(Bloomberg) — A glut of fertilizers at the biggest Brazilian ports signals that the price of the nutrients may have to drop further before farmers start buying.

In Paranagua, private warehouses reached theirs maximum storage capacity of 3.5 million tons, according to Luiz Teixeira da Silva, Paranagua’s operations director. A terminal operated by VLI Logistics, one of the two at Santos port that store fertilizers, is also full, according to people with knowledge of the matter who asked not to be named as the information isn’t public.

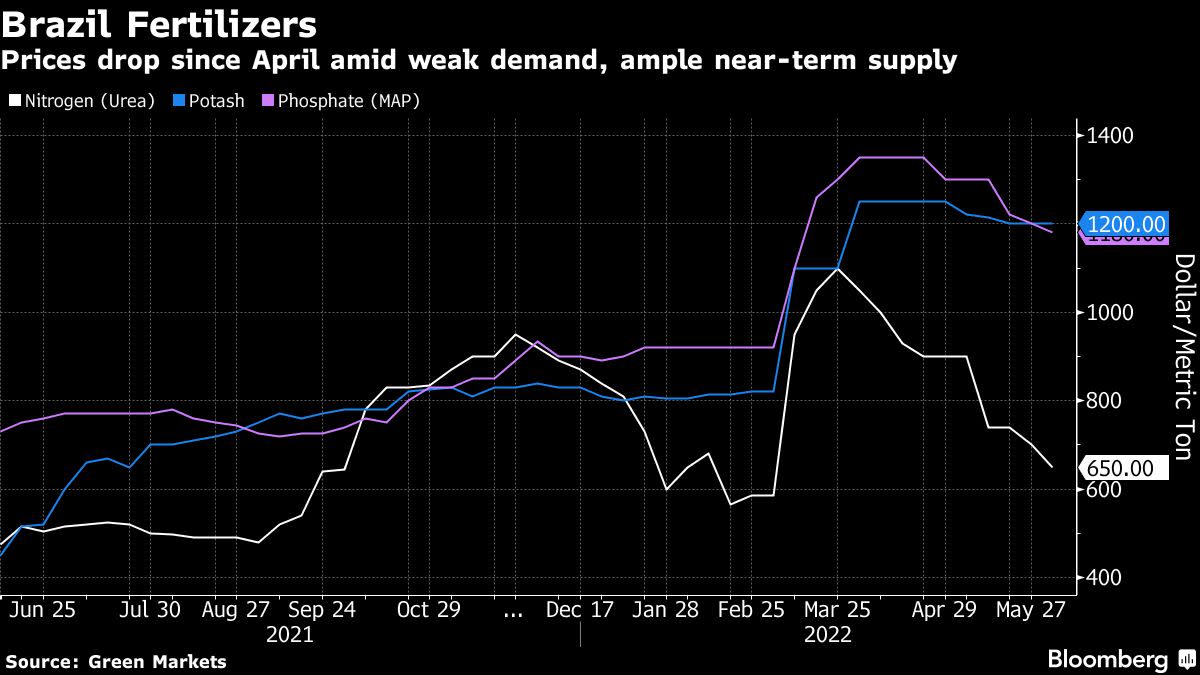

Fertilizer prices soared to records after the war in Ukraine sparked fears of a shortage. Brazil imports nearly 85% of its fertilizer and Russia is the main origin. As supplies have normalized, prices have declined over the past weeks, but farmers still aren’t buying. They are waiting for further price cuts, according to Marina Cavalcante, an analyst at Bloomberg’s Green Markets.

“Farmers have the expectation that prices will keep falling after declines last week and in the previous one,” she said. “So they’ll wait for further decreases to buy.”

Brazil is the world’s biggest shipper of several crops, including soybeans. Farmers can delay their purchases until the eve of the soybean seeding in September. But if they all wait too long, a last-minute rush could lead to inland transportation bottlenecks that may leave some of them empty-handed.

Which commodities will outperform into year-end? Raw materials is the theme of this week’s MLIV Pulse survey. Please add your voice.

©2022 Bloomberg L.P.