(Bloomberg) — A growing number of Wall Street strategists see last week’s stock market rebound as a head fake before more selling, as risks to the US economy and corporate earnings growth remain with stubbornly high inflation.

The S&P 500 Index is drifting lower Tuesday after snapping its longest streak of weekly drops in two decades. And analysts from banks and investment firms including Morgan Stanley, Bank of America Corp. and Oppenheimer & Co. expect more losses ahead.

The recent bounce was driven by oversold conditions tied to hopes that that the Federal Reserve may be debating a pause in September, Morgan Stanley’s Michael Wilson, one of Wall Street’s most vocal bears, told clients in a note. He thinks earnings estimates remain too high and sees the S&P 500 trading close to 3,400 by the end of the second-quarter earnings season in mid-August, implying 18% downside from Friday’s close.

Jonathan Krinsky, chief market technician at BTIG, also thinks the S&P 500 will decline to 3,400 to 3,500, but told clients in a note that it’s “probably a late summer or early fall event,” and before that the equities benchmark will bounce between 3,800 and 4,250.

Sam Stovall, chief investment strategist at CFRA Research, pointed out how the S&P 500 was due for rally as its price-to-earnings ratio based on forward 12-month estimates reached 16.8, the lowest reading since early April 2020 and 1.1% below a two-decade average.

“The market was primed for at least a short-term snap-back,” Stovall told clients in a note. “We remain skeptical of this rally’s sustainability.”

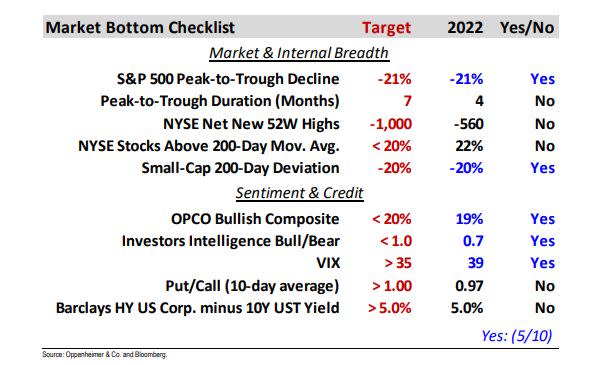

That said, the S&P 500 is likely “closer to a bottom than a top”, according to Ari Wald, head of technical analysis at Oppenheimer, as several of the firm’s market-bottom indicators near their targeted thresholds. The S&P 500, for instance, tallied a peak-to-trough decline of 21% during intraday trading on May 20.

Still, weak market breadth may herald further declines for U.S. stocks in the near term as fewer stocks moving major indexes higher.

“We’re assuming that the S&P 500 overshot to the downside in May, and recent stabilization has positioned the index for counter-trend relief,” Wald told clients. “We also believe this year’s downturn requires additional time over the coming months, and that relief rallies are likely to be sold until an established base is presented.”

©2022 Bloomberg L.P.