One of the classic benchmarks of the economy’s health and strength is the housing market. Stocks of retail companies like Home Depot (HD) and Lowe’s (LOW) often serve as proxies of to guide the market’s perception of the housing market.

It’s also pretty common to see experts and analysts referring to homebuilders like D.R. Horton (DHI) and Toll Brothers (TOL) in the same way. During the pandemic, the housing market saw a surprising increase in demand that gave a lot of these stocks big boosts in prices. Among a lot of other contributors, increases in housing prices throughout the U.S. are just one of the reasons that inflation has increased to levels not seen since 1981. That has forced the Fed to raise rates three times on an accelerating basis so far in 2022, with Fed chair Jay Powell stating publicly the Fed’s determination to keep raising for as long as it takes to tame the pace of inflation and bring it back to more sustainable levels.

Rising interest rates are anathema to home buyers, which naturally have to pay more in mortgage interest to own a home. It also complicates large remodeling and home improvement projects that, for the average homeowner, typically require some kind of financing – home equity loans, for example – to pay for. That’s why stocks in the Homebuilding industry have been challenged throughout the year, and why some experts are keeping these stocks at arm’s length right now.

Another segment of the Homebuilding industry that I find to be interesting is in homebuilding suppliers. Owens Corning (OC) is a leader in the Building Products sub-industry. This is an industry that benefits from a robust market in new home purchases as well as in remodeling of existing homes, which is why stocks like OC are usually a good barometer for broader economic health. Like the rest of the industry, the typical expectation also works in opposite fashion; rising interest rates, and an expected slowdown in economic activity are usually factors that will work against the prices of these stocks just as they do for homebuilders.

OC The stock dropped to levels not seen since late 2014 at around $28 in March, but has not only reclaimed the distance it lost since then, but also moved more than $10 per share past its pre-pandemic high point. For those investors that had the foresight to buy this stock at or near those March lows, the stock’s current price provides an outstanding dinner party story; but does that mean that the opportunity is over for this stock, or is there more upside ahead?

OC is a stock that rode the pandemic-driven homebuilding wave from a March 2020 low at around $30 to a high in May of this year above $101. From that high, the stock has dropped about -26%, with the biggest portion of that drop coming this month as broad market activity has turned generally bearish. Despite that price activity, this is also a company with some interesting fundamental reasons to make the stock worth paying attention to. The real question, of course is whether those strengths are enough to suggest the stock could offer a useful value under market conditions. Let’s dive in and find out.

Fundamental and Value Profile

Owens Corning is engaged in the business of composite and building materials systems, delivering a range of products and services. The Company’s products range from glass fiber used to reinforce composite materials for transportation, electronics, marine, infrastructure, wind-energy and other markets to insulation and roofing for residential, commercial and industrial applications. The Company’s segments include Composites, Insulation and Roofing. The Composites segment sells glass fiber and/or glass mat directly to a small number of shingle manufacturers. Its insulating products include thermal and acoustical batts, loosefill insulation, foam sheathing and accessories, and these are sold under brand names, such as Owens Corning PINK FIBERGLAS Insulation. The primary products in the Roofing segment are laminate and strip asphalt roofing shingles. Its other products include oxidized asphalt, roofing components and synthetic packaging materials. OC has a current market cap of about $7.2 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 64.16%, while revenue growth was about 22.5%. On a quarterly basis, earnings grew by more than 29%, while revenues increased by a little over 10%. The company’s margin profile is healthy, with signs of strength; over the last twelve months Net Income as a percentage of Revenues was 12.2%, but improved to 12.96% in the last quarter.

Free Cash Flow: OC’s free cash flow is healthy and has improved throughout the course of the year. For the trailing twelve months, Free Cash Flow was $1.12 billion in the last quarter. That is a bit below the $1.28 billion reported a year ago, but still translates to an attractive Free Cash Flow Yield of 15.22%.

Dividend: OC’s annual divided is $1.40 per share, which translates to a yield of 1.85% at the stock’s current price. It is worth noting that in late 2019, the dividend was just $.88 per share, per annum, and $1.04 per share at the beginning of 2021. That suggests that despite the pressures of the last two and a half years, OC has managed to raise its dividend when many other companies have been forced to reduce or eliminate dividend payments altogether.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $91 per share. That means the stock is nicely undervalued, with 24% upside from its current price.

Technical Profile

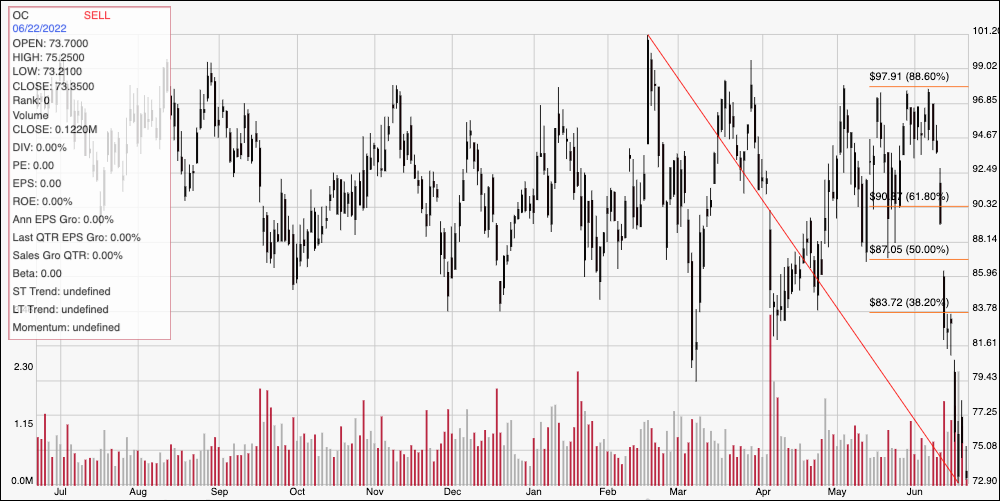

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend from its February high at around $101 to its current, 52-week low at about $73; it also informs the Fibonacci trend retracement lines shown on the right side of the chart. After seesawing in pretty volatile fashion between $80 and $97 through March, April and May, the stock picked up a lot of bearish momentum in the first week of this month, dropping below all of its major retracements lines and hitting that $73 low to mark current support this week. Immediate resistance looks to be at around $77, which has been the top end of the stock’s daily activity for the last three or four days. A drop below $73 could see about $4 of downside to next support at about $69, which a push above $77 should find next resistance at around $81 based on prior pivot lows in that area in March and April.

Near-term Keys: Watch the stock’s activity from this point. You can take a bounce off $73 as a sign that the stock’s newest support level is holding, which could provide a strong signal to buy the stock or start working with call options, with a target price at about $77. A drop below $73, on the other hand would be a good signal to consider shorting the stock or buying put options, with a short-term target price at around $69. The company’s generally solid fundamentals, along with the latest drop in price have put the stock at an attractive valuation level, which suggests that if you don’t mind the possibility of additional volatility, OC could provide a good-term long-term opportunity. The long-term is important to keep in mind, since broad momentum, as well as rising interest rates are likely to keep the stock from rebounding strongly in the near term.