No matter how tired we get of hearing about COVID-19, there is no denying that ever since the virus found its way to American shores more than two years ago, a lot of media attention has been given to the Healthcare sector – and especially to the Biotechnology industry, where many of the biggest names across the world worked nonstop to develop effective treatments for the disease. Available vaccines have been available for wide distribution to most age groups. Besides vaccines and their booster follow-ups, anti-viral treatments also saw a significant push in development along with big demand.

Some of the names that showed early promise also received the most attention from analysts and media types, at least in the earliest stages of the pandemic. One of those companies is Gilead Sciences Inc.

(GILD), a large-cap company with treatments for diseases such as HIV/AIDS, cancer, and other respiratory diseases. One of their antiviral drugs, remdesivir was originally created to combat the hepatitis C virus, but that demonstrated a significant enough benefit in clinical trials with hospitalized COVID patients to gain emergency approval from the FDA. Remdesevir (sold under the brand name Veklury) gave the company a revenue stream that in 2020 represented approximately 12.5% of sales, and more than doubled to about 26.1% of total sales in 2021. Outside of COVID-19, the company has also been investing heavily since 2019 to bolster its drug pipeline, with its acquisition of Immunomedics providing a newly approved treatment for metastatic triple-negative breast cancer that was approved by the FDA earlier this year and is expected to generate $3.5 billion in sales by 2025. The caveat associated with Veklury as a growth driver is that its long-term benefit is less clear; analysts point to the expectation that Veklury sales will decline as pandemic concerns fade. While variants like delta and omicron prompted big spikes in infections, hospitalizations, and deaths in late 2021, generally declining numbers included a shift by most state governments in reporting and resource allocation for the virus have some wondering if we may, in fact be seeing coronavirus finally move to an endemic status. If so, those bearish forecasts about Veklury and its continued utility as a growth driver may be correct.

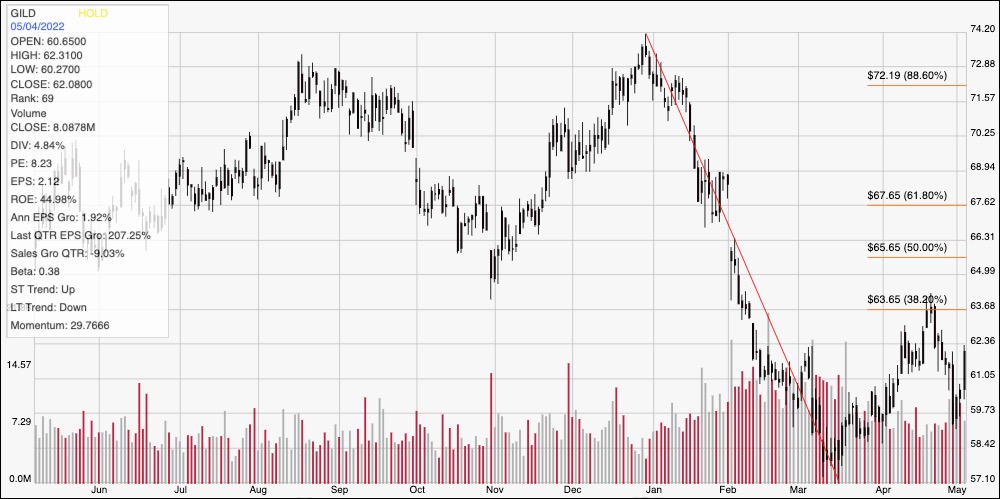

Some of the early news about Veklury gave investors enough enthusiasm about GILD to push the stock from a February 2020 low around $62 to a peak before the end of that year at around $86. From that point, however, the company’s following earnings reports showed that, while the company has a generally healthy balance sheet, their capital expenditures – which certainly, and appropriately included a big push to fast-track Veklury as a COVID treatment – put the company’s operating profile in net-negative territory. That was a strong enough concern to push the stock into a downward trend into the beginning of 2021 that saw it hit a trend low at around $56.50. From that low, the stock staged a sizable new bullish trend that peaked in mid-August at around $74 in late December. The stock’s momentum then, however turned strongly bearish, with the stock dropping rapidly from that peak to a new low point in mid-March at around $57. While the stock has recovered a bit from that low, the decline does bring up a good question: does the pace of that decline imply that the market is pricing fundamental problems into the stock’s price, or could it simply be a case where the market has discounted the stock further than it should given the company’s fundamental strength? Let’s see what we can find.

