(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Zimbabwe’s central bank raised interest rates to a record and the government officially reintroduced the US dollar as legal currency to rein in surging inflation and stabilize the nation’s tumbling exchange rate.

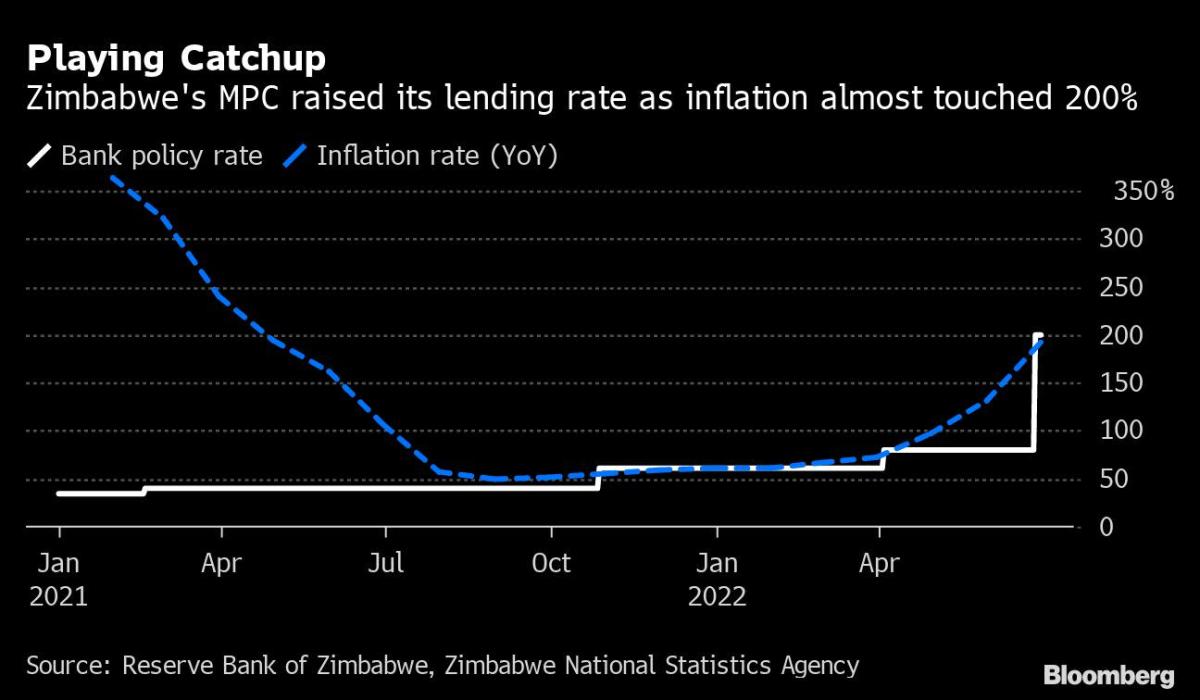

The monetary policy committee more than doubled the key rate to 200% from 80%, Governor John Mangudya said in a statement on Monday. That brings the cumulative increase this year to 14,000 basis points — the most globally.

“The monetary policy committee expressed great concern on the recent rise in inflation,” Mangudya said. “The committee noted that the increase in inflation was undermining consumer demand and confidence and that, if not controlled, it would reverse the significant economic gains achieved over the past two years.”

Central bankers globally have been unleashing what may prove to be the most aggressive tightening of monetary policy since the 1980s to contain runaway inflation, prevent capital outflows and currency weakness as investors hunt for higher yields.

Zimbabwe’s annual inflation rate jumped to the highest level in over a year in June as food costs more than tripled. The increase in prices has been spurred by a sharp depreciation in the Zimbabwe dollar, which has lost more than two-thirds of its value this year and is Africa’s worst-performing currency.

Finance Minister Mthuli Ncube said Monday the government will for the second time in more than a decade legalize the use of the US dollar.

“Government has clearly stated its intention of maintaining a multi-currency system based on dual use of the US dollar and the Zimbabwe dollar,” Ncube told reporters in the capital, Harare. “To eliminate speculation and arbitrage based on this issue, the government has decided to embed the multi-currency system and the continued use of the US dollar into law for a period of five years.”

Among other steps announced by the central bank are an increase in deposit rates to 40% from 12.5% and the introduction of gold coins to provide an alternative store of value. The coins, to be minted by the state-owned Fidelity Gold Refineries Ltd., will be sold to the public through banking channels, Mangudya said, without providing more details.

Plans are also being developed by the central bank to introduce forward-pricing of the currency, Mangudya said. Details will be announced later.

The measures announced on Monday are the latest attempt by the authorities to deal with a currency crisis that stretches back to 2009, when the Zimbabwe dollar was abandoned in favor of the US currency after a bout of hyperinflation. The Zimbabwe dollar was reintroduced in 2019 and immediately began to weaken.

Previous attempts to stop Zimbabwean currency’s collapse have included a 10-day ban on bank lending, restrictions on trades on the Zimbabwe Stock Exchange, allowing companies to pay taxes in the local unit and introducing a new interbank rate at which most commerce will take place.

©2022 Bloomberg L.P.