(Bloomberg) — It’s ending as fast as it began for retail day traders, whose crowd-sourced daring was the pre-eminent story of pandemic equities.

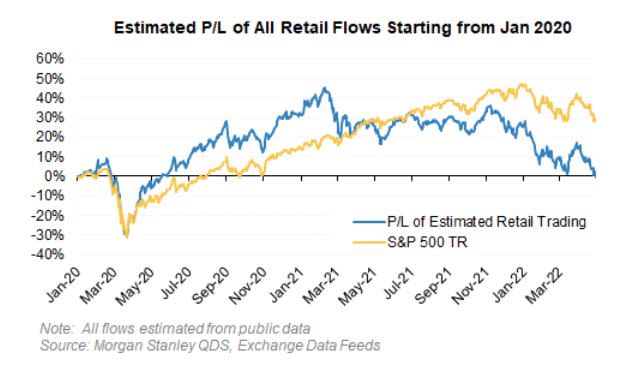

Nursing losses in 2022 that are worse than the rest of the market’s, amateur investors who jumped in when the lockdown began have now given back all of their once-prodigious gains, according to an estimate by Morgan Stanley. The calculation is based on trades placed by new entrants since the start of 2020 and uses exchange and public price-feed data to tally overall profits and losses.

A craze born of the coronavirus outbreak and nurtured by Federal Reserve largesse is being laid low by a villain of identical lineage, inflation, which global central banks are racing to combat by raising the same interest rates they cut. The result has been a lumbering bear market in speculative companies that surged when the stimulus started flowing in March 2020.

“A lot of these guys started trading right around Covid so their only investing experience was the wacked-out, Fed-fueled market,” said Matthew Tuttle, chief executive officer at Tuttle Capital Management LLC. “That all changed with the Fed pivot in November, but they didn’t realize that because they have never seen a market that wasn’t supported by the Fed,” he said. “The results have been horrific.”

Could the DIY crowd bounce back? Yes. People have been foretelling the death of 2020-vintage retail investors since the moment they surfaced — past reports of their demise were exaggerated. Armed with zero-commission trading accounts, individual investors have managed to will their favorite stocks back from the brink multiple times, and may be able to do so again.

Still, famous names from the height of the frenzy are nursing serious losses. AMC Entertainment Inc. is down 78% since June 2021. It’s lost 49% this year. Peloton Interactive Inc. is off 90% from its record. From the start of 2020 to last November, a basket of retail stock favored by retail trades that Goldman Sachs Group Inc. tracks more than doubled. This year, that basket has plunged 32%, more than twice the S&P 500’s decline.

It’s an epic fall from 2021, when at-home traders shot to fame after banding together on WallStreetBets forums to try to squeeze professional investors out of short positions and otherwise overthrow the Wall Street order. Retail investors accounted for roughly 24% of the total stock trading at one point, according to an estimate from Bloomberg Intelligence. Their influence made Reddit blogs and Stocktwits posts must-read material for anyone gathering intel on markets.

In 2022, when about $9 trillion has been erased from the value of U.S. equities, the day-trader army has held relatively firm, at least in terms of positioning, which contrasts with professional money managers who have been retreating. Hedge funds, for instance, have been cutting risk for months, sending their equity exposure to a two-year low, data compiled by Morgan Stanely’s prime broker unit show.

For investors looking for signs of a market bottom, retail behavior is something to watch, according to Morgan Stanley analysts including Christopher Metli.

“Traditional capitulation is typically marked by a quick de-grossing by hedge funds + systematic macro strategies, where positioning is already light,” Metli wrote in a note last week. “Instead, the next leg of de-risking is likely to be more gradual, coming from asset allocators/real money/retail and is therefore likely slower to play out, making a precise bottom more difficult to call.”

There are signs that the day-trader crowd is souring on the market. In April, retail investors snapped up $14 billion in stocks, the second-slowest uptake in any month since late 2020, Morgan Stanley data show. In the options market, where they used to rush to bullish calls for quick profits, activity is now tilting toward bearish puts.

At Bank of America Corp.’s private client unit, where the firm overseas $3 trillion, wealthy individuals exited stocks over the past four weeks at the fastest rate since November.

With personal savings as a percentage of disposable income having fallen back to pre-Covid levels, Vanda Research analysts including Giacomo Pierantoni are doubtful that individual investors will have much more financial and emotional capital to continue buying the dip aggressively.

“Retail investors’ confidence is hampered by poor portfolio performance, and wealthier/older investors look to money market funds for income and protection,” they wrote in a note earlier this month. “Markets always find ways to put investors through the toughest of tests…time will tell if the new-age ‘diamond hands’ mentality will hold.”

©2022 Bloomberg L.P.