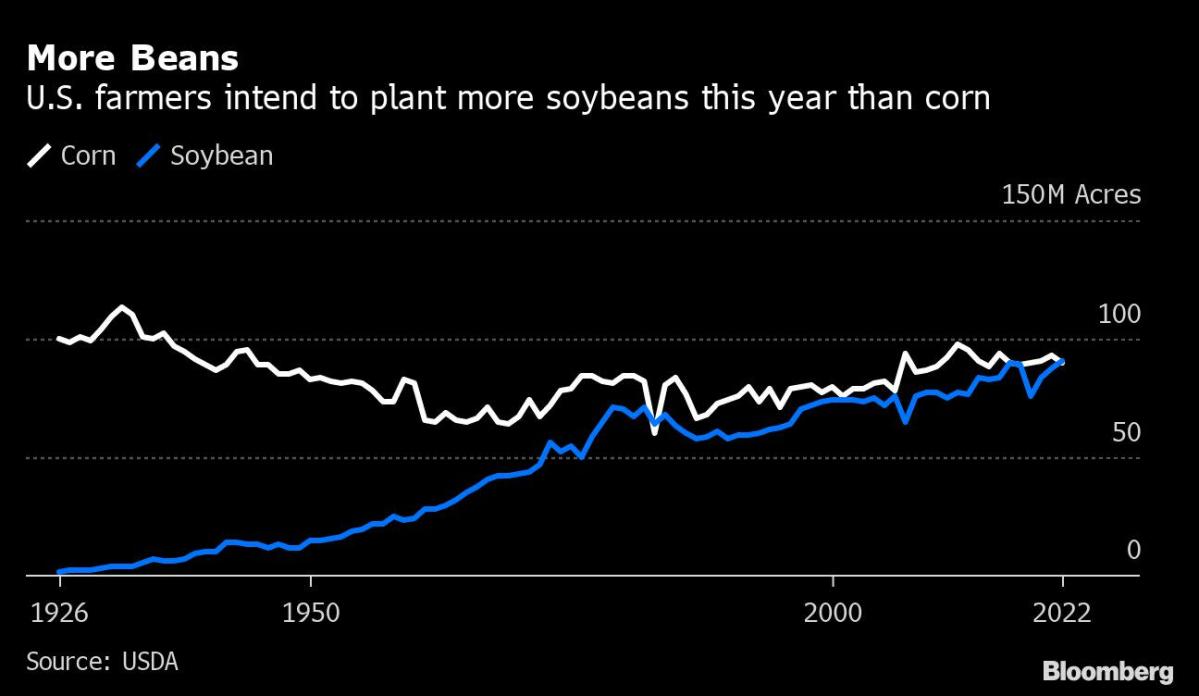

(Bloomberg) — U.S. farmers are poised to plant more soybeans than corn for just the third time ever as the highest fertilizer prices on record prompt growers to turn away from the cost-intensive grain. Corn and spring wheat futures rose.

Corn seedings are estimated at 89.5 million acres, according to the U.S. Department of Agriculture’s closely watched prospective plantings report. That’s down from 93.4 million last season and far lower than the 92 million anticipated by a Bloomberg survey. Soybean sowings are seen rising to a record 91 million acres, compared to an estimate of 88.9 million. Wheat acres are expected to rise only 1%.

Growers are grappling with the highest farm-cost inflation in decades, including record fertilizer prices as Russia’s invasion of Ukraine shakes up global supplies. Grain shipments also are being disrupted, and along with drought in key producing countries, crop prices soaring. That’s adding to a surge in global hunger that was triggered by the pandemic.

“The lower corn sowings are proof of how much stress a lot of these farmers are under with these higher costs and broader inflationary pressures, along with so much market uncertainty,” Jacqueline Holland, an analyst at Farm Futures, said in a phone interview. Her firm’s survey of producers was one of the only forecasts prior to the USDA report that called for soy to exceed corn.

Corn is typically the U.S.’s biggest crop, followed by soybeans.

Corn futures for May delivery in Chicago rose as much as 4.3% to $7.70 a bushel. December corn futures, which reflect the autumn U.S. harvest, jumped to a record. Soybeans dropped as much as 3% to $16.135 a bushel, the lowest in more than a month.

The last time soybeans, which are used in everything from fuel to animal feed, exceeded corn acres was in 2018 as former President Donald Trump’s trade war with China dented export sales. The only other time was in 1983, when the government asked producers to plant less corn in a bid to lift crop prices.

There were other surprises in the report. Acres of durum wheat used to make pasta were up 17% while plantings of other spring-wheat varieties eased 2% and fell below analyst expectations. Plantings of sunflowers – supplies of which are being disrupted by the war in top producer Ukraine – will rise by 10% while barley plantings will climb 11%, according to USDA.

The cuts to grain plantings could add to a global squeeze on supplies with war in Ukraine threatening more than a quarter of the world’s wheat shipments and about a fifth of corn.

Benchmark wheat in Chicago fluctuated between gains and losses before ending the trading day down 2.1% at $10.06 a bushel. The futures on a quarterly basis are up 31%, the most since 2010.

Minneapolis spring wheat climbed as much as 5.5% to $11.1625 a bushel.

Farmers in parts of the southern U.S. have already started planting and sowings will begin picking up pace next month. The U.S. government will release a more definitive planting assessment in June.

Risk, Reward

Soybeans typically get just a quarter of the fertilizer that corn does, while wheat falls in the middle. Most importantly, soy doesn’t require nitrogen, which is a big deal these days when farmers like Dan Cekander of central Illinois report paying $1525 a ton for the fertilizer, up from $504 a ton last year.

Another Illinois producer, Kenneth Hartman, faced roughly the same price increase and opted to pull back some the corn on his 4000 acres.

“The risk versus the reward isn’t there,” Hartman said. “People talk about $6 to $7 corn, but we went from $500 to $1665 nitrogen.”

Meanwhile, soaring grain prices and drought have presented a challenge for livestock and poultry producers to find affordable feed for their animals. USDA said the U.S. hay harvest will be the smallest since 1907.

©2022 Bloomberg L.P.