(Bloomberg) — Stocks fell Monday as high inflation, tightening monetary policy and China’s Covid lockdowns deepened concerns about the economic outlook.

Equities dropped in Japan, Australia and South Korea, while S&P 500 and Nasdaq 100 futures wavered after U.S. shares in April posted one of their worst monthly declines since the pandemic roiled markets in 2020.

The stock slide, rising bond yields and dollar strength are tightening financial conditions ahead of looming U.S., U.K. and Australian interest-rate hikes.

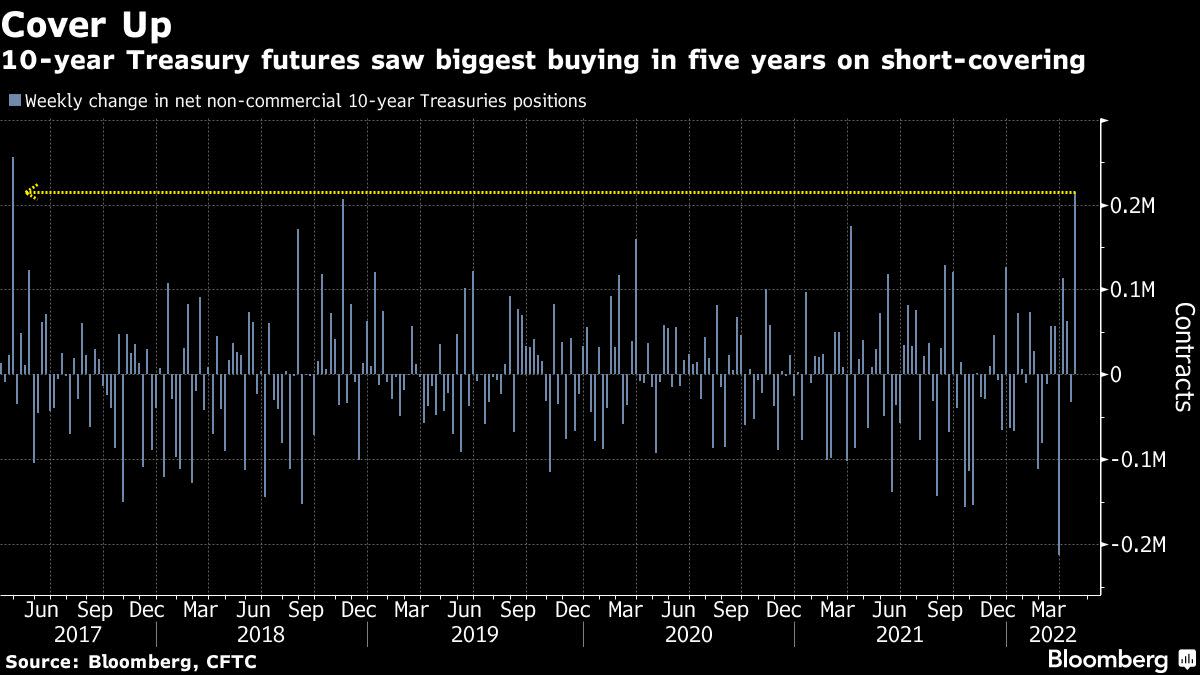

Treasuries held a Friday tumble, while bonds in Australia and New Zealand retreated. A dollar gauge was around the highest level since 2020.

The offshore yuan weakened in the wake of data signaling a sharp contraction in Chinese economic activity amid idled factories and snarled supply chains.

The Federal Reserve is expected to raise rates by 50 basis points Wednesday, the largest increase since 2000. The question is how high it needs to go to get runaway inflation under control and whether that will trigger a recession.

The market is “discounting a high probability of a recession,” Geir Lode, global equities head at Federated Hermes Ltd., wrote in a note. “The Fed is getting ready to fight inflation by increasing interest rates faster than anticipated.”

Price pressures are being stoked by the elevated cost of commodities ranging from fuel to food, in part due to disruptions from Russia’s war in Ukraine.

Those challenges could intensify: the European Union is set to propose a ban on Russian oil by the end of the year, with restrictions on imports introduced gradually until then, according to people familiar with the matter. Crude oil dipped but remained closed to $104 a barrel.

Markets in China and Hong Kong are shut for holidays. Beijing will close gyms and cinemas over the Labor Day break and Shanghai will keep mobility curbs in place despite falling Covid cases.

Chinese officials last week promised to scale up economic stimulus, which provided some respite for sentiment before Friday’s Wall Street gyrations.

This week sees some market closures in Asia and Europe, which could impact liquidity and exacerbate already volatile conditions.

Bond yields are set to stay “elevated for the foreseeable future” because of inflation and sharp Fed rate hikes allied with balance-sheet reduction, Seema Shah, chief global strategist at Principal Global Investors, wrote in a note.

Key events this week:

- Earnings include Airbnb, Airbus, BMW, BNP Paribas, BP, Credit Agricole, Hilton, ING Groep, Pfizer, Shell, Starbucks, Uber, VW

- Reserve Bank of Australia rate decision, Tuesday

- Fed rate decision, briefing with Chair Jerome Powell, Wednesday

- EIA crude oil inventory report, Wednesday

- Bank of England rate decision and briefing, Thursday

- OPEC+ convenes virtually for a regular meeting, Thursday

- U.S. April jobs report, Friday

©2022 Bloomberg L.P.