In my search for value, I’ve found it useful to develop a watchlist of stocks that I can check on a regular basis. That means that I often recycle stocks that I’ve previously used to make useful investments in, but don’t currently have a position in.

That’s useful, because the familiarity that comes with the company and its approach builds a shorthand that I think can help to make the analysis process more efficient. As changes happen over time, it also helps to provide a historical context that aids perspective about current events and changes.

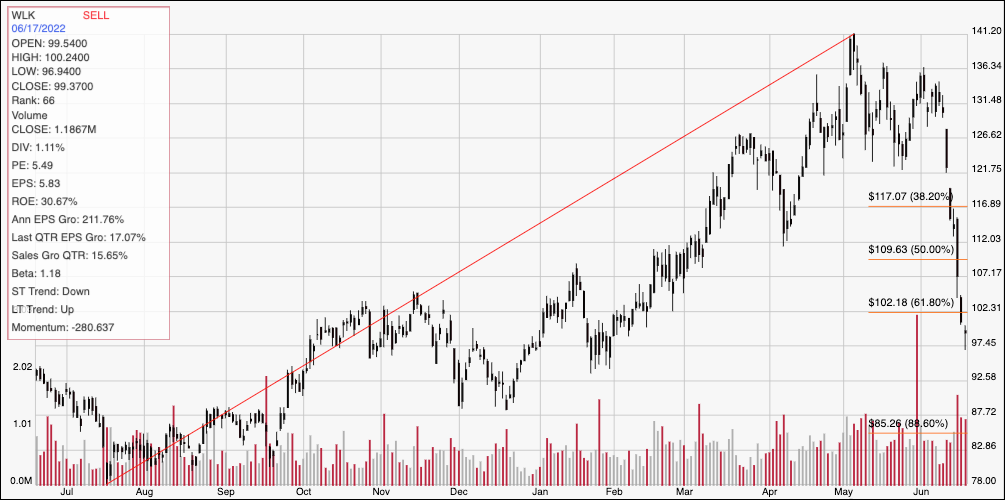

Westlake Chemical Corporation (WLK) is an example of a stock I’ve followed for a while, have used for some very productive previous investing opportunities, and that I like quite a bit. Technically speaking, the stock has been one of the more interesting stocks to watch in the Chemicals industry. The stock followed the rest of the market lower during the pandemic to finally find bottom at around $28, and then moved into a very extended long-term upward trend that saw the stock nearly quadruple in price, peaking in June 2021 at around $106.50. After a sharp turn down to about $78 in July of last year, the stock picked up bullish momentum again, peaking last month above $141. The market’s strong bearish momentum over the last month or so has pushed the entire Chemicals sector lower since then, and WLK hasn’t been immune, falling below $100 as of the end of last week.

WLK’s niche in the Chemicals industry is driven primarily by the housing market. One of the most interesting trends to come out of the pandemic was the sustained rise in demand for housing, leading to outsized increases in real estate prices across the country. That meant that stocks tied to housing had a nice headwind to propel their businesses forward through 2021, but as 2022 dawned, rising inflation has prompted sharp increases in interest rates that most economists are predicting will continue. Not surprisingly, the housing market has seen drops in mortgage applications, with many of the hottest housing markets during the pandemic starting to see their own declines in activity.

Rising interest rates make new and existing home purchases more difficult, on top of the acceleration in housing prices in 2020 and 2021 that saw the average home price rise above affordability levels for the average American family. They also complicate another important aspect of the housing market for a company like WLK, which applies to existing homeowners investing home improvement projects. WLK is one of the biggest producers of PVC products, which are driven primarily by new home starts, but also by improvement projects in existing homes. The company’s most recent earnings reports suggest not only that WLK weathered the pandemic storm better than most, but continues to grow while others in the sector have begun to see declines in revenues and operating margins. The company also boasts healthy liquidity and free cash flow to work with along with a strong, stable operating profile. Does the stock’s latest decline – nearly -30% in the last six weeks or so – mean that there is both a good technical set up buy the stock, as well as a useful value-based opportunity? Let’s find out.

