In my opinion, one of the really surprising stories of the past two years has been not only the resilience, but the simple outperformance of the real estate industry. Despite the global COVID-19 pandemic and all of the complications that have accompanied it, and that some now say we may never fully get away from, the housing market through much of the United States has been a source of strength. In fact, one of the pandemic-related trends that has helped things move along is the migration by many homeowners away from coastal regions of the U.S. further inland, to less urban areas. That has helped real estate and housing prices in a lot of those areas see significant increases – the national average as of last month showed an 18.7% increase in the price of new homes, while other areas have seen even larger increases.

That housing boom has helped a lot of companies in the Homebuilding industry show some very impressive results over that time period. One of the largest builders of luxury homes in the U.S., Toll Brothers (TOL) has also tapped into homebuyers looking to move up.

Perhaps from their first starter home, as well as empty nesters who are ready to move on from the home they raised a family in. These are generally more affluent buyers, and even as supply chain issues have raised prices, TOL has largely been able to pass those input cost increases on by raising their home prices, and manage what costs they can by being deliberate in managing their pace of construction.

This is a company with a fundamental profile that includes healthy Free Cash Flow, liquidity and operating profits, along with manageable debt and a dividend that survived the pandemic and has actually increased appreciably from about $.44 per share in 2019, to its current level. From the latter part of 2021 to today, the stock has fallen significantly off of a high at around $75 and is sitting around $51 as of this writing. Some of that decline can certainly be tied to concerns about rising input costs, as well as first of multiple expected interest rate increases that came last week. Since how long rising housing prices can be sustained is an open question, especially when rates are going up, the stock’s current price can be seen as either an opportunity to buy an interesting company at a nice price, or a gamble on an industry that could be on the cusp of tough times ahead. Which is it? Let’s try to find out.

Fundamental and Value Profile

Toll Brothers, Inc. is engaged in designing, building, marketing, selling and arranging financing for detached and attached homes in luxury residential communities. The Company operates through two segments: Traditional Home Building and Toll Brothers City Living (City Living). Within the Traditional Home Building segment, it operates in five geographic segments in the United States: the North, consisting of Connecticut, Illinois, Massachusetts, Michigan, Minnesota, New Jersey and New York; the Mid-Atlantic, consisting of Delaware, Maryland, Pennsylvania and Virginia; the South, consisting of Florida, North Carolina and Texas; the West, consisting of Arizona, Colorado, Nevada and Washington, and California. City Living is the Company’s urban development division. Its products include Traditional Home Building Product and City Living Product. Its Traditional Home Building Product includes detached homes, move-up, executive, estate, and active-adult and age-qualified lines of home. TOL has a current market cap of about $5.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by a little more than 63%, while revenues grew 14.56%. In the last quarter, earnings declined by almost -59% while sales decreased a little over -41%. TOL’s healthy margin profile is showing some signs of decline; over the last twelve months, Net Income was 9.86% of Revenues, and declined somewhat in the last quarter, but remains healthy at 8.48% in the last quarter.

Free Cash Flow: TOL’s free cash flow is healthy, at $897.31 million and translates to a very nice Free Cash Flow Yield of 14.64%. That number has declined from a little over $1.3 billion in the last quarter, which is a concern.

Debt to Equity: TOL has a debt/equity ratio of 0.61. This is a conservative number, and the company’s operating profile indicates that profits are sufficient to service their debt. The company’s balance sheet also shows $671 million in cash and liquid assets against $3.1 billion in long-term debt. There is a red flag that coincides with both the decline in Free Cash Flow and Net Income; two quarters ago, cash and liquid assets were $1.65 billion. I take all three together as a reflection of the rise in supply chain costs that the entire industry is dealing with, and that the company is mostly passing through by raising housing prices; but raising prices to offset those costs begs the question of the sustainability of revenues and is one of the things I think can be attributed to the latest decrease in Net Income.

Dividend: TOL’s annual divided is $.80 per share, which translates to a yield of 1.57% at the stock’s current price. In early 2021, management increased the dividend from $.44 per share, per annum to $.68 per share, with the latest increase announced after the last earnings report. An increasing dividend is a strong sign of management’s confidence.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $67 per share. That suggests that TOL is nicely undervalued, with 33% upside from its current price.

Technical Profile

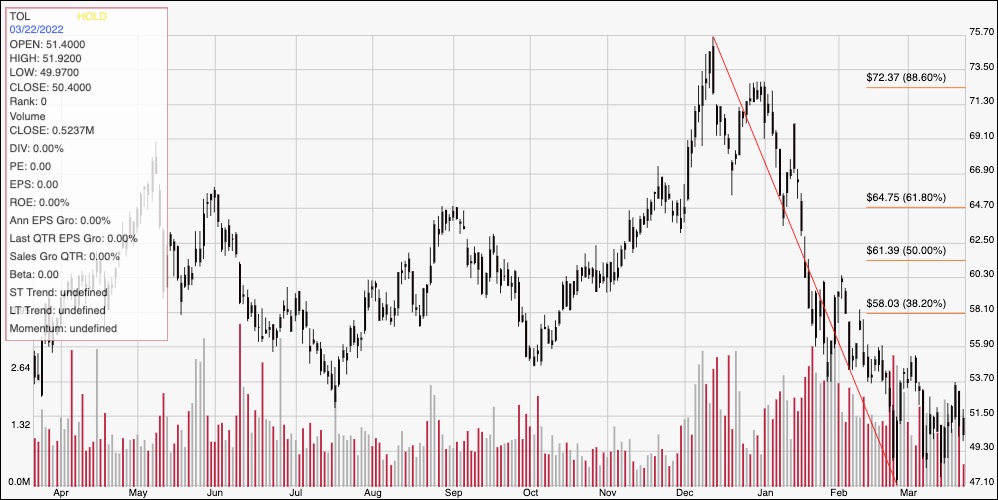

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend beginning in December of last year, when the stock peaked at aorund $76, to its low in late February at around $47; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. From that low point, the stock has mostly appeared to stabilize, with current support sitting at around $50, and immediate resistance at the last peak around $54. A push above $54 could have upside to between $56 and $58, depending on how much buying enthusiasm goes along with it, while a drop below $50 will have next support at around $47. If selling pressure picks up, downside could be to about $43.50, based on pivot activity last seen in December 2020.

Near-term Keys: TOL has a solid value proposition – enough, even to make the stock a tempting target for a value-focused investor like myself. I do think that the current market environment makes this stock a bit of a reach, at a time when a rising number of factors could begin working against the company’s fortunes. That suggests that the best probabilities to work with this stock are in short-term trading opportunities. A bounce off of current support at around $50 could be an aggressive signal to consider buying the stock or working with call options, using $54 to $56 as useful profit targets on a bullish trade. A drop below $50, on the other hand could be a good signal to consider shorting the stock or buying put options, with $47 to $43 offering interesting profit targets on a bearish trade.