(Bloomberg) — Federal Reserve Chair Jerome Powell is likely to slow the pace of interest-rate increases after front-loading policy with half-point hikes next week and in June, economists surveyed by Bloomberg say.

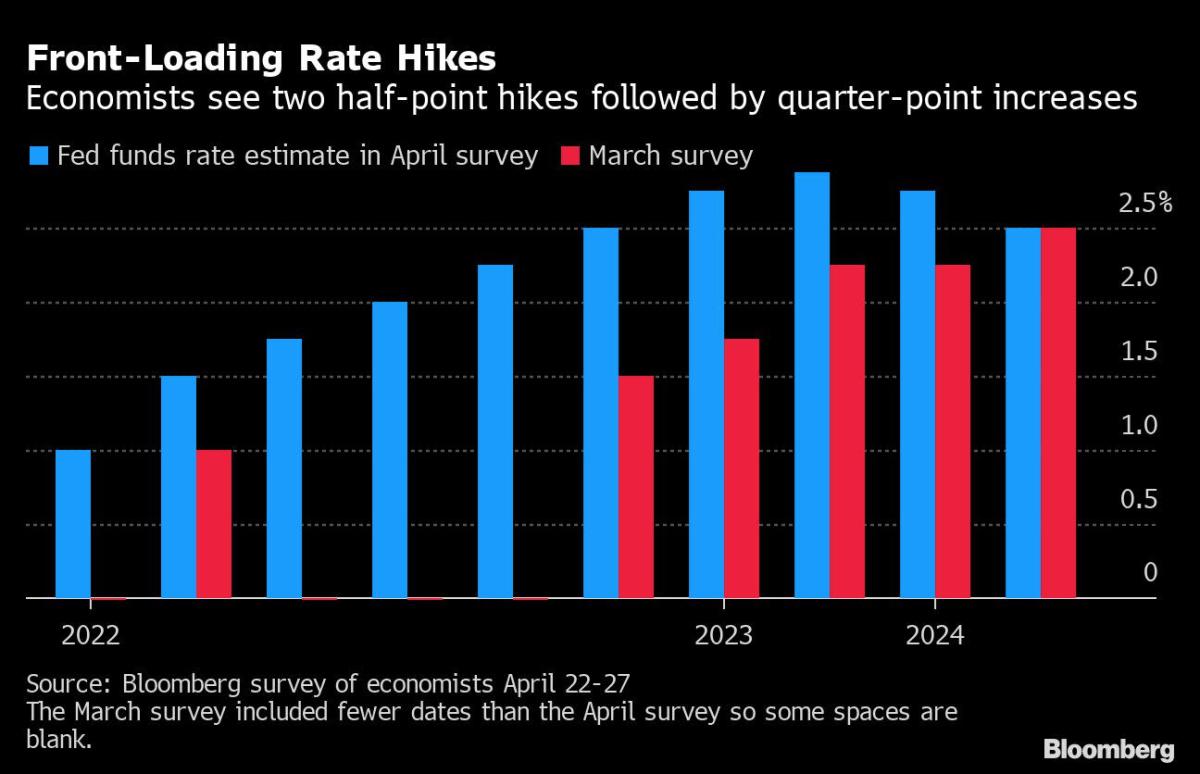

They expect the Federal Open Market Committee to raise its benchmark rate by 50 basis points at the May 3-4 meeting and do so again in June — the first hikes of that size since 2000 — then downshift to a series of quarter-point moves during the second half of the year. The U.S. central bank will also start to shrink its $9 trillion balance sheet in May.

The survey of 48 economists conducted from April 22 to 27 forecast the Fed will lift rates to a target range of 2.25% to 2.5% by December, while markets are pricing in around 2.75% at year’s end. The last published forecasts by the Fed in March showed rates rising to 1.9% this year and 2.8% in 2023. The economists see Fed rates peaking at 2.88% in December 2023.

