One of the big recovery stories over the past year has come from the Aerospace industry, which includes commercial airlines. It really comes as no surprise to say that in 2020 and the early part of 2021 the industry was one of the biggest, unquestioned losers in the stock market after commercial travel dried up to practically nothing because of global shutdowns and shelter-in-place orders beginning in February 2020. As vaccinations increased and infection and hospitalization rates started to drop, a lot of economists and analysts pointed at this industry as one to watch, since many were predicting a recovery in travel demand as consumers started to exercise long-pent-up desires to get out, take vacations, and see family and friends.

There are two principle commercial airline producers in the world: Boeing and Airbus. Boeing’s problems predate the pandemic; the company spent practically all of 2019 dealing with the negative impact of fatal crashes of its popular 737 MAX jet that killed all passengers on board.

Those crashes were attributed to failures in the planes’ sensor system, resulting in the global grounding of the jet all over the world as the company went back to the drawing board. The MAX was formally cleared to return to service by the FDA in December of 2020, clearing the way for travel to pick up again as social and business activity gradually finds its way back, with some optimists predicting travel demand could match pre-pandemic levels sometime in 2023, but more pessimistic analysts suggesting it could take until 2025.

This year’s market volatility has been characterized by inflation fears, the reality of rising interest rates, along with questions about whether the Fed is too far behind the curve to be able to temper inflation in a moderated way that doesn’t force the economy back into recessionary conditions. Those are current issues that can’t be dismissed, but being a contrarian by nature often means looking past current pressures and thinking about much longer-term trends. That normally means that industries that have been out of favor, but look like they could be in position to recover, start to naturally look a bit more attractive, especially in the long term. While many of the most well-known, commercial airlines in the Aerospace industry have been hammered by the collapse in consumer and business travel, with modest gains that still haven’t offset the loses they were forced to absorb, there are also bright spots that have managed to buck that broader trend. Raytheon Technologies Corp. (RTX) is an example.

In the commercial airline segment, RTX’s biggest customer isn’t Boeing – it’s Airbus, which before COVID-19 became a global issue was drawing a number of Boeing customers to its business in the wake of the MAX grounding. RTX is also a major player in the government-funded Defense space, which has historically proven to be resilient and even resistant to economic downturns. The pandemic has proved the value of RTX’s Defense business, as 2021’s earnings reports demonstrated that segment backstopped the entire company, putting it in position to recover more quickly than other companies whose businesses are closely tied to Boeing. Strength in their Defense business didn’t completely offset Commercial travel losses in 2020, but they did nonetheless help their balance sheet absorb the hit that prompted management at other companies in this industry to take drastic measures, including eliminating dividend payouts to preserve cash. The company completed a merger in April of 2020 with Raytheon, which increased its defense and intelligence business to nearly 60% of annual revenues. That gives RTX a backstop of revenue and cash flow that has enabled it to exercise patience with its commercial business, and that most other companies in the industry probably don’t have. I also believe another likely, long-term tailwind lies in the grim reality of the conflict in Ukraine. Escalating tensions between Russia and the West imply that military spending will increase, for the U.S. and other NATO nations.

The market has recognized RTX’s strength this year, pushing its price from a November 2020 low at around $52 to a high last month at around $106. The stock has dropped back sharply off of that high and is now sitting at around the $95 level following its latest earnings report, which saw some drawdowns in free cash flow and liquidity; however that appears to be attributable to the federal government’s delay in approving its budget until March of this year and threatening a temporary shutdown. Are the company’s fundamentals still strong enough to make the stock a useful at its current price? Let’s find out.

Fundamental and Value Profile

Raytheon Technologies Corp, formerly, United Technologies Corporation is engaged in providing high technology products and services to the building systems and aerospace industries around the world. The Company operates through segments such as Pratt & Whitney and Collins Aerospace Systems. The Pratt & Whitney segment supplies aircraft engines for the commercial, military, business jet and general aviation markets. Pratt & Whitney segment provides fleet management services and aftermarket maintenance, repair and overhaul services. The Collins Aerospace Systems segment provides aerospace products and aftermarket service solutions for aircraft manufacturers, airlines, regional, business and general aviation markets, military, space and undersea operations. RTX has a current market cap of $142.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 28%, while sales were a little more than 3% higher. In the last quarter, earnings improved by about 6.5% while Revenues were -7.8% lower. RTX’s Net Income versus Revenue over the last year was 6.47%, and strengthened somewhat in the last quarter to 6.9%.

