(Bloomberg) — Software makers that have been battered amid this year’s stock slump were dealt another blow this week when Microsoft Corp. warned of even more headwinds coming down the pike.

The world’s largest software maker cut its profit forecast for the current quarter on Thursday and blamed the surging US dollar for an upcoming drag on its earnings to the tune of $460 million. The company’s rare mid-season revision took markets by surprise and briefly sent futures on the S&P 500 Index tumbling.

Microsoft and other large US software makers such as Oracle Corp. and Adobe Inc., have complex global operations and higher exposure to foreign currencies. The US Dollar Index has risen more than 7% off a January low, and last month hit its highest in two decades. The more expensive dollar is bound to add to pressures already threatening the companies’ margins such as higher costs.

“A strong dollar will be a recurring theme across many large software companies, as most generate over one-third of their sales outside the US,” said Anurag Rana, senior analyst with Bloomberg Intelligence.

Soaring U.S. Treasury yields and expectations of tighter monetary policy from the Federal Reserve have caused investors to flee software stocks with pricey valuations and whose profits are expected to be delivered far in the future.

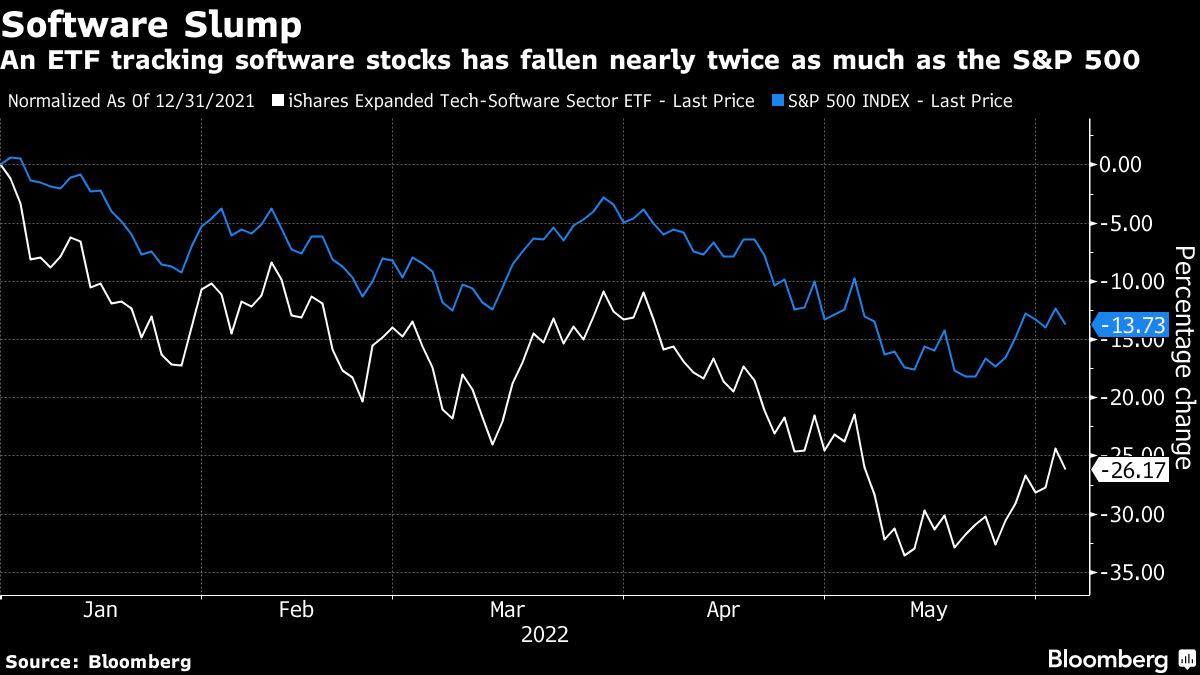

The iShares Expanded Tech-Software Sector ETF is down 26% in 2022, including a drop of 2.3% in Friday’s session. A Goldman Sachs basket of the priciest software names is down more than 45%, while the broad S&P 500 Index is down 14%. Microsoft fell 1.7% on Friday and ended the week with a 1.2% decline.

Dollar Hedge

Wall Street has been encouraged by strong financial results from software makers this earnings season. Salesforce Inc. this week gave a bullish full-year forecast but said results were hurt by the dollar’s strength, and warned that it expects the issue to extend into the second quarter.

Companies with larger exposure to currencies like Salesforce will have to look into hedging strategies to protect against the dollar strength, said Brendan McKenna, a strategist at Wells Fargo. He sees the dollar bulking up against most developed countries’ currencies, as well as those from emerging markets, with few exceptions.

For now, analysts have remained sanguine about profits lost to foreign-exchange rates, focusing instead on strong fundamentals that point to the group’s resilience in the face of slowing economic growth.

But for some investors, there are still too many risks to justify piling back into software stocks despite more attractive prices.

“They’re more attractive than they were, but we won’t chase the quality names lower thinking they’re bargains yet,” Stephen Hoedt, managing director of equity research at Key Private Bank. “Cheap can quickly become cheaper in a rising-rate environment.”

©2022 Bloomberg L.P.