Fundamental and Value Profile

Gilead Sciences, Inc. is a research-based biopharmaceutical company that discovers, develops and commercializes medicines in areas of unmet medical need. The Company’s portfolio of products and pipeline of investigational drugs includes treatments for Human Immunodeficiency Virus/Acquired Immune Deficiency Syndrome (HIV/AIDS), liver diseases, cancer, inflammatory and respiratory diseases and cardiovascular conditions. Its products for HIV/AIDS patients include Descovy, Odefsey, Genvoya, Stribild, Complera/Eviplera, Truvada, Emtriva, Tybost and Vitekta. Its products for patients with liver diseases include Vemlidy, Epclusa, Harvoni, Sovaldi, Viread and Hepsera. It offers Zydelig to patients with hematology/oncology diseases. Its products for patients with various cardiovascular diseases include Letairis, Ranexa and Lexiscan. Its products for various inflammation/respiratory diseases include Cayston and Tamiflu. It had operations in more than 30 countries, as of December 31, 2016. GILD has a current market cap of $77.9 billion.

Earnings and Sales Growth: Over the past year, earnings increased by 1.92%, while sales were 2.6 higher%. In the last quarter, earnings rose by more than 207%, while sales showed -9.03% decline. At the end of 2020, GILD’s operating profile dipped into negative territory, but stabilized and even showed solid signs of recovery into the end of the third quarter of 2021. That recovery looks to be in jeopardy, however; Net Income as a percentage of Revenues was 16.43% in the trailing twelve-month period and deteriorated in alarming fashion, to 0.29% in the last quarter. This is a continuation and extension of a similar pattern from the quarter prior and acts as a signficant warning sign.

Free Cash Flow: GILD’s Free Cash Flow is healthy, at about $10.8 billion. On a Free Cash Flow Yield basis, that translates to 13.88%. It should be noted that this number has declined steadily since the beginning of 2016, when Free Cash Flow peaked at $19.5 billion, but has also improved from late 2019, when Free Cash Flow was about $6.6 billion. It is also higher from the last quarter, when Free Cash Flow was $9.4 billion.

Debt to Equity: GILD has a debt/equity ratio of 1.74, which is high, and also reflects increasing debt the company has taken on, in part to complete its acquisition of Immunomedics; but by itself this number doesn’t really tell the whole story. Their balance sheet shows $6.75 billion in cash in the last quarter (down from $23.9 billion at the end of 2020) against roughly $34.6 billion in long-term debt. The company’s operating profile suggests there should be no problem servicing its debt, however if the present pattern of declining Net Income is not reversed, debt service will quickly begin to eat into the company’s liquidity.

Dividend: GILD pays a dividend of $2.92 per share (up from $2.52 in 2019, $2.72 in 2020, and $2.84 last year), which translates to an annual yield of about 4.7% at the stock’s current price. Management’s ability to increase the dividend is a positive sign.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $66 per share, which means that GILD is somewhat undervalued, with about 10% upside from its current price. It also puts a practical bargain price at around $54.50.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: the chart above covers the last year of price activity for GILD. The diagonal red line traces the stock’s plunge from its late December high at around $74 to its mid-March low at around $57; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock rebounded from its $57 low point to hit resistance at the 38.2% retracement in the $63.50 level before falling back. The stock has dropped back again, but rallied in the last few days from current support at around $59, with immediate resistance at the recent, $63.50 high. A push above $63,50 should have upside to about $67.50 where the 61.8% retracement line sits, while a drop below $59 should see the stock retest its 52-week low at around $57.

Near-term Keys: Given the limited upside given GILD’s current valuation, the stock doesn’t work as a useful value right now. I also find the drop in Net Income a big enough red flag to call a pause on any serious consideration of GILD as a useful, long-term buying opportunity until the most recent pattern changes. The fact that Net Income has remained razor-thin for two straight quarters also increases the level of concern about the company’s current profitability. That also means that the best probabilities in working with this stock lie in short-term trading strategies. You could use a break above $6350 as an opportunity to buy the stock or work with call options, with $67.50 offering a practical profit target on a short-term, bullish trade. A drop below $59 would be a strong signal to consider shorting the stock or buying put options, with $57 offering a practical profit target level on a bearish trade.