(Bloomberg) — The dollar was firm Monday while equity futures pointed to the possibility of stock market gains in Asia following a bounce in US shares.

Contracts rose for Japan, Australia and Hong Kong after a technology-led jump on Wall Street Friday in a tumultuous week in markets.

The risk of an economic downturn amid high inflation and rising borrowing costs is the major worry for markets, alongside Russia’s war in Ukraine and China’s growth-sapping Covid lockdowns.

China is set to report the weakest monthly economic indicators since the outbreak of the pandemic. Analysts are divided on whether the central bank will cut the interest rate on one-year policy loans Monday.

The People’s Bank of China effectively cut the interest rate for new mortgages over the weekend, seeking to bolster an ailing housing market.

In sovereign bonds, a key question is whether growth concerns will help stem this year’s selloff driven by inflation and rate hikes. The 10-year U.S. Treasury yield starts the week at 2.92%.

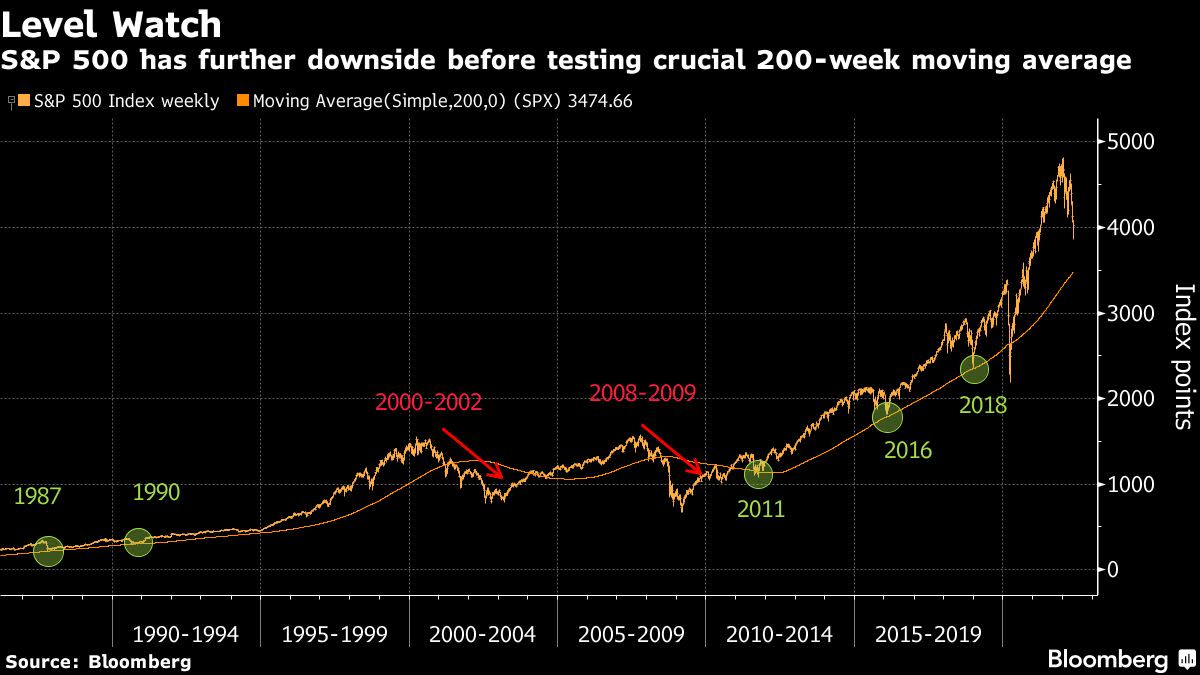

The Federal Reserve’s scope to fight price pressures without causing a hard landing in the world’s largest economy remains in doubt, portending more market volatility. Hence, many traders remain wary of calling a bottom for equities despite a 17% drop in global shares this year.

“There is a belief we could feasibly see a short-term calming before another leg lower with a greater degree of panic involved,” Chris Weston, head of research at Pepperstone Group, said in a note.

Goldman Sachs Group Inc. Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a US recession, saying it’s a “very, very high risk.”

The firm’s economists cut their forecasts for US growth this year and next — they now expect the economy to expand 2.4% this year and 1.6% in 2023, down from 2.6% and 2.2% previously.

Food and fuel prices are feeding into rising costs, with oil around $110 a barrel and India’s move to restrict wheat exports set to reverberate through global agricultural markets.

Geopolitical concerns in Europe related to the Russia-Ukraine war are likely to remain in the spotlight. Finland and Sweden moved toward joining the North Atlantic Treaty Organization, potentially amplifying tensions.

Sentiment appears to have stabilized in cryptocurrencies after last week’s rout. Bitcoin made gains over the weekend and was trading near $31,000.

©2022 Bloomberg L.P.