The Tech sector has enjoyed a lion’s share of attention among all segments of the economy for a number of years. Throughout the pandemic, that attention only seemed both intensified and justified, as technology companies provided the tools that allowed much of corporate America to keep things going by shifting their workforces to remote working models. That motivated investors to buy those stocks enthusiastically, which is a big reason that the sector not only moved past its pre-pandemic highs, but surged more than 40% from that high-water mark to establish a new all-time high in April of this year, as measured by the S&P 500 Technology SPDR ETF (XLK). Despite that big upward move, there were some stocks that definitely did not keep pace. That is always true in any sector, no matter what the broad sector momentum looks like; there are always individual companies that will diverge from the normal pattern.

For example, since early 2020, companies that focus on the “enterprise” space – where most corporate tech spending has traditionally gone, for products like servers, computers, printers, and the tools to connect them all in a traditional network setting, for example – have struggled to keep up.

Some analysts have speculated how much of the work-from-home element of corporate operations will become a permanent part of business life, which means that some of the capital normally allocated to in-office tech solutions are likely to stay allocated to solutions and services that continue to facilitate remote work. Even so, there are also signs that for many businesses, back-in-office is becoming an increasing expectation. That could mean that while many of the companies that operate in the Enterprise space could continue to be pressured for the time being, revenues and earnings in many cases have also likely begun their own recovery.

Current geopolitical, economic and market conditions are dealing with a lot of other pressures right now, with the pace of inflation in the U.S. that has prompted the Fed to raise rates for the first time in about four years and Russia’s invasion of Ukraine taking center stage. How how elements play into the fortunes of companies in the Tech sector for the rest of 2022 certainly remain uncertain, but could certainly act as a global headwind to economic health and growth.

That brings us to today’s highlight. Hewlett Packard Enterprise Co. (HPE) is a spin off of Hewlett Packard Corporation (HPQ), and a business that is among those companies that underperformed through most of 2020, falling from a pre-pandemic high at around $16.50 at the end of 2019 to a March low at around $7.40. It mostly hovered within a couple of dollars of that low until November 2020, when the stock started picking up a lot of bullish momentum; in fact, from that starting point a little above $8 in November, the stock rallied to $12 per share by the end of 2020. From that point, the momentum accelerated even more, pushing the stock to a consolidation range a little above the stock’s pre-pandemic highs, and a little below $17 in June.

After cycling back to a low around $13 in September 2021, the stock moved into a pretty solid upward trend that peaked in mid-February at around $18. From that point, broader market fears pushed the stock into a new retracement, where it found its latest bottom at around $15 to start this month, and has been picking up momentum since then to drive to a current price a little below $17. This is a company that saw some material improvements in its fundamental strength and its value proposition as 2021 came to close. With a new set of earnings data in the books from its latest report, the question now is whether those strengths remain in place? If they are, HPE could be a good stock to think about using for a functional, value-based investment right now.

Fundamental and Value Profile

Hewlett Packard Enterprise Company (HPE) is an edge-to-cloud platform-as-a-service company. The Company’s segments include Compute, High Performance Compute & Mission-Critical Systems (HPC & MCS), Storage, Advisory and Professional Services (A & PS), Intelligent Edge, Financial Services (FS), and Corporate Investments. The Compute portfolio offers both general-purpose servers for multi-workload computing and workload-optimized servers. HPC & MCS portfolio offers workload-optimized servers designed to support specific use cases. FS provides investment solutions, such as leasing, financing, information technology (IT) consumption, and utility programs and asset management services, for customers that facilitate technology deployment models and the acquisition of complete IT solutions, including hardware, software and services from HPE and others. Corporate Investments include Hewlett Packard Labs, which is responsible for research and development. HPE has a current market cap of $21.5 billion.

Earnings and Sales Growth: Over the past year, earnings increased more than 129%, while sales increased by 1.87%. In the last quarter, earnings we were about -79.6% lower, while sales also declined by -5.34%. The company operated with a narrow margin profile through 2020 that saw big improvements in 2021, but is showing signs of deterioration in the last quarter; over the last twelve months, Net Income was 13.32% of Revenues, and decreased to 7.37% in the last quarter.

