 Index rose 1%

- South Korea’s Kospi index fell 0.3%

Currencies

- The Japanese yen traded at 117.57 per dollar, down 0.2%

- The offshore yuan was at 6.3608 per dollar

- The Bloomberg Dollar Spot Index was steady

- The euro was at $1.0926, up 0.1%

Bonds

Commodities

- West Texas Intermediate crude fell 2.6% to $106.53 a barrel

- Gold fell 0.8% to $1,972.74 an ounce

©2022 Bloomberg L.P.