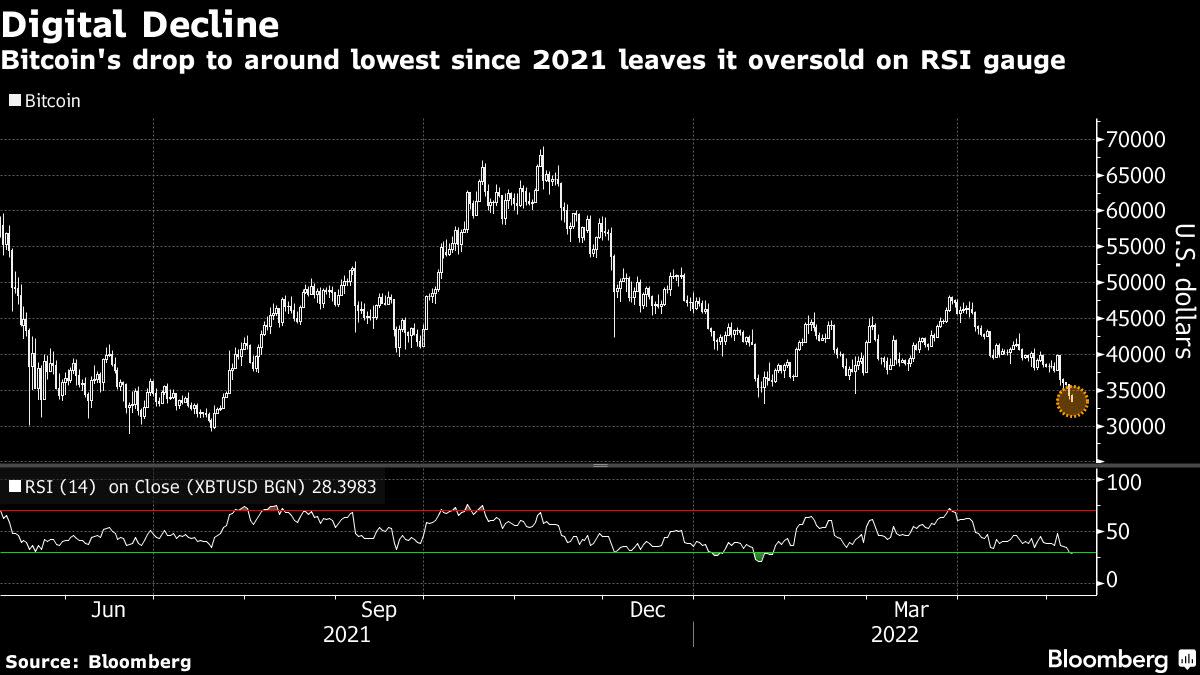

(Bloomberg) — Bitcoin is falling toward levels last seen in July 2021, part of a wider retreat in cryptocurrencies amid a global flight from riskier investments.

The world’s largest digital token dropped as much as 2.7% on Monday and was trading at $33,741 as of 12:40 p.m. in Singapore. The second biggest, Ether, shed as much 4.6%. Most of the major virtual coins were under pressure over the weekend and the downbeat mood carried over into Monday.

Tightening monetary policy and ebbing liquidity are turning investors away from speculative assets across global markets. Adding to the caution around digital assets, the value of TerraUSD or UST, an algorithmic stablecoin that aims to maintain a one-to-one peg to the dollar, slid below $1 over the weekend before recovering.

Rising interest rates are giving individual and institutional investors pause for thought about the crypto market outlook, according to Edul Patel, chief executive officer of Mudrex, an algorithm-based crypto investment platform.

“The downward trend is likely to continue for the next few days,” he said, adding Bitcoin could test the $30,000 level.

The token would hit its lowest level since July 2021 if it weakens below $32,970. Bitcoin’s 27% decline in 2022 compares with a retreat of more than 10% in global bonds and shares, and a 2.5% advance in gold.

©2022 Bloomberg L.P.