(Bloomberg) — The Federal Reserve gave a much needed shot in the arm of technology stocks on Wednesday by ruling out an more aggressive rate hike path and reassuring the U.S. economy remains strong.

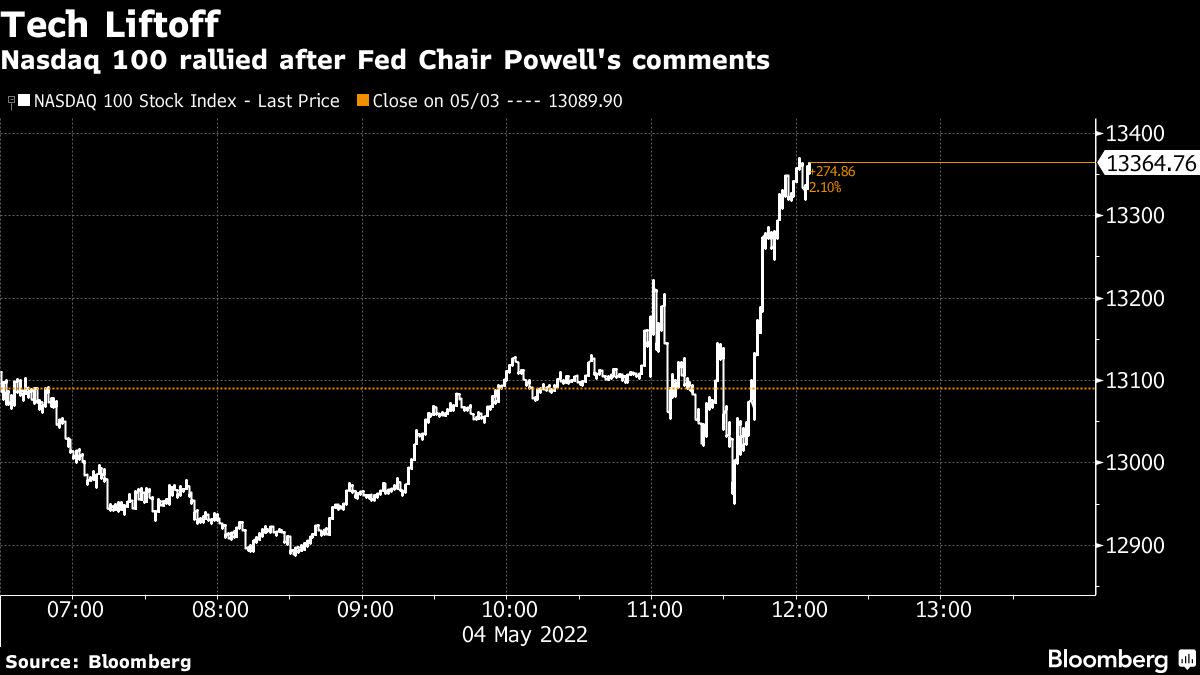

The megacap tech complex — which includes Apple Inc., Microsoft Corp. and Amazon.com Inc — rallied after Fed Chairman Jerome Powell said a 75 basis point hike is “not something that the committee is actively considering,” sending the Nasdaq 100 Index up 3.4%, its biggest one-day jump in about a week. Both Apple and Alphabet gained more than 4%, while Microsoft gained 2.9% and Nvidia advanced 3.7%. Meta Platforms rose 5.4%.

“Stocks were excited about Powell refuting talk of 75 basis points-increases and his optimism” about recent consumer prices trends, writes Vital Knowledge founder Adam Crisafulli

The U.S. central bank raised the benchmark rate by a half percentage point, the steepest increment since 2000, as it moves to combat inflation, which Powell said was “much too high.”

“There’s some optimism that we can get a soft landing, and that the Fed isn’t going to drive the economy into a ditch and create a recession,” said Kim Forrest, chief investment officer at Bokeh Capital Partners.

A Goldman Sachs basket of software stocks staged a major reversal on Wednesday afternoon and jumped 4% after earlier touching its lowest since May 2020. Software companies are are among the most richly-valued within the technology sector, and the most under pressure from higher interest rates, which in turn hurt the value of its future profits.

Software companies including Datadog Inc., Zscaler Inc., Snowflake Inc., and Cloudflare Inc., which have dropped between 40% and 60% off their November peaks, rallied in afternoon trading, with Snowflake closing up more than 5%.

Still, with inflation running high, technology stocks aren’t out of the woods yet, according to Michael Mullaney, director of global market research at Boston Partners.

“There are no major surprises from the Fed, and the market seems to be relieved about that,” he said. “But this is only one of many steps that will be needed to quell inflation.”

©2022 Bloomberg L.P.