Free Cash Flow: HPE’s Free Cash Flow is healthy, at more than $2.58 billion. On a Free Cash Flow Yield basis, that translates to 11.88%. A year ago, Free Cash Flow was $2.08 billion. The improvement over the course of the year is a good indication of the company’s ability to survive the pandemic and to emerge in a stronger position than it was in when it started, however it is also worth noting that Free Cash Flow was $3.7 billion in the last quarter.

Debt to Equity: HPE has a debt/equity ratio of .50, which is a conservative number. Their balance sheet shows about $3.8 billion in cash against a little less than $10.3 billion in long-term debt. Their operating profits are adequate to service their debt, with health financial flexibility as well, however the latest quarter’s declines in Net Income and Free Cash Flow could act as drags on the company’s liquidity.

Dividend: HPE pays a dividend of $.48 per share, which translates to an annual yield of about 2.87% at the stock’s current price. I think that it is also noteworthy that the company has not cut or reduced their dividend; in fact it remains a bit above the $.44 per share payout they maintained until the beginning of 2020, when management increased the dividend to its current level.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $21.25 per share. That suggests that HPE’s stock is undervalued, with about 27% upside from its current price.

Technical Profile

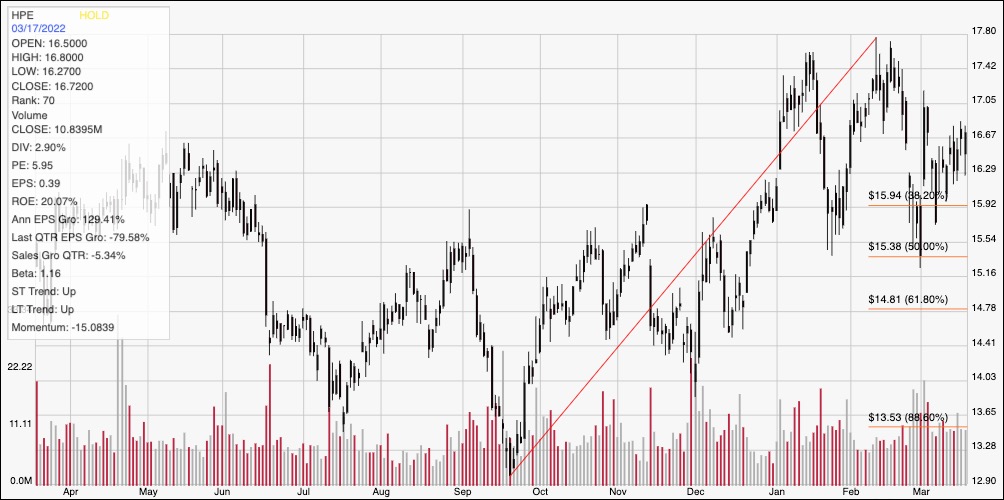

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above traces the last year of price activity for HPE. The red diagonal line traces the stock’s upward trend from a low point in September 2021 at around $13 to its peak in February a little below $18. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After dropping to the 38.2% retracement line around $16 to start this month, the stock has bounced off of that level, which marks current support at $16, and has been rallying since. Immediate resistance should be a little the stock’s current price at around $17. A push above $17 should have momentum to retest the stock’s 52-week high at around $18, with additional upside to around $19 if buying momentum persists. A drop below $16 should find next support at around $15.50 based on pivot high activity seen in October and November of last year, and a pivot low in January at around that level. It is also just a little above the 50% retracement line at around $15. The stock would need to drop below about $14.50 to build enough bearish momentum to test the stock’s 52-week low at around $13.

Near-term Keys: HPE has been pretty choppy for the last few months as it established new 52-week highs to start the year before capitulating to broader market conditions. The stock’s recent rally could be setting a short-term, bullish trading opportunity; a push above $17 could provide a signal to think about buying the stock or working with call options, so long as you keep an eye on $18 as a quick profit target, and $19 in the event that buying momentum accelerates. A drop below $15.50 has limited downside, which makes a short-term, bearish trade with put options or by shorting the stock a pretty low-probability set up. The stock’s value proposition, in the meantime if very attractive, however I do see the last quarter’s declines in Free Cash Flow, Net Income, and immediate liquidity as potential red flags to pay attention to. Those could be somewhat cyclical concerns, driven by sector-wide supply disruptions. If you’re willing to be patient, the stock could offer an interesting, value-based opportunity, however in the near-term the stock could continue to see high levels of volatility.