The path outlined by the economists’ consensus is far less aggressive than that laid out by some forecasters such as Nomura Holdings Inc., which is projecting 75 basis-point hikes in both the June and July meetings. The most hawkish of the Fed officials, St. Louis Fed President James Bullard, has called for rates of 3% to 3.25% this year and has said a 3.5% rate would be justified.

“As much as this Fed says it will be aggressive, Chair Powell still appears to be more conservative than other members,” Joel Naroff, president of Naroff Economics LLC, said in a survey response. He’s looking for one or two half-point hikes to begin.

The overwhelming consensus among economists for a 50 basis-point hike in May is not surprising, after Powell blessed such a move. “I would say that 50 basis points will be on the table for the May meeting,” he declared on April 21, just before officials entered their pre-meeting blackout period. Several of his colleagues have echoed that sentiment.

What Bloomberg Economics Says…

“Comments from Fed Chair Jerome Powell and other Fedspeak ahead of the FOMC blackout period signaled that a 50 basis-point rate hike is in the cards at the May meeting. Most of the committee appears to be on board with “expeditiously” raising the federal funds rates to the neutral level — which the median FOMC member currently estimates at 2.4% — and we interpret that to mean by the end of the year.”

— Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger (economists)

To read the full note, click here

The vast majority of economists surveyed saw little appetite for a 75 basis-point hike, which the Fed last delivered when Alan Greenspan was chair back in 1994.

“I would expect the Federal Reserve to return to more serenity” after an initial one or more half-point hikes, as the economy slows, said Thomas Costerg, senior U.S. economist at Pictet Wealth Management. “Financial conditions are tightening faster than the Federal Reserve realizes, in my view, and there will be a major impact on the economy in the second half of the year.”

The Fed is all but certain to announce its plans to allow runoff of maturing securities, another means of tightening monetary policy. The FOMC has outlined plans for maximum monthly reductions of $60 billion in Treasuries and $35 billion in mortgage-backed securities. Economists expect runoff to start in May, with cuts of $20 billion in Treasuries and $15 billion in MBS, reaching the maximum caps over three months.

An overwhelming majority expect officials will resort to outright sales of MBS, in line with their stated preference to only hold Treasuries in the longer run. There’s a range of views on when selling would begin, with a slight majority seeing it start this year.

Powell has emphasized that the Fed will be nimble in its rate-hiking plans and the FOMC in its prior statement offered only loose guidance that ongoing increases would be appropriate. Four-fifths of the economists expect the committee to repeat the guidance, while the rest say there may be a signal of consideration of one or more half-point moves.

The economists see risks of a recession, with one-third seeing a downturn as likely within the next two years while the rest believe Powell and his colleagues will be able to avoid a contraction. Powell has said their goal is to achieve a soft landing — a slower U.S. economy with a still-robust labor market and inflation that falls to the central bank’s goal of about 2%.

“The economy will likely go into a growth recession if not a full-blown recession, where growth is too weak to keep the unemployment rate falling,” Grant Thornton LLP chief economist Diane Swonk said. It’s “hard to see how we get the labor market on a more sustainable long-term path without a fairly sharp reduction in the demand for workers.”

Wall Street economists have recently been raising more concerns, with Goldman Sachs Group Inc. estimating chances of a contraction at about 35% over the next two years, while Deutsche Bank AG has predicted a major recession with the unemployment rate rising several points. Bloomberg Economics’ recession-probability model has estimated a 44% chance of recession happening before January 2024.

Balancing that risk, the Fed could well stop raising rates even with inflation somewhat above its target, in the view of the economists. The FOMC would likely tolerate a rate of around 2.5%, in the median of the forecasts.

The economists generally think the Fed will get monetary policy about right. If they were setting policy, they say they would raise rates by a half point at each of the next two meetings with the target rate peaking at 3% in December 2023 — very close to what they expect from the central bank.

©2022 Bloomberg L.P.