(Bloomberg) — Stock traders still clinging on after this week’s vicious drop in US benchmarks had better tighten their grip — OpEx is back to whip up more turmoil.

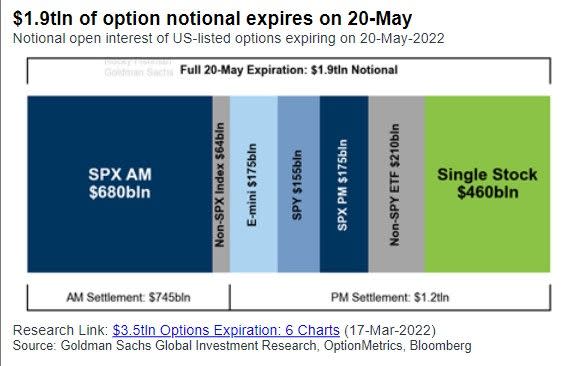

The monthly expiration of options tied to equities and exchange-traded funds is notorious for stirring up volatility, and the next event takes place on Friday. Traders will close old positions for an estimated $1.9 trillion of derivatives while rolling out new exposures, all with the S&P 500 on the brink of a bear market.

This time round, $460 billion of derivatives across single stocks is scheduled to expire, and $855 billion of S&P 500-linked contracts will run out, according to Goldman Sachs Group Inc. strategist Rocky Fishman.

With daily options volume heading for an annual record, the expiry is a widely watched event on Wall Street since moves in the derivative market have the capacity to spur gyrations in underlying securities. All this is another layer of trading complexity for investors battered by the drumbeat of disappointing corporate earnings and Federal Reserve hawkishness.

“Sentiment is poor,” said Danny Kirsch, head of options at Piper Sandler & Co. “Now with daily options, the landscape of open interest is super dynamic at least as it relates to the S&P 500.”

Down for a seventh straight week in a row, the S&P 500 is on course for its longest decline in 21 years. Stock losses deepened this week as earnings from retail giants like Target Corp. and Walmart Inc. reinforced concerns that inflation is eating into corporate America’s bottom line. The S&P 500 fell 0.6% to 3,900.72 on Thursday.

The equity selloff is getting no sympathy from central bankers. After having almost always come to rescue at the first sign of market troubles in the past decade, the Fed is now squarely focused on tightening monetary policy to combat inflation, a shift that has underpinned this rout.

Fears that rate hikes could drag the economy into a recession have prompted traders to seek protection in the option market. The 10-day average of Cboe’s put-call volume ratio for single stocks rose to the highest level since the 2020 pandemic crash, a sign of elevated caution.

But lately, there are indications that investors are also scooping up bullish options on ETFs tracking indexes like the S&P 500 and Nasdaq 100, a move that some analysts say reflect fears of missing out should the market bounce back after one of the worst routs in decades.

All that means 2022 is shaping up to be the busiest year for option trading. Almost 40 million contracts have changed hands daily on average, 6% above last year’s record, data compiled by Bloomberg show.

Going into Friday, expiring S&P 500 options showed the highest concentration in the 4,000 strike, with over 93,000 open positions set to run out. That includes 41,024 calls and 52,269 puts.

Should the S&P 500 close well below 4,000 Friday, that could set the stage for a bounce Monday as dealers who brokered these options and were short stocks to neutralize their positions would need to unwind that hedge, according to Brent Kochuba, founder of analytic service SpotGamma. In other words, market makers will be free to buy back stocks to cover the short exposures that are no longer needed.

Still any knee-jerk recovery is unlikely to last, Kochuba says.

“The Fed will still be raising rates,” he wrote in an email. “Any ultimate rally off of Opex, we’d consider to be short covering, and subject to swift reversals into the end of next week.”

©2022 Bloomberg L.P.