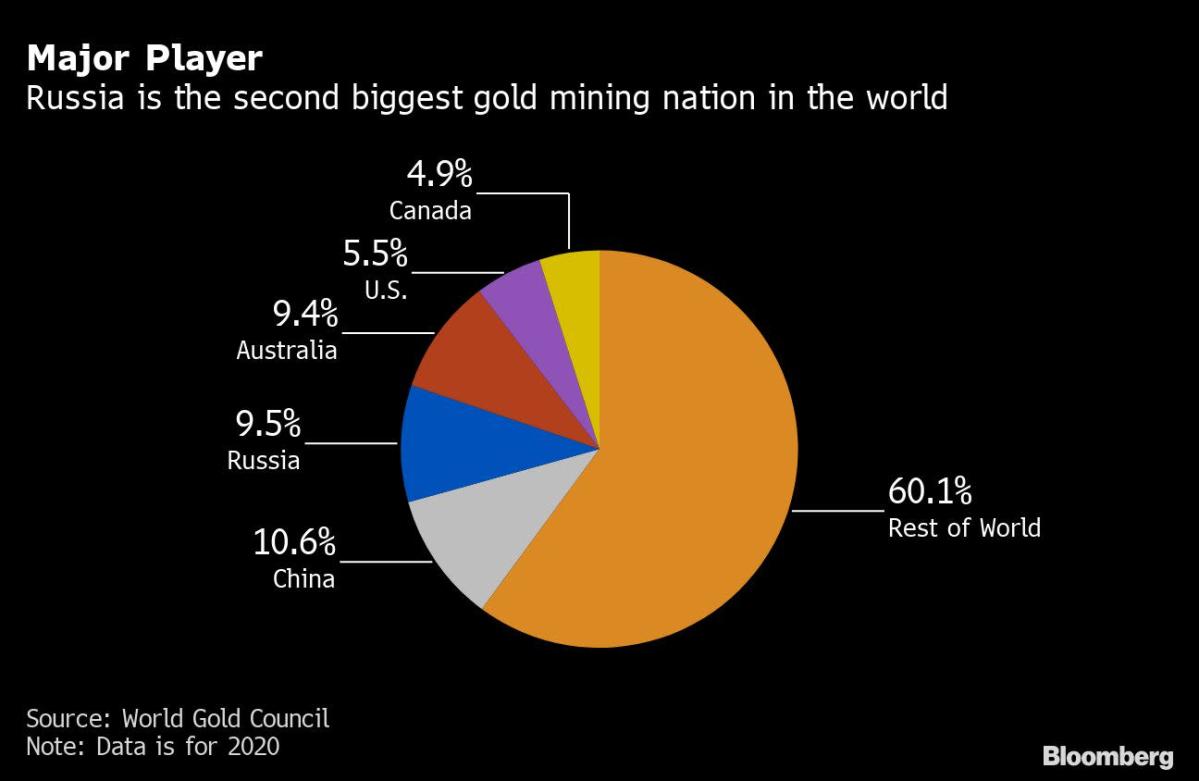

(Bloomberg) — Russia’s huge gold industry is searching for new ways to sell its metal, such as exporting more to China and the Middle East, as sanctions choke off its traditional sales routes.

The second-biggest bullion miner is finding European and U.S. markets largely closed because of a ban on newly produced Russian gold, and some refineries are refusing to remelt old bars. The country’s miners have typically sold to a few — mostly state-run — local banks such as VTB Bank PJSC and Bank Otkritie, which then export the metal, or until recent years to the central bank.

But sanctions mean that selling to those banks is now not an option, and although the Bank of Russia said it will start purchasing gold again after a two-year pause, it isn’t expected to buy as much as it used to.

That’s left Russia’s gold sector wondering how to sell the roughly 340 tons it mines each year that’s worth about $20 billion. There aren’t many non-sanctioned banks that can realistically handle such volumes. And while the government granted miners general export licenses two years ago that allow them to export directly, few have used the process so far because they’ve preferred to rely on banks’ sales infrastructure.

That may soon change though, as Russian miners are considering direct exports, and both producers and lenders are exploring sales in Asia and the Middle East, according to people familiar with the matter.

Polymetal International Plc is one producer looking to use direct exports, with opportunities for sales to the United Arab Emirates and China, a spokesman said. Some other large miners have started talks with Chinese and UAE-based companies as well, according to two people familiar with the matter, who asked not to be identified as the information isn’t public.

The Bank of Russia was once the biggest sovereign buyer of gold, scooping up almost all of the country’s mined output before it paused purchases in early 2020. Its pledge to start buying again will help absorb some of the supply that can’t be exported.

“There are very good budget revenues,” said Natalia Orlova, economist at Alfa-Bank. “Now they can be saved only through gold purchases.”

While the central bank boosted its gold holdings significantly through 2019, transactions are likely to be more muted going forward.

The central bank is limiting the price at which it’s willing to buy at 5,000 rubles a gram, roughly $1,880 an ounce at the current exchange rate and below international prices. The planned purchases are designed to support gold miners’ sales because of the difficulty exporting, and the domestic market won’t be able to absorb those volumes, according to two officials close to the central bank who asked not to be identified.

The central bank didn’t immediately respond to a request for comment.

Retail Potential

More business could also come from the domestic retail market. The government canceled value-added tax on such purchases — a move that had long been discussed — following the fallout from the war in Ukraine.

“We are seeing a significant increase in demand for gold in retail,” the Polymetal spokesman said. “Banks are ready to pay for it using international benchmark price, and not at 5,000 rubles.”

Although gold prices don’t tend to react to supply and demand fundamentals in quite the same way as other commodities such as base metals, energy or agriculture, the prospect of reduced Russian exports would cut global supplies.

“The gold market is usually in surplus,” said Suki Cooper, an analyst at Standard Chartered Plc. “If Russia’s demand grows, its mine output is not reintroduced to the international market and the excess supply is mopped up by ETFs, the gold market could be closer to balance for the first time since 2015.”

©2022 Bloomberg L.P.