Free Cash Flow: RTX’s Free Cash Flow has been strengthening over the last year. In the last quarter, free cash flow was a little over $4.7 billion from about $3.3 billion a year ago. In the quarter prior, this number was about $5 billion, but as previously mentioned, the drop in the last quarter can be attributed to delays in funding for military spending. The current free cash flow number translates to a modest Free Cash Flow Yield of 3.34%.

Debt to Equity: RTX has a debt/equity ratio of .42, which is very conservative, and marks a drop from 1.03 in the first quarter of 2020. Their balance sheet shows about $6 billion (versus $7.8 billion two quarters ago) in cash and liquid assets against $31.3 billion in long-term debt (versus $45.3 billion at the end of the first quarter of 2020). Servicing their debt is no problem.

Dividend: RTX pays an annual dividend of $2.20 per share, which at its current price translates to a yield of 2.33%. It should be noted that early in 2020, management announced it was reducing the dividend from $2.94 to $1.90 per share, a cost-cutting measure that can be interpreted as positive or negative depending on your general view. Management raised the dividend in 2021 to $2.04, and then again to its current level after the latest earnings report, which I take as a sign of increasing strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $112 per share. This suggests that the stock is actually undervalued at its current price by about 19%.

Technical Profile

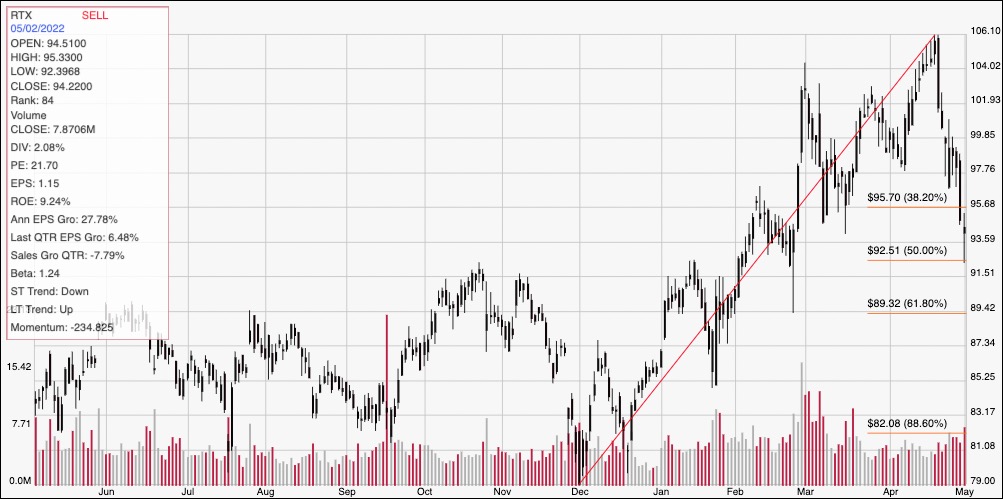

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line defines the stock’s upward trend from its February 2021 low to its peak, reached last month at around $106 per share. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock’s drop from that peak has been rapid, pushing the stock below the 38.2% retracement line to mark immediate resistance at around $96, with current support expected at around $92.50 where the 50% retracement line sits. A drop below $92.50 should have limited downside to next support at around $91.50, however an increase in selling pressure beyond that level could see the stock drop to about $89 where the 61.8% retracement line waits. A push above $96 should see the stock rally to about $98 to next resistance, with additional upside to about $102 if buying activity accelerates.

Near-term Keys: RTX’s balance sheet has remained solid throughout the past year, despite the sizable headwinds in its commercial business, and the inevitable impact they carried over the course of the past two years. I think that resilience is largely a reflection of the company’s operations in the Defense space (even with the latest quarter’s Defense-related challenge from Washington gridlock) along with aggressive cost-cutting measures it took during the early stages of the pandemic in its commercial business. It is also interesting that, despite the stock’s increase in price since 2020, the value proposition is still more than enough to be useful. The airline industry does makes for a good reopening story, but remember that this is an economically-sensitive industry, which means that these stocks can continue to be volatile depending on the state of current economic conditions. If you prefer to focus on short-term trading strategies, a drop below $91.50 could be a good signal to consider shorting the stock or buying put options, using $89 as an practical bearish trade target, while a a break above $96 could be a good signal to buy the stock or work with call options, with quick upside to about $98 on a bullish trade, and possibly $102 if buying momentum accelerates.