(Bloomberg) — Half-point rate hikes by the Federal Reserve at each of its next two policy meetings are no longer a sure thing for traders, even as policy makers reiterated an aggressive tightening stance.

Swap contracts indicated on Wednesday that markets priced less than 100 basis points of combined rate hikes at the June and July meetings. The value of such contracts is determined by the effective federal funds rate after Fed meeting dates.

That comes even as minutes of the May 3-4 meeting showed members saw half-point rate hikes as appropriate at the next two meetings. Price action in Treasuries was also muted, with yields remaining slightly richer on the day across the curve.

Fed Saw Aggressive Hikes Providing Flexibility Later This Year

It’s a sharp contrast from last week, when traders priced in at least two half-point hikes over the next two months, with a small chance of a 75-basis-point move at one of the meetings.

For the subsequent meeting in September, the contracts priced in 33 basis points of hikes — a 66% chance of a half-point hike that month. That’s down from a peak of more than 60 basis points before the Fed’s May meeting

Disappointing April new-home-sales data Tuesday sparked the recent wave of dovish repricing across US short-term rates. A report on durable goods orders that also fell short of economist estimates saw that pricing gather pace Wednesday.

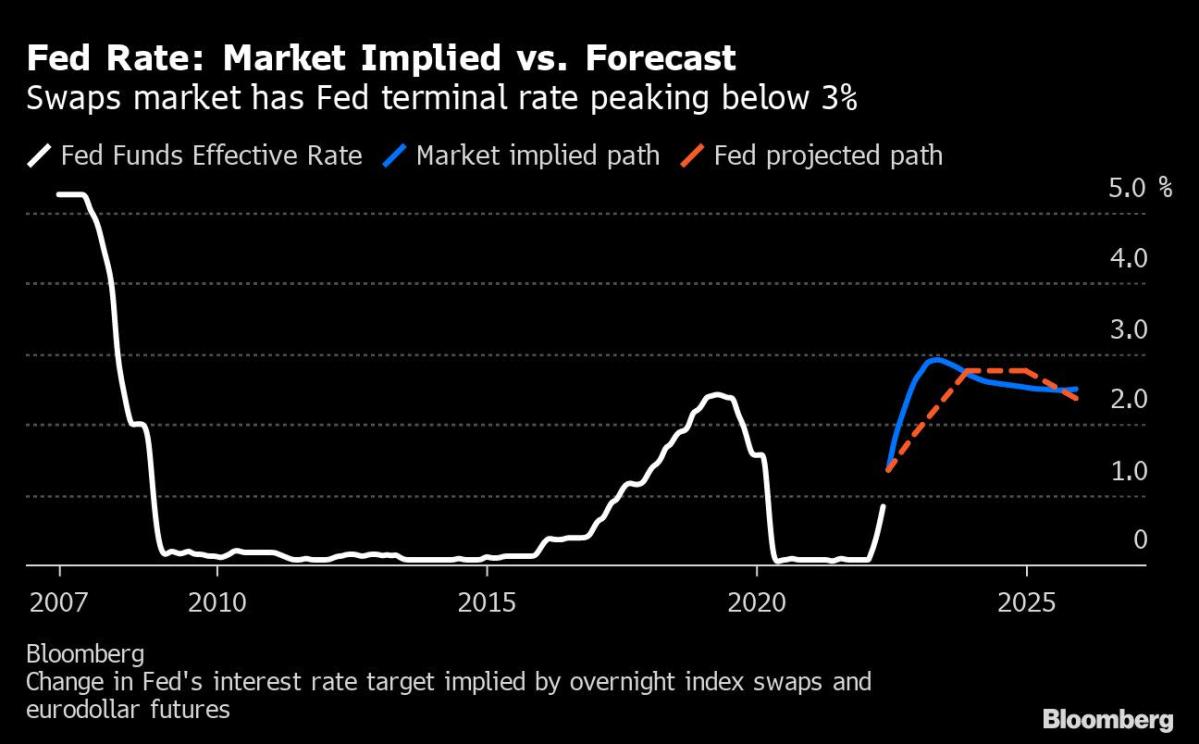

Expectations for the level at which the fed funds rate will peak are pulling back from 3%. The policy rate is being priced to top out at around 2.93% by the middle of next year Wednesday, down from 3.4% earlier this month.

©2022 Bloomberg L.P.