(Bloomberg) — Federal Reserve Bank of St. Louis President James Bullard said the central bank needs to move quickly to raise interest rates to around 3.5% this year with multiple half-point hikes and that it shouldn’t rule out rate increases of 75 basis points.

“More than 50 basis points is not my base case at this point,” Bullard said in a virtual presentation to the Council on Foreign Relations on Monday, adding the Fed under Alan Greenspan did such a hike in 1994 leading to a decade-long expansion. “I wouldn’t rule it out, but it is not my base case here.”

Fed Chair Jerome Powell has said that a 50 basis-point increase is possible at the Fed’s May 3-4 meeting. Comments by colleagues since then have hardened expectations they’ll make that move, as officials extend a hawkish pivot to curb the hottest inflation since 1981.

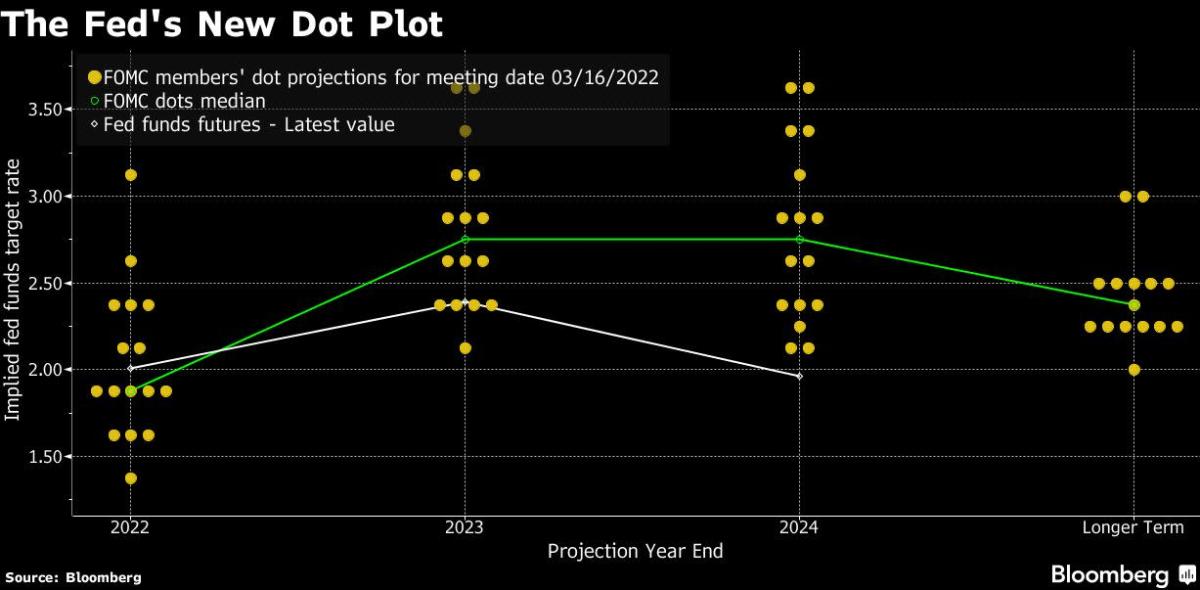

Bullard repeated he favors an interest rate of about 3.5%, citing a version of the Taylor rule, a guideline developed by Stanford University’s John Taylor that uses inflation, the unemployment rate and an estimate of the neutral interest rate — a rate neither contractionary nor expansionary — to come up with his estimate.

“You can’t do it all at once, but I think it behooves us to get to that level by the end of the year,” Bullard said.

The Federal Open Market Committee’s first goal should be getting to a neutral rate soon, Bullard said. The committee estimates that rate at about 2.4%.

“We want to get to neutral expeditiously, I guess is the word of the day,” he said, repeating a word used by a number of colleagues. “I’ve even said we want to get above neutral as early as the third quarter and try to put further downward pressure on inflation at that point.”

The St. Louis Fed official said talk about recession was premature, with the Fed having only raised rates once at this point. He predicted that the U.S. economy would grow at a healthy rate in excess of its long-term trend both in 2022 and 2023, adding he expects unemployment to fall below 3%.

Minutes of their March meeting showed many Fed officials favored raising rates by a half point and only opted for the more cautious 25 basis-point move because of the uncertainty around Russia’s invasion of Ukraine.

The account showed officials expect to start shrinking their balance sheet by $95 billion a month, or more than $1 trillion a year, and could announce a decision in May. Governor Lael Brainard said April 12 that could mean roll-off as soon as June.

A known hawk, Bullard has been favoring faster and more aggressive rate hikes by the Fed. He was the lone dissenter in the 8-1 policy vote in March having favored a 50 basis points move and has also pushed for balance sheet reduction.

That hawkishness is being mirrored by other central banks too. The Bank of Canada and Reserve Bank of New Zealand both this month raised their benchmark rates by 50 basis points — their biggest moves in 22 years — indicating a new sense of urgency among policy makers to rein in inflation.

Bullard’s hawkishness could yet prove to be a defining pivot for Fed policy makers, said Stephen Innes, managing partner at SPI Asset Management.

“The fact that Bullard is talking about a seventy-five basis point hike suggests other hawks are on the same page,” he said.

©2022 Bloomberg L.P.