Fundamental and Value Profile

Westlake Chemical Corporation is a global manufacturer and marketer of basic chemicals, vinyls, polymers and building products. The Company’s products include a range of chemicals, which are fundamental to various consumer and industrial markets, including flexible and rigid packaging, automotive products, coatings, water treatment, refrigerants, residential and commercial construction, as well as other durable and non-durable goods. Its segments include Olefins and Vinyls. It manufactures ethylene (through Westlake Chemical OpCo LP (OpCo)), polyethylene, styrene and associated co-products at its manufacturing facility in Lake Charles and polyethylene at its Longview facility. The Company’s products in its Vinyls segment include polyvinyl chloride (PVC), vinyl chloride monomer (VCM), ethylene dichloride (EDC), chlor-alkali (chlorine and caustic soda) and chlorinated derivative products and, through OpCo, ethylene. It also manufactures and sells building products fabricated from PVC. WLK’s current market cap is $23.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by nearly 212% (not a typo), while revenues increased by more than 72%. In the last quarter, earnings improved by more than 17%, while sales were about 15.6% higher. The company’s operating profile is strong and stable at a time when a lot of its industry brethren are reporting slowdowns; Net Income was 18.64% of Revenues for the last twelve months, and 18.64% in the last quarter.

Free Cash Flow: WLK’s free cash flow is healthy and strengthening, at $2.05 billion. This measurement has improved significantly over the past year, when Free Cash Flow was $1.16 million. Its current level translates to a Free Cash Flow Yield of 16.07%. The strength in this metric is a solid confirmation of the earnings and Net Income picture I just described.

Debt to Equity: WLK’s debt/equity ratio is .53, which is conservative and implies the company takes a careful approach to debt management. WLK’s cash and liquid assets in the last quarter were about $1.05 billion while long-term debt was about $4.9 billion. The company’s liquidity has dropped over the last six months, from $3.5 billion at the start of the year; but the company also announced two, $1 billion+ acquisitions in late 2021, and closed both of them by February of this year. Their operating profile indicates they should have no problem servicing their debt, with healthy liquidity providing additional flexibility.

Dividend: WLK pays an annual dividend of $1.19 per share, which translates to a dividend yield of about 1.2% at the stock’s current price. While the dividend yield is conservative, it should be noted that management announced a 10% increase in its dividend payout in late 2021, from $1.08 per share. I consider a consistent dividend to be a sign of fundamental strength; an increasing dividend is an even stronger assertion of management’s confidence in their operating and competitive strategies.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $132 per share. That suggests that WLK is undervalued by about 33% from its current price. I would also like to note that about a year ago, this same metric yielded a long-term target price at around $110 per share.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s upward trend over the past year, from a low at around $78 in July of last year to its May high at around $141; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After consolidating through May between $122 and $136, the stock followed the broad market’s bearish momentum last week to fall below all three major retracement lines to its current price below $100. It may now be sitting at level where support may be found at around $97 (around the stock’s low price on Friday, and where a lot of pivot activity was seen in late 2021 and in January of this year). Immediate resistance is at around $102, where the 61.8% retracement line sits. A drop below $97 could see additional downside to about $88 per share, while a push above $102 will likely find next resistance where the 50% retracement line sits at around $109.

Near-term Keys: WLK’s fundamentals, which continue to show signs of increasing strength, lend credence to the stock’s value proposition, which is interesting enough to warrant a diligent eye. If you’re willing to accept the volatility associated with the stock’s general price action right now, and the possibility that the current bearish drop isn’t done, the stock could offer an interesting value opportunity right now. If you prefer to work with short-term trading strategies, you could watch for a push above $102 as a signal to consider buying the stock or working with call options, using $109 as a practical profit target. A bearish trade has a higher likelihood of success, so you could also use a drop below $97 as a signal to think about shorting the stock or buying put options; in that case, use $88 as a useful area to take profits on a bearish trade.