Over roughly the last three years, I’ve been writing about the wisdom in being very selective about the investments you make. That includes taking a defensive approach by looking for industries and businesses whose operations aren’t as sensitive to the and ebb and flow of economic growth.

In 2020, Food Products stocks were the clear winners, as consumers clamored to stock up on basic home supplies and other packaged, non-perishable food products, like canned food, prepackaged meat, and so on. Most of the pandemic-induced fear and uncertainty that has been part of daily life for the last two years has given way in 2022 to concerns about inflation that started, but certainly weren’t limited to from still-prevalent, pandemic-associated constraints along with the ongoing war in Ukraine and the pace of interest rate increases. When you think of all of those elements together, along with less-publicized but the reality that COVID-19 hasn’t gone away, it’s really not surprising to see that the market now finds itself in the midst of legitimate bear market.

All of the problems I just described are among the reasons that economists continue to forecast steady demand for household goods, including pantry, fridge and freezer foods, as eating at home versus going out looks like the kind of thing that is becoming a habit resulting from two years of isolation and social distancing as learned behavior. Along with rising consumer prices that force families to look for value to make their household budgets stretch, that could offer a tailwind that makes the Food Products industry a natural fit for anybody that wants to find places to invest that could represent “safe havens” within the market and that aren’t as sensitive to economic downturns and prolonged periods of uncertainty.

Prepackaged food stocks like Hormel Foods Corp (HRL), CPB, and KHC have all been facing significant challenges over the last few years related to changing consumer preferences. HRL occupies a somewhat different niche than some of these other stocks, however because its products fit nicely into that shift towards healthier, organic choices, with a specific emphasis on proteins. That also fits into related reports regarding China, which is increasing protein imports to make up for domestic supply shortages from the swine flu pandemic in 2018 that ravaged its pork capacity and still continues to impact that area. HRL has specifically noted increasing orders for SPAM for China. This is a company that is also taking advantage of opportunities to diversify its business, as last year’s $2.8 billion acquisition of KHC’s Planters-branded snack business gives it a way to begin moderating some of the commodity-driven risk associated with its heavy emphasis on protein products.

A lot of prepackaged food companies have distinct business segments dedicated to foodservice – primarily referring to supply to restaurants – and grocery. One of the interesting ways a number of companies in this industry were forced to adjust in 2020 was to de-emphasize foodservice channels, where forced shutdowns across the globe shuttered restaurants and social dining and focused more on grocery delivery. The recovery of foodservice – which, even though I believe eating at home is likely to be a “sticky” behavior, eating out should continue to see gradual recovery – provides a good potential tailwind that could work in HRL’s favor in the months ahead. HRL’s fundamental profile showed some signs of struggle in the first few quarters of 2021, and that contributed to a downward trend in the stock that didn’t find bottom until late September of last year at around $40.50 before rallying into a upward trend that peaked in April above $55. Since then, however, broad market momentum pushed the stock down to a low this month at around $44, with the stock now just a little above that level. What does that mean for the stock’s fundamentals and value proposition? Are they both improving enough to make the stock a good buy in the current environment, or is there more downside ahead? Let’s find out.

Fundamental and Value Profile

Hormel Foods Corporation is engaged in the production of a range of meat and food products. The Company operates through four segments: Grocery Products, which is engaged in the processing, marketing and sale of shelf-stable food products sold for the retail market and health and also consists of nutrition products, including Muscle Milk protein products.; Refrigerated Foods, which consists of the processing, marketing and sale of branded and unbranded pork, beef, chicken and turkey products for retail, foodservice and fresh product customers; Jennie-O Turkey Store (JOTS), which consists of the processing, marketing and sale of branded and unbranded turkey products for retail, foodservice and fresh product customers; and International & Other, which includes Hormel Foods International Corporation, which manufactures, markets and sells the Company products internationally. HRL’s market cap is about $25.3 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 14.3%, while sales increased by 18.8%. In the last quarter, earnings grew by 9.1%, while sales were 1.7% higher. The company’s margin profile is healthy and stable; over the last twelve months, Net Income was 7.7%, and improved to 8.45% in the most recent quarter.

