2022 has played out pretty differently than a lot of experts thought it would. While the COVID-19 pandemic is still not over, it has been surpassed in newsworthy conversations – political, social, or economic – by the reality of high inflation, rising interest rates, and geopolitical turmoil. It’s been enough to push all of the major indices into or near their own respective bear market levels.

The Tech sector is often one of the top-performing sectors of the market when things are broadly bullish, and the same has been true this year on the downside; Tech stocks are among the most beaten-down companies in the market right now.

That sounds a little scary if your investing focus is strictly on growth-oriented stocks; but for a value investor, it’s also something that starts to make the market more and more interesting as the pool of useful long-term opportunities keeps growing. That does mean that you buy everything you can; but it does mean that if you’re careful, selective, and conservative about when you take a new position, and how much of your capital you commit to any new investments, you can keep the market working for you, even when everything looks more and more risky.

Juniper Networks Inc. (JNPR) is a stock that I’ve followed for a number of years, and used off and on in my own investing systems to good advantage. JNPR has a foothold in the remote networking and cloud space as a provider of Wide Area Network (WAN) solutions, which is part of the tech ecosphere that virtual private networks (VPNs) generally fall under. JNPR is a company that doesn’t jump off the page, or off of the tongues of talking heads when they talk about tech companies, because they tend to be focused on glitzier, attention-grabbing names. Even so, JNPR occupies an interesting niche in its market. The fact that the stock has dropped more than -22% off its latest, 52-week high from late March of this year also doesn’t hurt its value-based appeal.

For a value-focused investor like me, seeing a stock well off its 52-week high, and beginning to revisit its yearly low levels is usually an early sign to start thinking about the stock more seriously. Remember, though that mere fact a stock is near historical lows doesn’t automatically make it a good value; it’s a good idea first to run through a thorough fundamental and value analysis to see if the company’s fundamentals are strong enough to make the stock’s drop an opportunity, or a warning. Where does JNPR sit in that respect today? Let’s find out.

Fundamental and Value Profile

Juniper Networks, Inc. designs, develops and sells products and services for high-performance networks to enable customers to build networks for their businesses. The Company sells its products in over 100 countries in three geographic regions: Americas; Europe, the Middle East and Africa, and Asia Pacific. The Company sells its high-performance network products and service offerings across routing, switching and security. Its products address network requirements for global service providers, cloud providers, national governments, research and public sector organizations, and other enterprises. The Company offers its customers various services, including technical support, professional services, education and training programs. The Company’s Junos Platform enables its customers to expand network software into the application space, and deploy software clients to control delivery. The Junos Platform includes a range of products, such as Junos Operating System (OS) and Junos Space. JNPR has a current market cap of about $9.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased about 26.7%, while revenues increased by almost 9%. In the last quarter, earnings declined by -53.66%, while sales declined by a little over -10%. The company’s margin profile shows that Net Income as a percentage of Revenues weakened in the last quarter, from 7.03% over the last twelve months to 4.77% in the last quarter.

Free Cash Flow: JNPR’s free cash flow has been steady over the past year; over the last twelve month this number was $597.7 million, up a bit from $589.7 million in the last quarter and $582.5 million a year ago. The current number translates to a Free Cash Flow Yield of about 6.41%.

Debt to Equity: A has a debt/equity ratio of .39. This is a conservative number. JNPR currently has a little over $1 billion in cash and liquid assets against a little under $1.65 billion in long-term debt. The company’s balance sheet indicates their operating profits are sufficient to service the debt they have, with adequate liquidity to make up for any potential operating shortfall.

Dividend: JNPR’s annual divided is $.84 per share, and has increased from $.76 in 2019 and $.80 at the end of 2021; that translates to a yield of 2.84% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $24 per share. That suggests the stock is overvalued, with -19% downside from its current price, and with a useful discount price at around $19.50.

Technical Profile

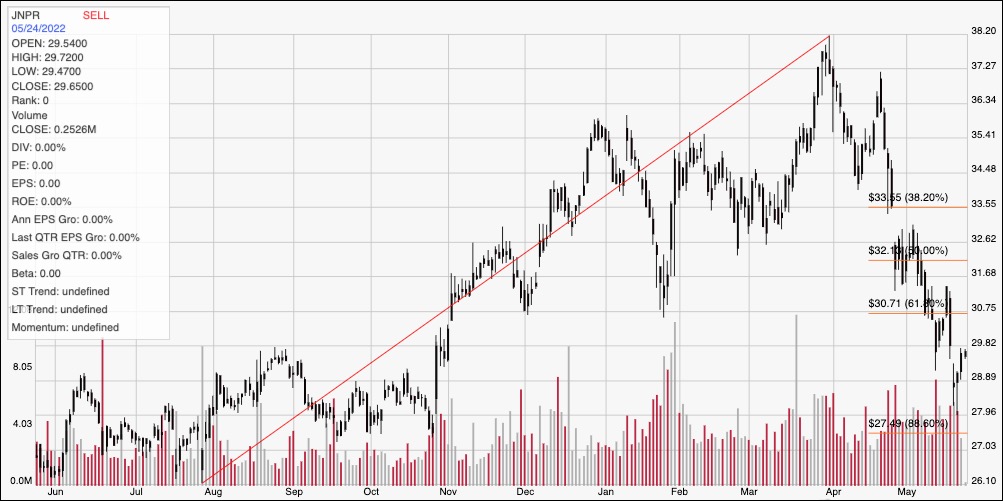

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend from August of last year at a low around $26 to its peak in March at around $38; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Current support is at the stock’s recent pivot low, at around $29, with immediate resistance sitting at the 61.8% retracement line a little below $31. A push above $31 should have near-term upside to about $32.60, and secondary resistance at around $33.50 where the 38.2% retracement sits if buying activity accelerates. A drop below $29 should find next support at around $27.50, with the stock’s 52-week low at around $26 in sight if selling momentum accelerates.

Near-term Keys: The stock’s current momentum is clearly bearish, making any kind of short-term bullish trade quite speculative, with limited profit potential right now; but if the stock does break above $31, that could offer an interesting (albeit speculative) signal that the short-term trend is about to reverse to the upside. That could provide an opportunity to buy the stock or to work with call options, using $32.50 as a practical profit target, and $33.50 if bulling momentum accelerates. A drop below $29 could be a signal to consider selling the stock or buying put options, with a near-term target between $27.50, and the stock’s yearly low at around $26 if selling activity increases. As for JNPR’s value proposition, the company’s fundamentals are informative, but unfortunately the stock’s current decline hasn’t brought its price in line with a useful valuation. Practically speaking, JNPR would need to drop to around $19 to provide a practical, realistic basis for a long-term, value-based investment.