(Bloomberg) — Long-maturity Treasuries are contending with their biggest drawdown on record, at least according to their most popular exchange-traded fund.

BlackRock’s $19 billion iShares 20+ Year Treasury Bond ETF (ticker TLT) has fallen almost a third from an all-time high in August 2020. That’s more than the previous record drawdown seen between 2008 and 2010, based on closing prices.

Such Treasuries, favored by the likes of pension funds, have longer duration, or sensitivity to interest-rate changes. That’s put them at the forefront of a global fixed-income selloff as the Federal Reserve signals it will raise rates swiftly to tame inflation.

The equivalent ETF focusing on Treasuries with a maturity between one and three years has fallen more than 4% from a peak hit in 2020.

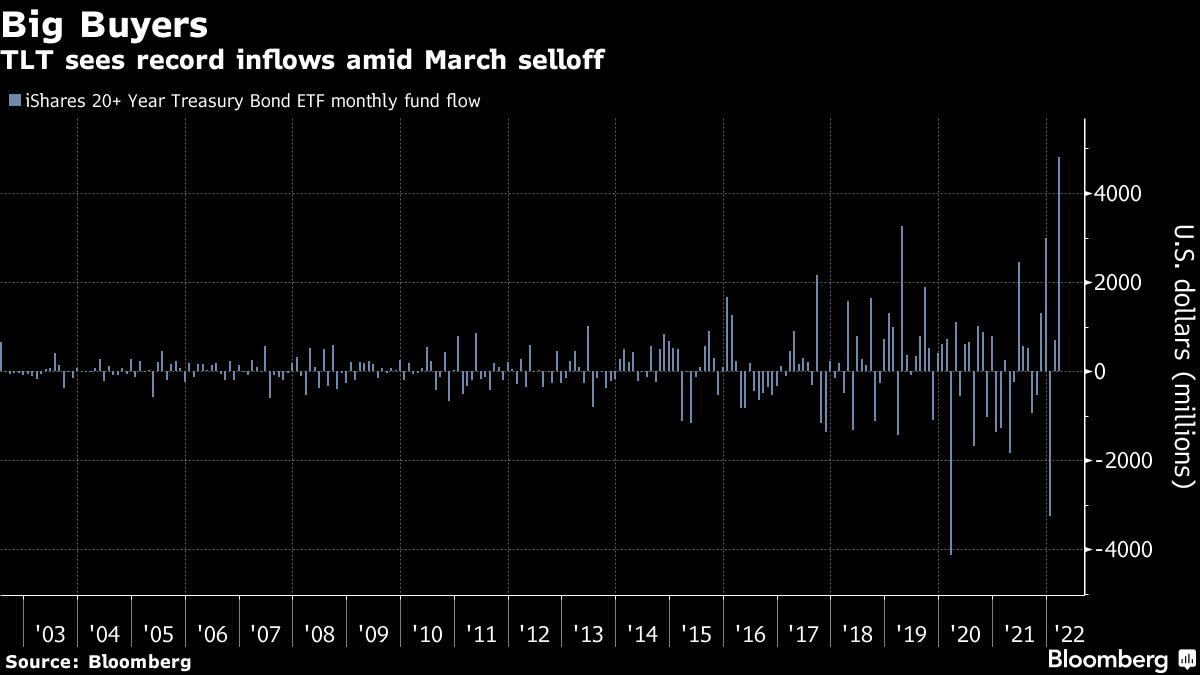

TLT saw record inflows last month. That was likely due to money managers with allocation limits between stocks and bonds having to rebuild their fixed-income exposure heading into quarter-end.

It’s among the world’s biggest and most liquid bond ETFs, making it the go-to vehicle to gain exposure to — or bet against — longer-maturity Treasuries.

©2022 Bloomberg L.P.