(Bloomberg) — Continental Resources Inc., Hess Corp. and Matador Resources Co. signaled plans to raise production from U.S. shale basins, a potential harbinger of things to come as Big Oil prepares to report results later this week.

Individually the extra production is small, but if the other dozens of public and private operators across the country follow suit, it could be a sign that U.S. shale is stepping up efforts to ease the global crude supply shortage and take advantage of $100-a-barrel oil prices. Exxon Mobil Corp. and Chevron Corp., the two biggest U.S. producers by market value, report earnings on April 29.

“We will give serious consideration to adding a fourth rig later this year which would accelerate our production ramp-up” in the Bakken oil field of North Dakota, Hess Chief Executive Officer John Hess said Wednesday on a conference call. “The world is facing a structural oil supply deficit, and the only way to address it is more industry investment, and that will take time.”

Previously, large shale operators like Pioneer Natural Resources Co. and Occidental Petroleum Corp. said equipment shortages and cost inflation would make it difficult for shale to exceed production targets this year. The Energy Information Administration lowered its U.S. growth forecasts earlier this month.

The trend will come as partial relief to President Joe Biden, who has called on U.S. oil companies to use record profits from high oil prices in the wake of Russia’s invasion of Ukraine to increase production and ease gasoline prices for consumers. Even so, the incremental increases from the U.S. are unlikely to offset the massive reduction in oil output expected by Russia this year due to international restrictions on buying the nation’s crude.

Continental said its 2022 oil output will average 205,000 barrels a day, a 2.5% boost from the company’s guidance just two months ago. The shale operator controlled by billionaire Harold Hamm increased its capital spending to as much as $2.7 billion from $2.3 billion. Hess said it can deliver 10% production growth annually over the next five years due to its giant project with Exxon in Guyana as well as increases from the Bakken and Gulf of Mexico.

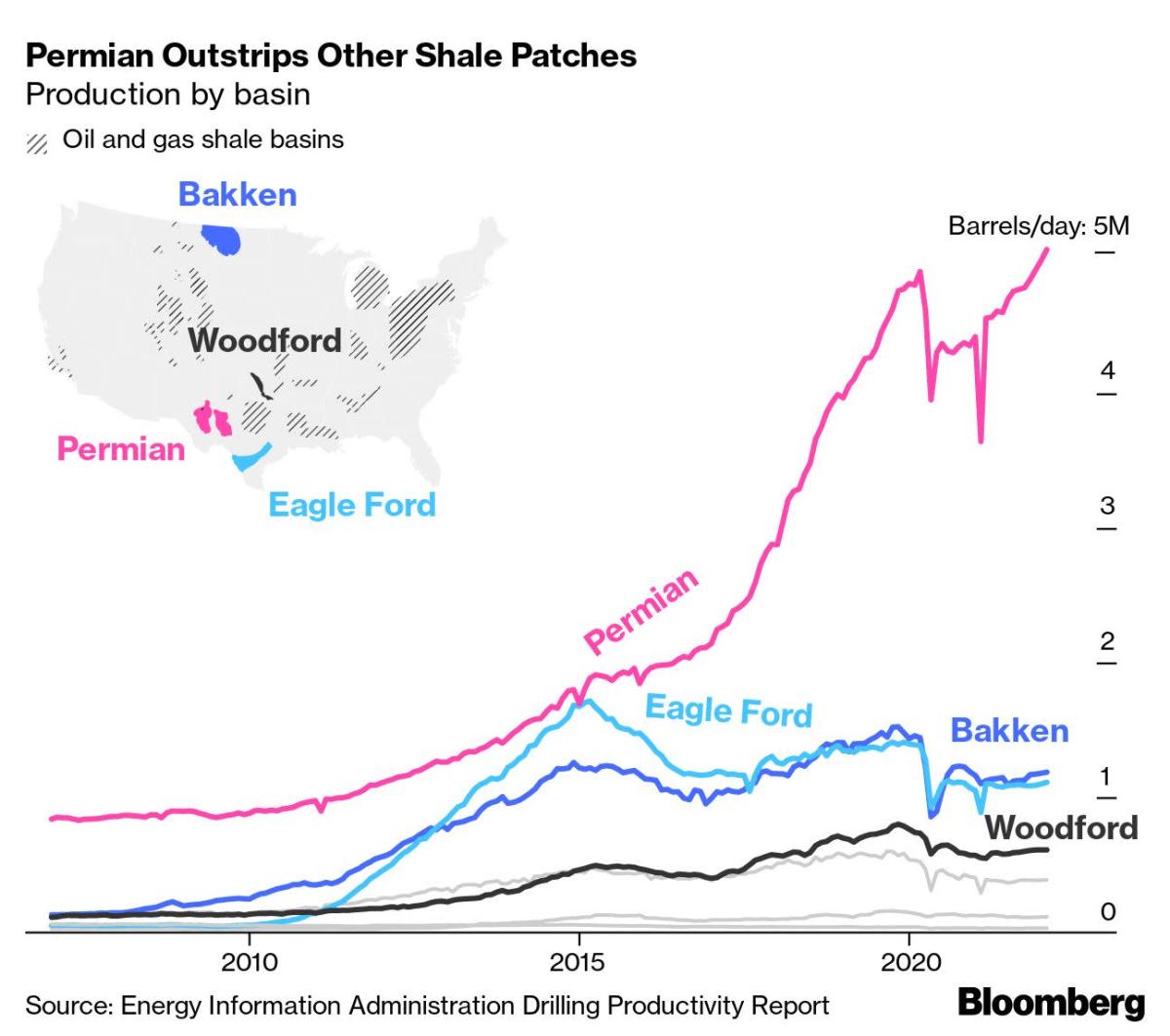

Matador, which operates in the Permian Basin, said it expects “significant increases” to oil and natural gas production, which will rise to 107,000 barrels a day in the second quarter, up 14% from the previous three months. Matador expects its capital spending to jump 31% to $675 million this year, in part due to service cost inflation and new well drilling.

U.S. production will average 12.01 million barrels a day this year, the EIA said earlier this month, lowering its estimate from the previous 12.03 million barrels a day as producers grapple with rampant cost inflation.

©2022 Bloomberg L.P.