(Bloomberg) — War, inflation and the lingering impact of a global disease made the first quarter a historically rough one for stock and bond investors.

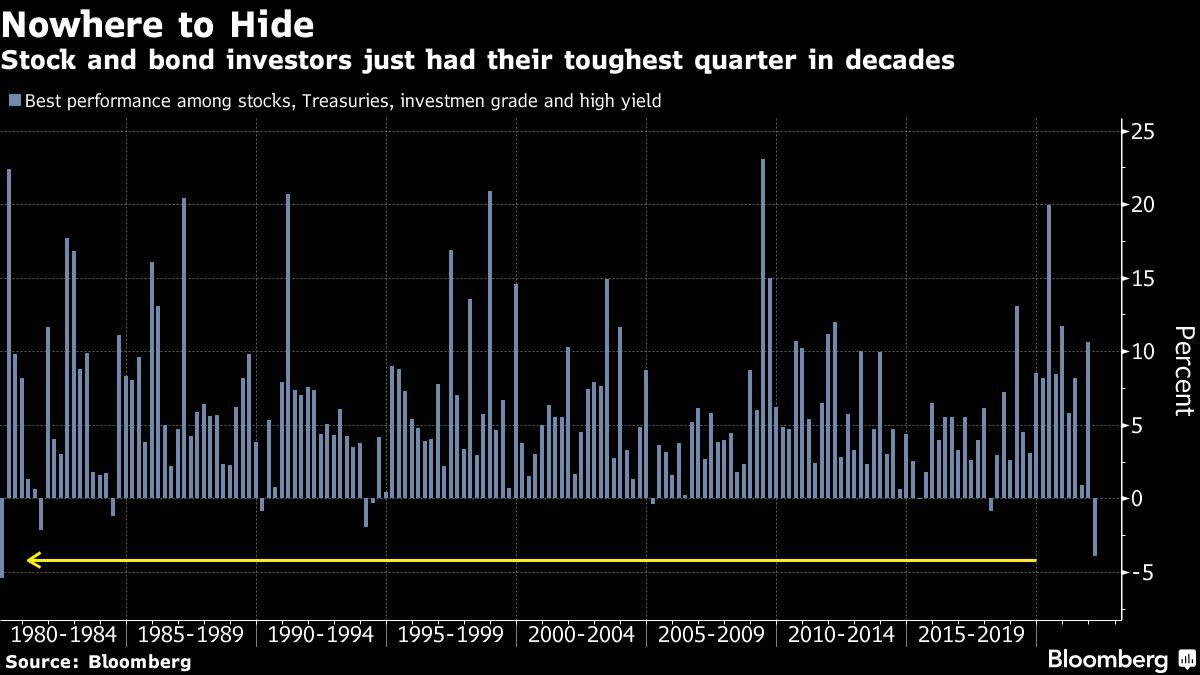

Across equity and fixed-income markets broadly, the least-bad performance among U.S. assets were declines of 4.9% in the S&P 500 and speculative credit. They were followed by a 5.6% fall in Treasuries and a 7.8% slide in investment grade. Not since 1980 has the best return among those four categories been so paltry, data compiled by Bloomberg show.

Numerous periods have obviously been far worse for specific sectors. This quarter’s retreat in equities pales in comparison to the 20% drubbing they took at the start of 2020. But viewed as a whole — and leaving out commodities, which soared — the new year has been a futile one for an investor seeking shelter from the global storm.

Things “really came together in a cocktail of bad timing between the high inflation, the Fed looking to tighten monetary policy in a hawkish manner,” said Fiona Cincotta, senior market analyst at City Index, by phone. “And throw into that the uncertainty for Putin’s war and what that means for energy and oil prices, which still need to ripple out in the economy, there is definitely more bad news to come.”

More than $3 trillion was erased from bond and equity values in the first quarter as the Federal Reserve raised interest rates for the first time since 2018. With traders quickly adjusting to a more hawkish central bank, parts of Treasury yield curves inverted, with long-dated rates falling below short-dated ones — a development that many investors view as flashing warnings that the economy may head into a recession.

Stocks also got off to a rough start. The S&P 500 suffered a peak-to-trough slide of 13% at its worst, while the tech-heavy Nasdaq 100 and the Russell 2000 of small-caps each entered a bear-market decline of 20%. Thanks in part to growing optimism that stocks may serve as a hedge against inflation, the market bounced back in the last two weeks and generally outperformed bonds, based on data through March 30.

The dire performance was a new experience for the majority of investors who park their money in stocks and bonds. The concerted selloff is particularly bad news for the popular 60/40 portfolio strategy that aims to perform well through the benefit of diversification and is widely followed by balanced mutual funds and pensions.

A Bloomberg model tracking a portfolio of 60% stocks and 40% fixed-income securities dropped 4.6% as of Wednesday, all but certain to notch the first quarterly loss in two years.

“No one’s happy, right?” Rob Haworth, senior investment strategy director at U.S. Bank Wealth Management, said by phone. “Interestingly, from a relative perspective, you’ve been even happier owning stocks than bonds, and I think it means you need to complement those with real assets.”

The only major asset that’s booming is commodities. From oil to copper to wheat, the prices of basic materials have surged as a supply crunch was exacerbated by Russia’s invasion of Ukraine. The Bloomberg Commodity Index jumped 25% for the best quarter since 1990.

Missing a rally of that size in one area of the market can be disastrous for an asset allocator. This was the first time in at least four decades when the best-performing asset was up that much while all the other returned losses.

To Jason Pride, chief investment officer of private wealth at Glenmede, how markets will perform from here largely hinges on the Fed’s path for monetary policy.

“It’s a function of the Fed taking the punch bowl away,” Pride said by phone. “We’ve kind of gone through the the Russia-Ukraine correction and the rebound. But that’s basically opened us up to the Federal Reserve being able to hit this market pretty hard. And they have to in order to establish their credibility on the inflation fighting front.”

Jeff Mortimer, director of investment strategy at BNY Mellon Wealth Management, is optimistic, saying the S&P 500’s ability to recover more than half its losses is a sign of resilience.

“As you get into late 2022 and into 2023, it’s possible that you’re in a lower inflationary environment naturally, both because of what the Fed has done, and perhaps supply chains get better, perhaps omicron or Covid-19 get put behind us,” he said in an interview on Bloomberg Radio. “And you might see yourself in a world in which you have low inflation, decent growth, a Fed which has most of its work behind it, and decent valuations in stocks.”

©2022 Bloomberg L.P.