(Bloomberg) — Software shares took their hardest hit since March 2020 as investors shunned the priciest corner of the U.S. technology group that’s particularly vulnerable to higher interest-rates and slower economic growth.

Tech losses were huge on Thursday with the Nasdaq 100 Stock Index sinking more than 5%. But for software makers such CrowdStrike Holdings Inc., ZScaler Inc. and DocuSign Inc. it was brutal — with each falling more than 10% at one point on Thursday.

That was also the magnitude of the drop for a Goldman Sachs basket of expensive software stocks, in their worst day since the depths of the pandemic-induced selloff more than two years ago. The iShares Expanded Tech-Software Sector ETF sank to its worst session since September 2020.

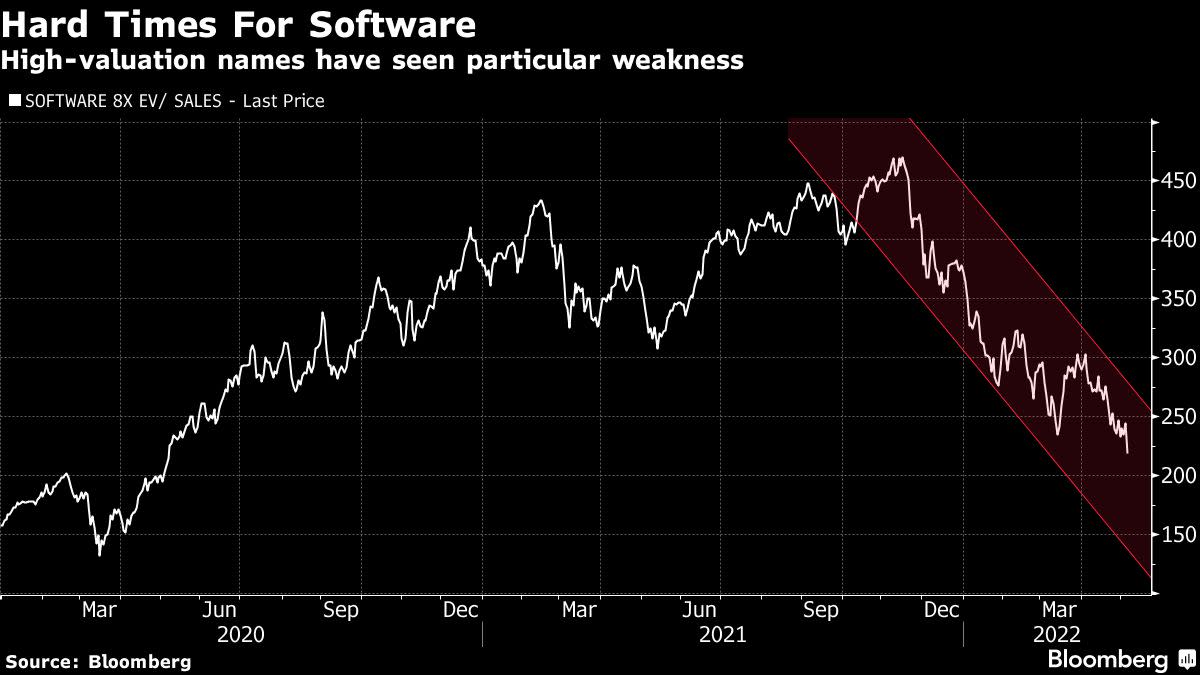

Software providers are being particularly punished as they trade at a premium to the tech-heavy Nasdaq 100 and many are unprofitable. The group of companies priced at 8 times sales or higher has fallen more than 50% from a November peak.

“A lot of these companies don’t have a lot of profit, which makes it more challenging to find a bottom,” said Daniel Morgan, senior portfolio manager at Synovus Trust. “If a stock is trading at 10 times earnings, I can say, it can’t get much worse than this.”

To put that into perspective, the S&P North American Expanded Technology Software Index is trading on 35 times projected profits over the next 12 months. That compares with the S&P 500 at 18 times and the Nasdaq 100 at 21.

Some software providers were also hit by quarterly earnings results and forecasts that fell short of analyst expectations, deepening the selloff Thursday. DigitalOcean Holdings Inc. cratered 18% after providing a forecast that came in below analysts’ expectations, while Rapid7 Inc. shed 17% following an “anemic” forecast boost.

Among other stocks, Snowflake Inc. dropped 11% to an all-time low, Cloudflare Inc. sank 14% to its lowest since May 2021, and Atlassian Corp. closed 9.4% lower. Trade Desk Inc., Hubspot Inc. and Unity Software Inc. all closed down more than 10%.

Even though some of these high-valuation, low-profitability names are down 60% to 70%, it doesn’t seem like there is any appetite to buy the dip.

“We’ve seen very little of that this year, which is very different than 2021,” said Randy Frederick, vice president of trading and derivatives for Charles Schwab. “They’re just absolutely getting crushed.”

©2022 Bloomberg L.P.