The Energy sector has been a point of focus for just about everybody in one form or another for most of the past two years, and certainly for value-driven investors. 2020 was a rough period, owing to shutdown and shelter-in-place orders that cratered demand for crude oil. The next year, the sector was a reflection, at least in part of the “reopening” theme that we all were looking forward to, when business and social activity could finally return to normal. That hope was only partially realized, as the virus continues to be a theme in 2022, with health experts starting to shift the discussion of the virus to endemic-stage monitoring and treatment.

For most of this new year, the conversation has centered around two primary, related themes where energy continues to be a critical part of the discussion. First, as economic activity has resumed for most of the past year, inflation indicators have clearly shown that prices are increasing at a rate not seen in the last 40 years. That reality prompted the Fed to raise interest rates for the first time in March by a quarter point. Going into the end of 2021, one area where inflation could clearly be seen was in the price at the pump, since oil producers throughout the world have been slow to increase production to meet rising demand.

The second theme is the conflict in Ukraine. Devastating in its human cost, Russia’s invasion has isolated that country from the rest of the Western world – including its biggest exports and primary source of income, which are natural gas and crude oil. Sanctions from the U.S., the U.K., and the European Union (along with just about every other country that isn’t China, Turkey or India) have cut purchases of those products in an effort to isolate Russia and its government from the world. From an economic standpoint, it also further curbs energy supply, which is the reason an article I read yesterday said the national average price for gasoline in the United States was around $4.15 per gallon. Since I don’t think that energy prices are going fall quickly and could remain elevated for most of the year, it also means that energy stocks could be interesting – depending on which part of the industry you focus on.

One of the companies in this industry with one of the most interesting fundamental profiles is Plains All American Pipeline, L.P. (PAA). This is a mid-cap company with pipeline transportation, terminaling and storage facilities, largely in the oil-rich Permian Basin area. That puts the company right in the middle of pre-pandemic capacity limitations that put a lot of inventory in 2019 and 2020 sitting in the Basin waiting to be transported to terminals in the Gulf of Mexico. PAA is one of the companies involved in a number of the projects to improve existing pipeline, terminal and storage infrastructure, many of which have come online in the last year or so. With pressure increasing on the Biden administration to loosen regulatory controls that have curbed production in the U.S. to counteract the effect the world’s Russia sanctions, that could mean that PAA is nicely positioned for the rest of the year. Is the company’s fundamental profile strong enough to suggest that it is also a good value? Let’s find out.

Fundamental and Value Profile

Plains All American Pipeline, L.P. owns and operates midstream energy infrastructure and provide logistics services for crude oil, natural gas liquids (NGL), natural gas and refined products. The Company operates through three segments: Transportation, Facilities, and Supply and Logistics. The Company’s transportation segment operations consist of activities associated with transporting crude oil and NGL on pipelines, gathering systems, trucks and barges. Its Facilities segment operations consist of activities associated with providing storage, terminaling and throughput services for crude oil, refined products, NGL and natural gas, as well as NGL fractionation and isomerization services and natural gas and condensate processing services. Its supply and logistics segment operations consist of the merchant-related activities, including the purchase of the United States and Canadian crude oil at the wellhead, the bulk purchase of crude oil at pipeline, terminal and rail facilities. EPD has a current market cap of about $7.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by about -13.8%, while revenues were 117.24% higher. In the last quarter, earnings increased by 13.64% while sales increased by 20.2%. The company’s margin profile has struggled with material deteriorations over the last couple of years, which isn’t surprising given the collapse in oil demand in 2020, but may have turned a corner this year and is showing additional signs of improvement; Net Income as a percentage of Revenues in the last quarter was 3.46% versus 1.41% over the last twelve months.

Free Cash Flow: PAA’s free cash flow is very healthy, at $2.54 billion. That translates to an impressive Free Cash Flow Yield of 32.32%. It is worth mentioning that Free Cash Flow increased from $1.1 a year ago, and confirms a multiyear improvement from $730 million at the end of 2015.

