(Bloomberg) — Deere & Co. slid the most in 14 years after the world’s largest manufacturer of agricultural equipment was the latest major US company bruised by supply chain snags and rising inflation.

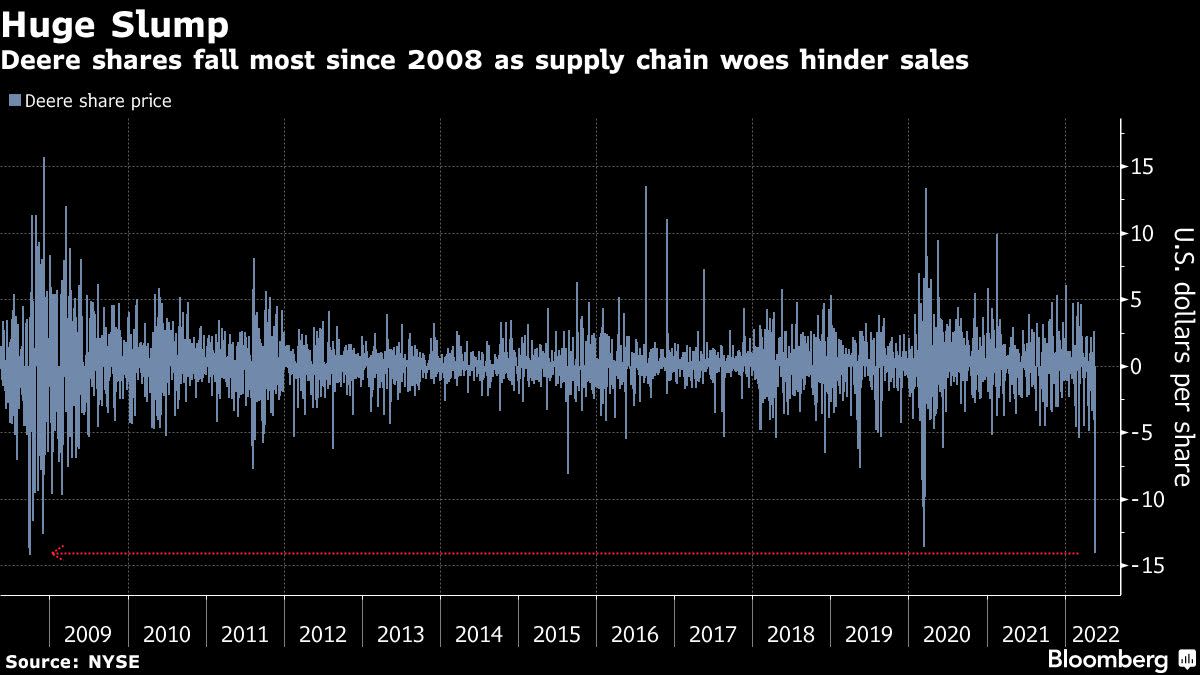

Shares fell 14% Friday, erasing a record $15.7 billion in market capitalization after the company posted disappointing quarterly sales and said that supply chain challenges will persist through the end of the year. Ongoing chip shortages continue to prevent Deere from producing more tractors to meet customer needs, and continuing problems with trucking and ocean shipments have forced the company to use more costly air freight to get key components to its plants.

“Very surprising — Deere was viewed as a relative safe-haven in a volatile market,” said Larry De Maria, an analyst at William Blair. Now the company will be forced to rely more heavily on boosting production in the second half “in a supply chain challenged world to achieve its targets,” he said.

Deere became the latest big US corporate name to warn on the effects of inflation and supply chain issues. Walmart Inc., Target Corp. and Cisco Systems Inc. this week cut their profit forecasts, stoking a selloff across the stock market. The company also said it suffered from higher production costs as supply chain snags continue to hound the manufacturer.

The interruptions are hindering sales just as US farmers are poised for another year of profit as war and global weather challenges have extended the 2021 crop price rally. At the same time, disruption from Russia’s invasion of Ukraine has elevated the cost of fuel and fertilizer, threaten to limit farmers’ spending power. Surging diesel prices mean some farmers are paying twice as much as they did a year ago to fill up their tractor. The costs of weedkillers, insecticides and nitrogen fertilizer are also soaring.

“The problem is more around supply chain constraints,” Stephen Volkmann, an analyst at Jefferies, said by phone. “The good news is they can sell whatever they can make, but the bad news is they’re constrained on what they can make.”

Deere forecast 2022 net income between $7 billion and $7.4 billion, above analysts’ average estimate of $6.99 billion and up from a prior range of $6.7 billion to $7.1 billion. The company also cited impairments related to the Russian invasion of Ukraine. It told investors in March that it halted shipments of its equipment to Russia.

On its earnings call, company executives said they haven’t seen demand for large farm machinery cool off, and expect strong agriculture demand into 2023.

“It’s definitely not a market to release an earnings miss” into, said Matt Arnold, an analyst at Edward Jones. The selloff “was an overreaction that creates a buying opportunity,” he said. “Demand remains very strong, and earnings are eventually going to reflect that strength.”

©2022 Bloomberg L.P.