(Bloomberg) — Federal Reserve Chair Jerome Powell said no one should doubt the US central bank’s resolve to curb the highest inflation in decades, including pushing rates into restrictive territory if needed.

“What we need to see is inflation coming down in a clear and convincing way and we’re going to keep pushing until we see that,” he said Tuesday during a Wall Street Journal live event. “If that involves moving past broadly understood levels of neutral we won’t hesitate at all to do that.”

US central bankers raised interest rates by a half point at their meeting earlier this month and Powell said two similar moves were on the table in June and July. The target for their benchmark lending rate currently stands in a 0.75% to 1% range. He repeated that guidance on Tuesday, noting that “if the economy performs as we expect then that’s something that will be on the table.”

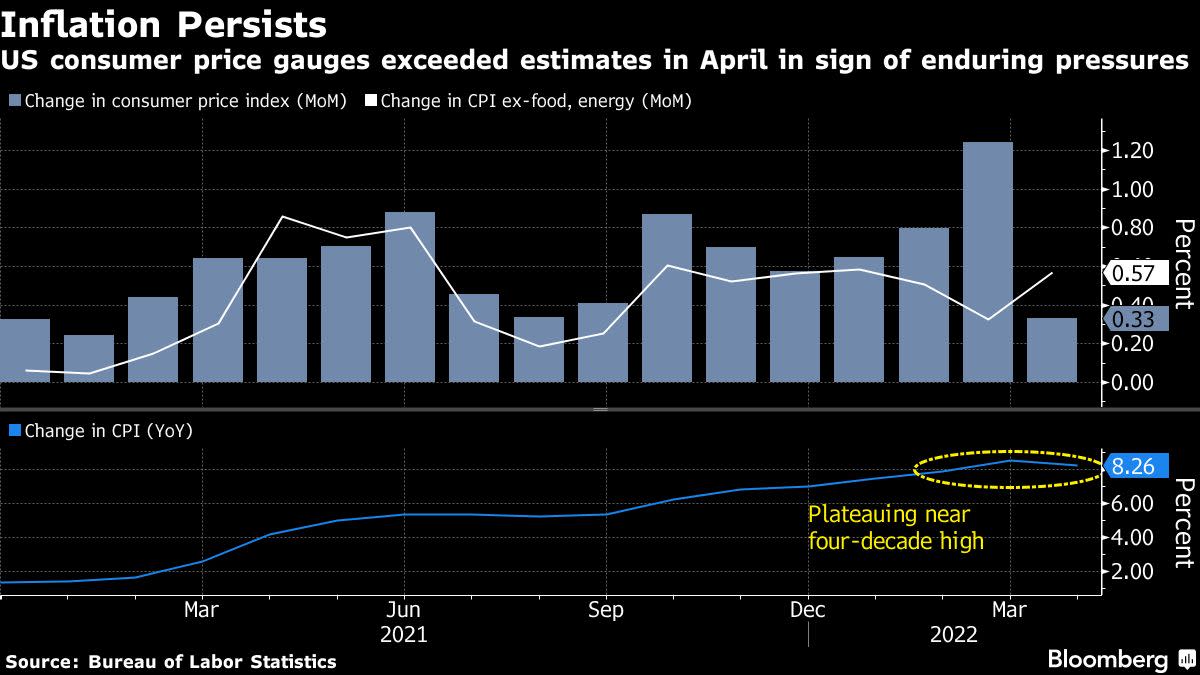

US consumer prices rose 8.3% in the 12 months through April, according to Labor Department figures published May 11. That was slightly lower than the 8.5% increase in the 12 months through March, which marked the highest inflation rate in 40 years.

Domestic demand remains strong even though financial conditions have tightened after a number of Fed officials have said they want to raise rates to neutral by year-end, which they see lying around 2.5%.

“This is a strong economy and we think it’s well positioned to withstand less accommodative monetary policy, tighter monetary policy,” Powell said. “There could be some pain involved in restoring price stability — but we think we can sustain a strong labor market.”

Fed officials say they can reduce demand for jobs without raising unemployment, a feat that hasn’t been seen in the past two recessions. Unemployment is low at 3.6%, and wages and benefits are rising.

Powell said the labor market would still be strong even if the jobless was “a few ticks” higher than that.

Financial Conditions

The Standard and Poor’s 500 stock index is down about 15% since its January peak, while yields on government 10-year notes stand around 2.96%, up from 1.5% at the start of the year.

The rise in longer-term yields is pushing up borrowing costs for housing — one of the most interest-rate sensitive sectors of the economy that the Fed would like to see cool to help curb price pressures. The rate on a 30-year fixed-rate mortgage stood above 5.4% last week, up slightly more than 2 percentage points from the start of the year, according to the national average tracked by Bankrate.com.

Powell said that the reaction in financial markets showed that investors were getting the Fed’s message.

“We like to work through expectations and I’m not blessing any particular day’s readings but it’s been good to see financial markets reacting in advance based on the way we’re speaking about the economy.”

©2022 Bloomberg L.P.