(Bloomberg) — After another wild week in global money markets, traders are betting big on the biggest regime shift in Europe in years: the end of the negative interest-rate era before 2022 is over.

Fueled by a flurry of hawkish monetary signals over the past week, the interest-rate swaps market now projects the European Central Bank will deliver three quarter-point hikes by December — winding down the eight-year experiment with sub-zero borrowing costs that’s saddled savers with financial repression and helped funnel billions of euros into speculative assets.

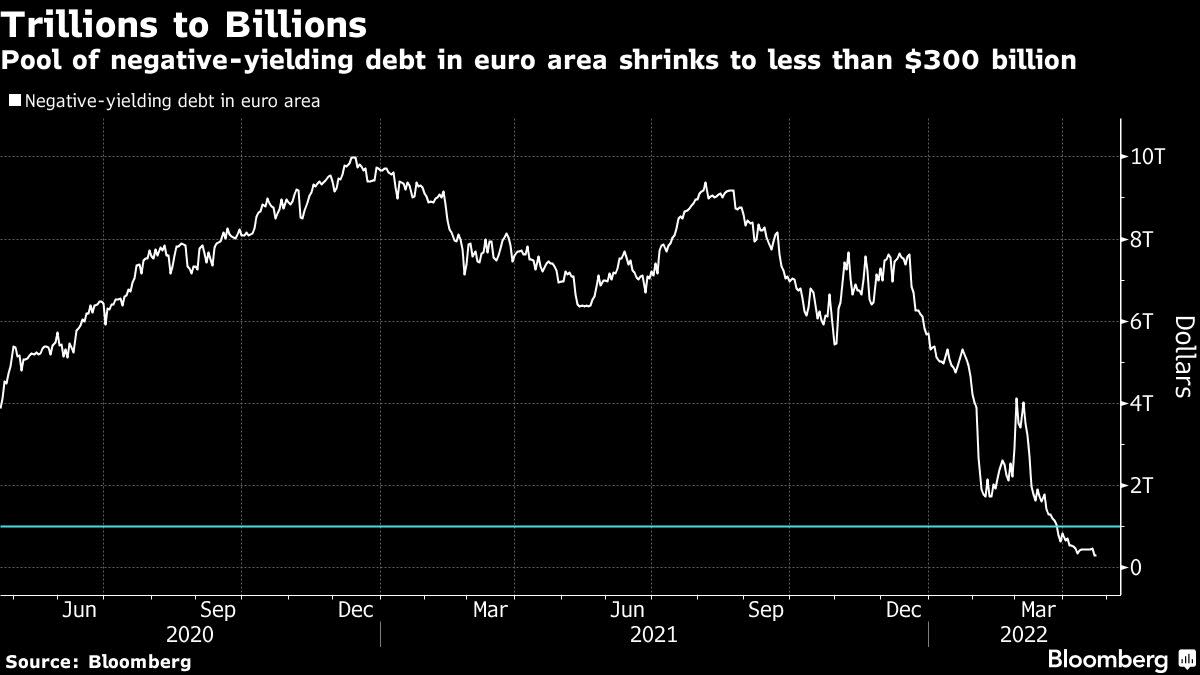

That’s creating a sea change in the region’s bond markets, where the pool of negative-yielding debt has collapsed to the equivalent of less than $300 billion from a peak of nearly $10 trillion in 2020.

The proximate cause: Fresh inflation alarms from five ECB officials in recent days that’s spurred investors to go big on wagers for policy tightening — and then some. Market pricing indicates the deposit rate could hit 1.5% toward the end of next year, from minus 0.5% currently. That compares with price action in prior weeks, when traders pared bets on rate hikes after Russia’s invasion of Ukraine blighted the growth outlook.

“The hawks appear to have more credibility now,” said Rishi Mishra, an analyst at Futures First. “So if the ECB is to let the idea float of a July rate hike being alive, that gives markets a license to price closer to 100 basis points of hikes by December.”

Hawkish Talk

Governing Council Vice President Luis de Guindos, and members Martins Kazaks and Pierre Wunsch, have driven home the message this week that the central bank’s first rate increase in a decade could come as soon as July, eventually spelling the end of negative borrowing costs in place since June 2014.

Market-based inflation expectations have motored higher, with oil and gas prices surging to multi-year levels. A potential ban on energy exports from Russia — from which the European Union gets 40% of its gas — threatens to fan inflation that’s already at a record level.

“The rise in breakeven inflation rates is a key driver of that hawkish talk,” said Frederik Ducrozet, global strategist at Banque Pictet & Cie SA. “Financial conditions never really tightened enough, so the hawks had to become more aggressive for that to be reflected in the rate hike pricing.”

Swaps linked to the direction of the euro area’s Harmonised Index of Consumer Prices (HICP) over the next decade are on the verge of exceeding those in the U.S. for the first time since 2009. Strategists at UBS Group AG and Citigroup Inc. are recommending trades that will profit if they keep surging.

European Inflation Wagers Are on the Cusp of Eclipsing U.S. Bets

Delicate Balance

All the same, the ECB will have to maintain a delicate balance between growth and inflation as war in Ukraine rages on. Euro-area policy makers’ measured approach to policy normalization contrasts with peers at the Federal Reserve, who have already delivered a quarter-point rate hike this year and could add another 200 basis points by September, according to swaps pricing.

Fed Rate Bets Turbocharged as Traders See Four Half-Point Hikes

That divergence has weighed on the euro, which slid this month to a two-year low, has also been held back partly by uncertainty stemming from the French presidential election. The runoff vote between incumbent Emmanuel Macron and right-wing nationalist Marine Le Pen is due to be decided on Sunday.

ECB forecasts in March showed slower economic expansion and faster inflation in 2022, with price growth easing to just below the 2% target in 2024.

Louis Harreau, rates strategist at Credit Agricole SA, expects the war to trigger a recession in the region deep enough for the ECB to delay the first quarter-point hike until December. That said, updated inflation projections in June should “scare” all the policy makers, which Harreau says could convince the Governing Council to raise borrowing costs in September.

“The hawks are trying to push the ‘July or September or December’ rate hike, so that they are sure to get September,” he said.

©2022 Bloomberg L.P.