(Bloomberg) — Traders of U.S. government debt were dealt a stern reminder last week not to sleep on a market that’s been headed in one direction for a long time.

Yields had risen to the highest levels in years in anticipation of more Federal Reserve interest-rate hikes and the central bank beginning to shed Treasury notes and bonds from its balance sheet by not replacing them when they mature. For most of the first quarter, short-dated yields paced the move.

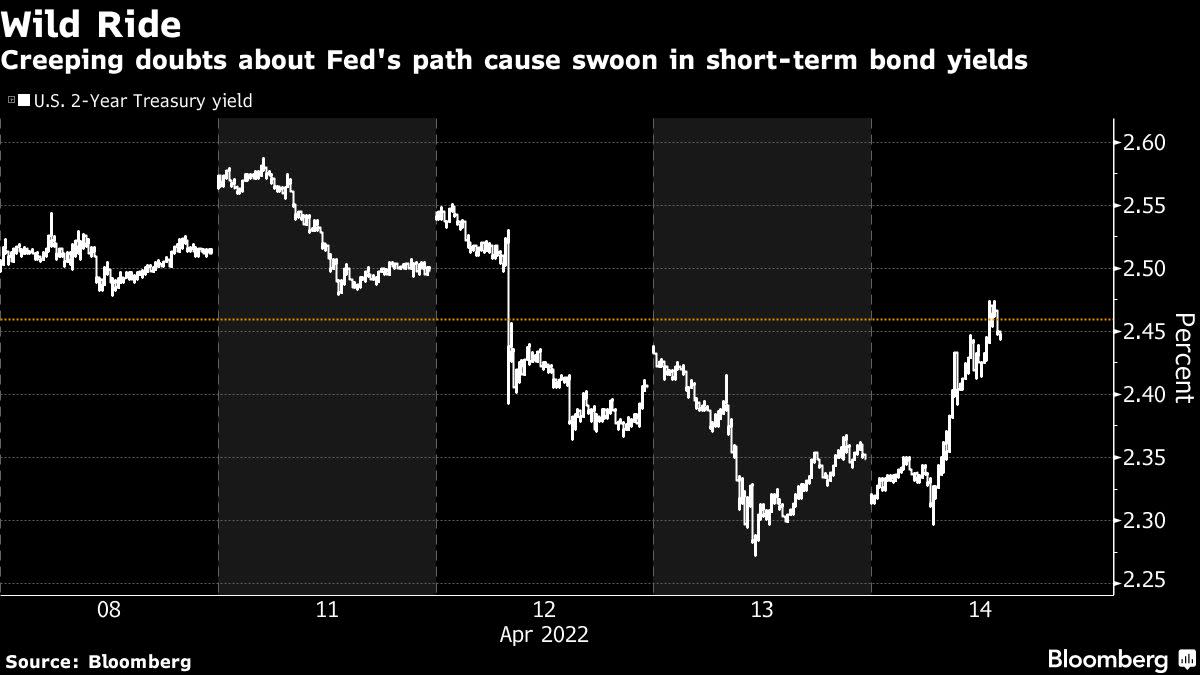

While the tune had begun to change this month, with long-dated yields leading the latest move higher, a violent mid-week dive in short-dated yields left traders wondering if they were looking at a new trend or just a bout of gains-harvesting on the old one. The reversal was accompanied by a plethora of large trades in related futures contracts, consistent with locking in profits.

A smaller-than-expected increase in March consumer prices excluding food and energy, reported Tuesday, provided a fundamental catalyst for wagers that the Fed may wind up raising rates less than currently expected as inflation cools, allowing short-dated yields to fall. But there’s no consensus on the inflation outlook, or prospect of one in sight. Economic data is sparse next week.

“It’s an awkward period at the moment for the bond market,” said Gregory Faranello, head of U.S. rates trading and strategy for AmeriVet Securities. “Inflation is at extreme levels and we just don’t know what level it declines to from the peak.”

Here’s how it shook out: The two-year note’s yield — more sensitive than longer-dated yields to changes in the Fed’s policy rate — fell to as low as 2.27% on Thursday from this year’s peak of 2.60% on April 6. It ended the week around 2.45% after a sharp rebound on Thursday, when a gauge of import prices rose more than economists expected. U.S. markets were closed Friday.

The swoon in two-year yields represented some dialing back of expectations for how much the Fed might raise rates this year, even as a half-point increase at the next meeting in May is nearly fully priced in to corresponding futures contracts.

New York Fed President John Williams on Thursday said that was “a reasonable option” because rates remain low. The March quarter-point increase to 0.25%-0.5% was the first since 2018. Williams also said the underlying inflation trend will soon peak. Fed Chair Jerome Powell is slated to take part in an IMF event next week on Thursday.

TD Securities recommended buying three-year Treasuries at yields near 2.75%, anticipating a decline to 2.25%.

The thinking is that if tighter monetary policy — combined with pandemic containment measures and global fallout from Russia’s invasion of Ukraine — limit growth, the peak in rates may be lower and nearer than previously expected. Futures markets currently price in a peak of just over 3% in mid-2023.

“It’s not clear what central banks will do when we’re left with little growth and inflation above target,” Faranello said.

Longer-dated yields continued to rise, with the benchmark 10-year note’s reaching a 2022 peak of 2.83%. It collided with a downward-sloping trend line that’s contained it for a generation. For some, it was confirmation that the four-decade bull run in bonds is ending — aided by the Fed’s move to allow its portfolio to run off.

As the 30-year bond’s yield also reached its highest levels of the year Thursday — 2.93% — the yield curve steepened, reversing the powerful curve-flattening trend that has defined the market for the past 12 months.

The gap between two- and 10-year yields, which shrank from a 2021 peak near 162 basis points to -9.5 basis points on April 4 — with the two-year exceeding the 10-year for the first time since 2019, snapped back to 37 basis points.

The five- to 30-year curve, which inverted on March 28 for the first time since 2006 and reached an extreme of -15.6bp on April 6, rebounded to 13 basis points.

“It is healthy to see a steeper, more normal-sloping curve after recent inversions,” said Jason Pride, chief investment officer of private wealth at Glenmede. “The Fed wants to push markets until there is a more negative reaction — especially in credit and equities — that slows the economy.”

Curve-flattening, which normally unfolds in anticipation of Fed rate hikes, began much sooner relative to the first hike than has occurred historically, putting traders on edge about when the trend-reversal might begin.

JPMorgan Chase & Co. is among the Wall Street firms viewing the recent bout of steepening as merely an interruption. Its U.S. interest-rate strategists recommended positioning for a flatter curve after the move. The call was based on anticipated pension-fund demand for long-maturity debt as well as limited impact from the Fed’s balance-sheet measures.

Bond traders are left expecting a more contested market in the weeks ahead. The stakes are high. The first quarter was the Treasury market’s worst ever, and the second is off to an inauspicious start.

©2022 Bloomberg L.P.