(Bloomberg) — As the first half of 2022 shapes up to be one of the worst on record for financial markets, retail investors have been boosting their bets on a further downturn in US equities.

Metrics to gauge retail activity in the options markets, including small-lots trading and put buying, suggest that not only are small investors sticking to the sidelines as shares slump, but have been loading up on wagers that benefit should they continue to decline.

“It’s rare for the smallest traders to bet against the stock market, and when they do, stocks have never failed to fail them,” said Jason Goepfert, chief research officer at Sundial Capital Research.

Last week’s net relative bets against stocks exceeded previous records set in the early days of the global financial crisis in 2008 and the start of the Covid-19 pandemic, he wrote in a research report. The firm estimates day traders playing the options market could be sitting on $600 million or more in losses since Thanksgiving.

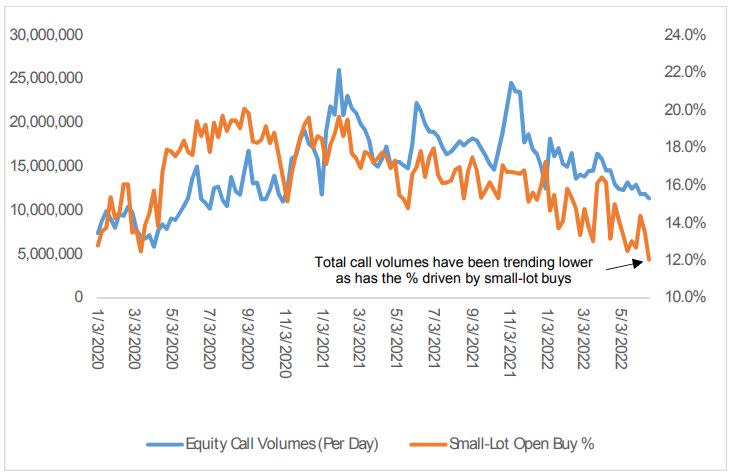

Meanwhile, small-lot volumes and premiums have continued to trend downward — both hitting new pandemic lows — as the market sell-off deepened, according to Christopher Jacobson, a strategist at Susquehanna Financial Group. This pattern suggests that, at least on the options side, retail investors have not been “buying the dip,” the strategist said.

Jacobson looked at the average total daily equity call volumes and the percentage of those volumes driven by small-lot opening call buys, one of his preferred proxies for what is likely retail trader participation, based on data from the Options Clearing Corporation.

The decline in small-lot call activity has also contributed to a shift in volumes back toward sector positioning over the past two years, Jacobson added. “Macro concerns are driving things right now, so there’s just less focus on stock-specific inputs,” he said by phone. “It’s not surprising to see more flow in those sectors or macro specific products on the ETF and index side.”

Ever since the height of the meme stock frenzy in early 2021, when at-home traders famously pushed up shares of GameStop Corp. and AMC Entertainment Holdings Inc., Wall Street has been obsessed with keeping track of how they behave.

But that was then. The stock market has since fallen into bear-market territory with the benchmark S&P 500 index shedding more than 20% and the tech-heavy Nasdaq 100 dropping nearly 30% this year. Data from Goldman Sachs Group Inc. showed roughly 50% of single-stock retail positions in the Nasdaq 100 and a quarter of those in the S&P 500 that had been accumulated since January 2019 have been sold.

“Clearly inflationary concerns and recession concerns aren’t going anywhere anytime soon,” Jacobson said. “But as we head into earning season, I would expect to see a little bit more interest in single stock options. Investors are looking for more divergence there at the equity level.”

Thus far, the only thing giving bulls any peace is the relative sturdiness of profit estimates. Analysts currently expect S&P 500 Index earnings to rise by 10.5% this year and 9.3% in 2023, according to consensus estimates compiled by Bloomberg Intelligence.

“If we get a return to a bull market, is that going to drive more of those participants back in? I would imagine so. Does that mean we will reach the same heights we saw in January of 2021? Maybe not,” Jacobson said.

©2022 Bloomberg L.P.