Debt to Equity: PAA’s debt to equity is .8, which is a pretty conservative reflection of management’s approach to leverage. Liquidity is a bit of a concern, since their balance sheet shows just $450 million in cash and liquid assets versus $8.4 billion in long-term debt (with no near-term maturities). A useful counter to the liquidity picture the current numbers paint is the fact that a year ago, cash and liquid assets were just $56 million, while long-term debt was around $9.3 billion. If Net Income can continue to improve on a quarterly basis, the argument that the worst is behind the company becomes much stronger.

Dividend: EPD’s annual divided is $.87 per share (reduced in 2020 from $1.44 per share, but up from $.72 per share a year ago), which translates to a much larger-than-normal yield of about 7.92% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $16.60 per share. That means the stock is nicely undervalued right now, with 52% upside from its current price. It is also worth noting that a year ago, this same analysis yielded a long-term target price at around $15.75 per share.

Technical Profile

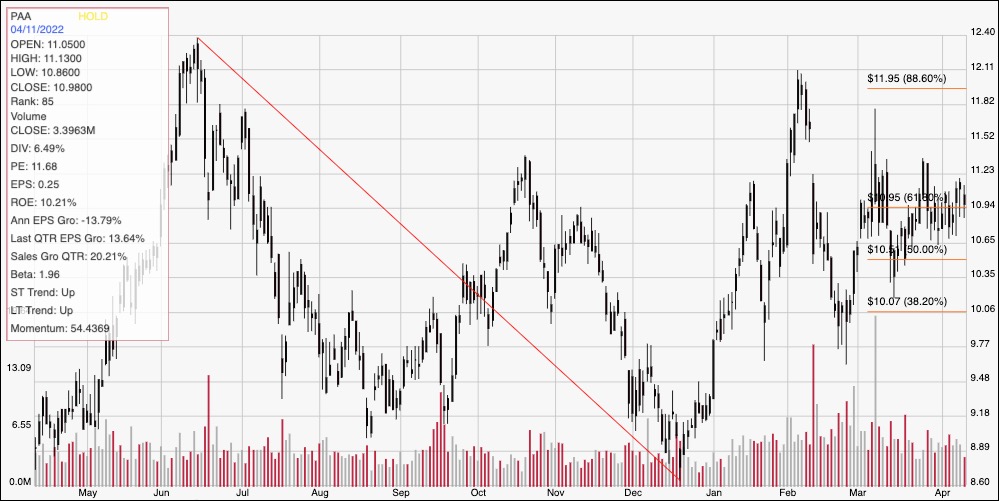

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red line traces the stock’s downward trend from a June peak at around $12.40 to its December 2021 low at around $8.50. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. After rallying to about $12 in early February, the stock dropped back again and has been hovering in a narrow range between $10.75 at support and $11 for resistance. A push above $11 should have room to test the stock’s February peak at around $12, with additional upside to the 52-week high at around $12.40 if buying activity picks up. A drop below $10.75 should find next support around $10, where the 38.2% retracement line sits.

Near-term Keys: PAA’s current consolidation pattern could offer an interesting set up for short-term trading strategies, depending on where the stock breaks the range. A push above $11 could be a good signal to think about buying the stock or working with call options, using a price target at around $12. A drop below $10.75 could provide a good signal to consider shorting the stock or buying put options, with $10 acting as a practical near-term profit target. I think that the stock’s fundamentals – especially its growing Free Cash Flow and improving liquidity, with lower debt – along with its value proposition really offer the best probabilities of success on a long-term basis. Even though it was reduced in 2020, this is also a stock with an annual dividend far above the average for stocks in the S&P 500 or even long-term bond yields. If you aren’t afraid to tolerate the potential for continued near-term price volatility, PAA could be a hard stock to ignore.