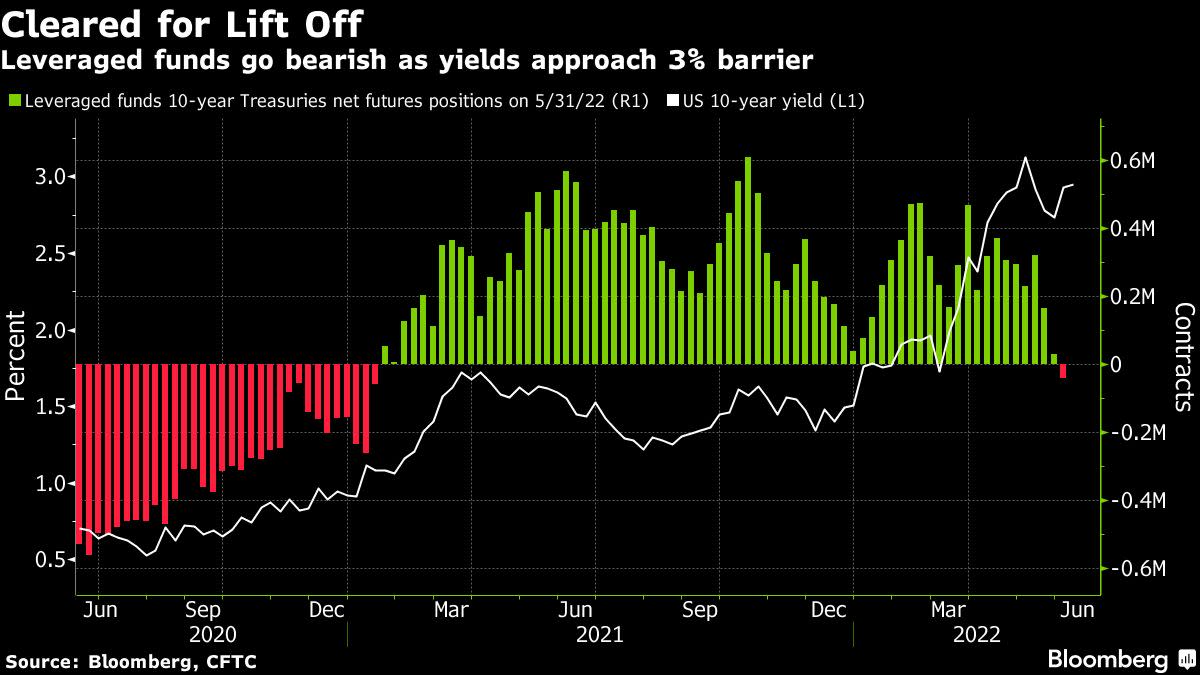

(Bloomberg) — Hedge funds are signaling it may be third time’s a charm as to whether US 10-year yields will climb above 3% to stay.

Leveraged funds become net short on the securities at the end of May, according to the latest data from the Commodity Futures Trading Commission. That’s the first time they have been bearish since January 2021.

The 3% level is proving a tough psychological barrier for 10-year notes to breach. Benchmark yields climbed above that threshold in early May, and again on May 18 before falling back. They moved toward it once again last week following robust Friday’s US payrolls data and were at 2.94% on Monday.

The risk for yields appears skewed to the upside. A report on Friday is forecast to show US consumer prices rose 8.3% last month from a year earlier, according to a Bloomberg survey of economists. That would match April’s inflation reading, which was among the highest in decades.

Elsewhere, the European Central Bank is expected to signal at a meeting this week that rate hikes are on the menu, while the war in Ukraine is helping to push up the prices of oil and other commodities.

Read More: Treasury Yields Staring Down 3% Threshold Await CPI for Next Cue

“The notion of the Fed pausing in September is likely to have more cold water poured on it this week,” said Prashant Newnaha, a rates strategist at TD Securities in Singapore, noting that Fed Atlanta President Raphael Bostic had flagged a pause then may make sense. “Oil prices trekking higher, a hawkish ECB meeting and May US CPI beating expectations should see US 10-years crack above the 3% mark this week.”

Swaps traders are fully pricing in 50 basis-point rate hikes at both the Fed’s June and July meetings, but are only anticipating 40 basis points of additional tightening in September. That outlook underscores concern the central bank may have to risk an economic slowdown to get inflation under control. Similar fears helped spur a Treasury rally that saw 10-year yields tumble as much as 50 basis points from this year’s high of 3.20% set on May 9.

©2022 Bloomberg L.P.