(Bloomberg) — While hedge funds were busy bailing from stocks at a record pace as the S&P 500 plunged into a bear market, Corporate America was furiously buying.

As the benchmark index notched successive drops of more than 2.9% on Friday and Monday, Goldman Sachs Group Inc.’s unit that executes share buybacks for clients saw volume spiking to 2.8 times last year’s daily average on the first day and more than triple the average on the second. Each session ranked as the firm’s busiest of this year.

The deluge of repurchases didn’t keep the S&P 500 completeing a 10% drop in just five sessions. Still, that willingness to snap up shares in times of turmoil underlines how reliable a source of support companies are in a year when many investors have taken the Federal Reserve’s hawkishness to heart and turned their backs on risky assets like stocks.

“It provides some level of comfort to know that companies are viewing the latest selloff as an opportunity to repurchase shares rather than retrenching,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. “It will be interesting to see if this trend can be sustained in the second half of the year.”

The S&P 500 jumped 1.5% Wednesday after the Fed raised interest rates by the most in almost three decades, but suggested such outsize moves won’t be common as it moves to bring inflation back under control.

Regardless, corporate buys don’t look set to slow when judging by announced plans. American firms have advertised the intention to buy back $709 billion of their own shares since January, 22% above the planned total at this time last year, data compiled by Birinyi Associates show.

David Kostin, chief U.S. equity strategist at Goldman, predicts actual buybacks this year will rise 12% to a record $1 trillion.

But Goldman’s trading desk also sounded a near-term warning: with second-quarter earnings season slated to kick off in weeks, Tuesday marked the start of a blackout period where buyback volumes usually decline by 35%.

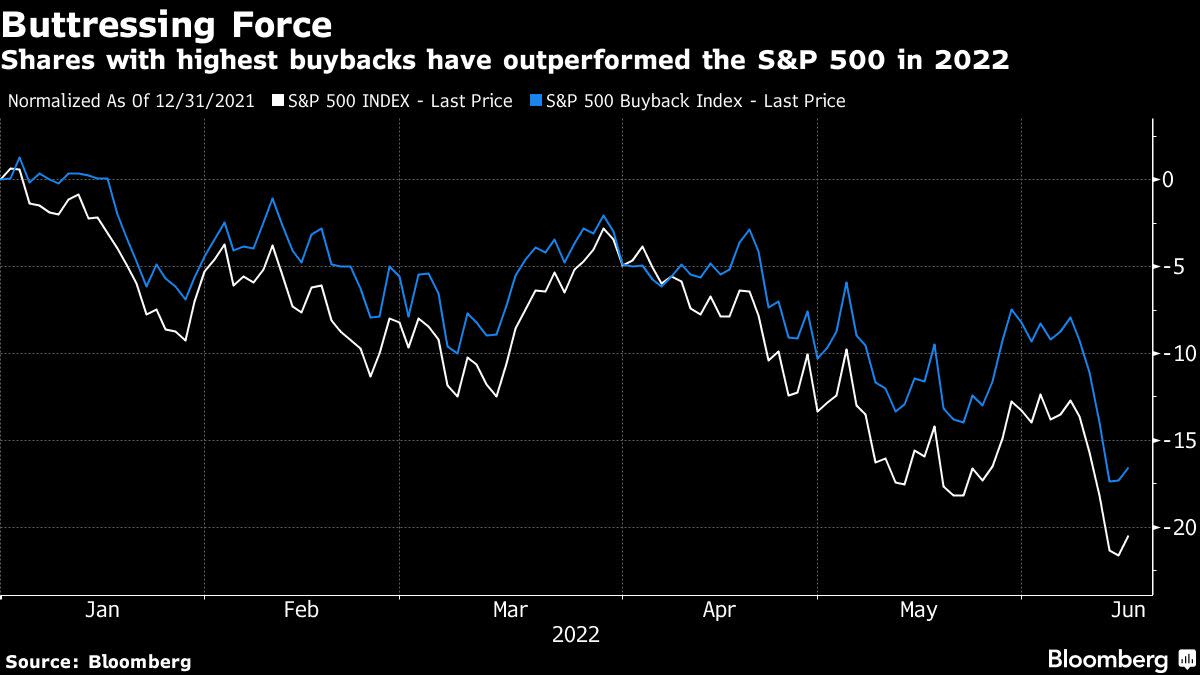

Repurchases tend to keep equity losses from snowballing. The S&P 500 Buyback Index, tracking the top 100 stocks with highest repurchases, is down 16.5% this year, roughly 4 percentage points better than the broad benchmark.

Shareholders fretting over stagflation are not totally in love with companies using cash in that manner. In Bank of America Corp.’s latest monthly survey, roughly one fifth of money managers voted for returning cash to shareholders, down slightly from the 2022 peak. Meanwhile, 44% of money managers wanted companies to strengthen their balance sheets, the highest proportion since January 2021.

Mike Wilson, chief U.S. equity strategist at Morgan Stanley, is less sanguine that corporate demand will be able to sustain the record-setting pace when the earnings outlook is murky.

Plotting sentiment among chief executive officers and corporate buybacks since 1998, Wilson’s team found that falling confidence among business leaders, as is the case now, tended to lead buybacks by roughly six months. Should the pattern play out this time, buybacks could fall toward the back half of this year.

“It’s unlikely we repeat the massive growth from 2021 vs. 2020 but the question is whether markets can maintain growth,” Wilson wrote in a note earlier this week. “2022 has been a unique year with cost pressures pushing down on corporate margins and posing risk to EPS estimates.”

©2022 Bloomberg L.P.