Free Cash Flow: HRL’s free cash flow was a little under $944 million over the past twelve months and translates to a minimal Free Cash Flow Yield of 3.73%. It should be noted that Free Cash Flow increased from $929.35 million in the last quarter, and about $410.05 million a year ago.

Dividend Yield: HRL’s dividend is $1.04 per share, and translates to a yield of 2.25% at its current price. It is also noteworthy that HRL increased their dividend in 2020 and in 2021; it was $.84 per share on an annualized basis until the end of 2020 and $.98 prior to the last increase. HRL is one of a select list of S&P 500 “dividend aristocrats,” having increased its dividend every year for the last 57 years.

Debt to Equity: HRL has a debt/equity ratio of 0.45. This is a conservative number that I think is a little misleading; more revealing is the fact that this ratio increased from 0.16 about a year ago, coincident to the $2.8 billion acquisition of KHC’s Planters snack business. HRL’s balance sheet also shows about $885.2 million in cash (versus about $1.77 billion at the end of 2020, but $846 million six months ago) and liquid assets against $3.8 billion in long-term debt.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $49.50 per share. That suggests that the stock is somewhat undervalued right now, with 7% downside from its current price, and with a useful discount price at around $39.50.

Technical Profile

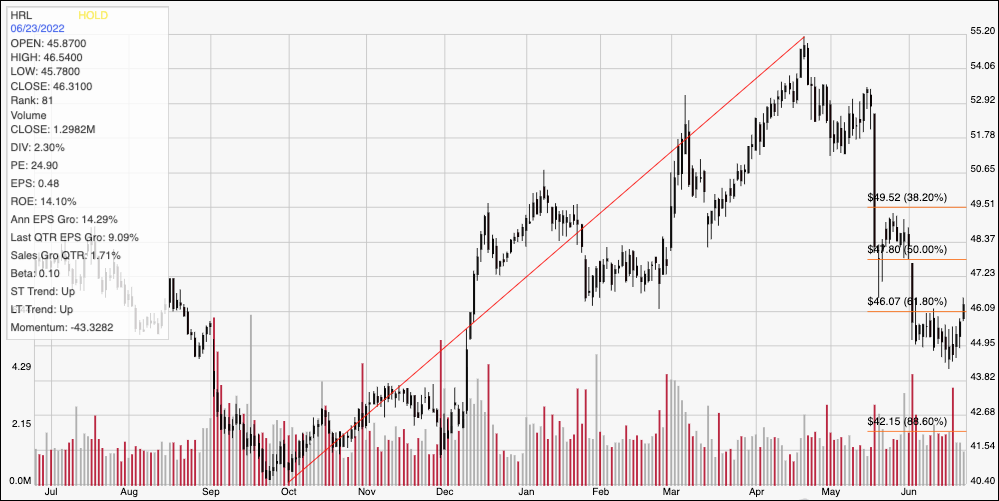

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The diagonal red line traces the stock’s upward trend from from its low point in October of last year at around $40.50 to its high in April above $55. It also acts as the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that peak, the stock has picked up a lot of bearish momentum, breaking below its major retracement lines before finding a pivot low this week at around $44 and pushing just above expected resistance $46 as of this writing. That puts current support at $46, with new, immediate resistance seen at around $47 and right around the 50% retracement line. A push above $47 should have additional upside to about $49.50 before finding next resistance around the 38.2% retracement line. A drop below $46 has next support at the recent pivot low at around $44, with room to fall to about $42 where the 88.6% retracement line sits if selling activity accelerates.

Near-term Keys: HRL’s fundamentals have generally been improving, even as the stock has picked up bearish momentum in the last couple of months. Even with the recent drop, however, the stock is only somewhat undervalued, which means that the best probabilities lie in short-term, momentum-based trading strategies, You could use a push above $47 as a signal to think about buying the stock or working with call options, using $49.50 as a near-term exit target for a short-term bullish trade. A drop below $46 could act as a signal to consider shorting the stock or buying put options, using $44 a practical, quick-hit profit target on a bearish trade and $42 if bearish momentum picks up.