(Bloomberg) — ASML Holding NV, the world’s largest semiconductor maker, said demand for its chip-making machines outstripped supply in the second quarter, prompting it to lift its longer-term sales forecasts.

“We continue to see that the demand for our systems is higher than our current production capacity,” Chief Executive Officer Peter Wennink said. “In light of the demand and our plans to increase capacity, we expect to revisit our scenarios for 2025 and growth opportunities beyond. We plan to communicate updates in the second half of the year.”

ASML shares were up as much as 3% on Wednesday.

The optimism for ASML was tempered in the short term after net sales forecast for the second quarter fell short of analyst expectations after a decision to delay testing its machines to speed up deliveries once again hit earnings.

In the second quarter, 800 million euros of net delayed revenue was excluded from the company’s guidance, according to Chief Financial Officer Roger Dassen. “That is the result of the fact that we expect more fast shipments at the end of Q2 than we had at the end of Q1.”

Dassen also cited the increase in labor, component, freight and energy prices. “If I were to quantify that, I think all in all we might be looking this year about a 1% incremental impact on the gross margin.”

Inflationary pressures are growing amid a rise in service fees to secure parts that are in short supply and very high demand, jump in freight costs on changing shipping corridors and fuel prices, and “very strong” competition in labor markets in Asia and Silicon Valley, according to Dassen.

ASML has cornered the market for the latest advanced extreme ultraviolet lithography equipment needed to make cutting-edge chips that are faster, cheaper and more efficient.

However, the company began skipping some final testing in its factories last year to speed up delivery. This meant clients get their machines more quickly, but ASML had to delay about 2 billion euros worth of sales that were expected to ship in the first quarter.

The Dutch company’s customers include Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co., which have been investing heavily to keep up with rebounding demand as lockdowns ended. It competes with Japan’s Nikon Corp. in deep ultraviolet machines used to produce more mature chips.

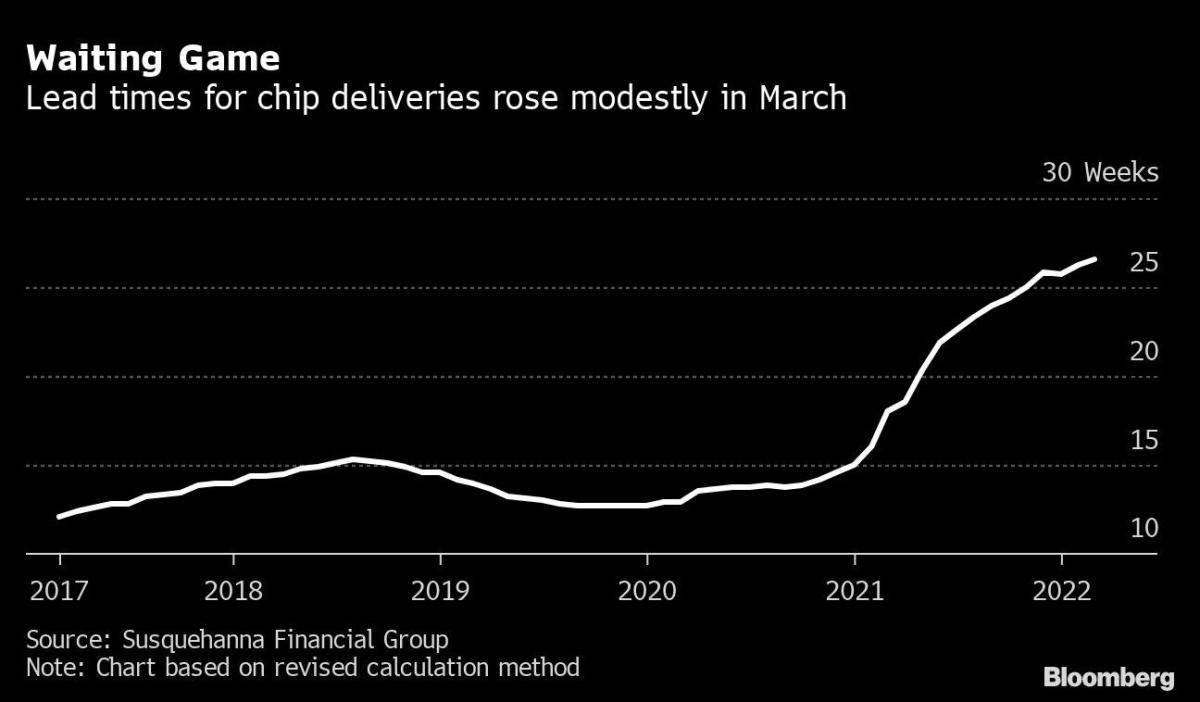

The wait times for semiconductor deliveries rose to a new high in March, after lockdowns in China and an earthquake in Japan further hampered supply. Lead times — the lag between when a chip is ordered and delivered — increased by two days to 26.6 weeks last month, according to research by Susquehanna Financial Group.

©2022 Bloomberg L.P.