Growth investing leans heavily on the principle that “a stock tends to follow the direction of its previous trend,” which may just be a nerdy way to say that the longer a stock has been going up, the more likely it is to keep going up. It is also why growth investors shun stocks that are at or near historical lows resulting from downward trends.

Value investing, on the other hand holds that all trends only last so long; every upward trend is doomed to fail at some point, and every downward trend is destined to recover. This is a contrarian, counter-intuitive idea for many because it means that value investors aren’t afraid to buy a stock when the rest of the market has sold it and is staying away. Sometimes, it means buying a stock at what the bargain hunter has decided is useful, and then watching the stock drop even more. That is also a hard thing for a lot of investors to endure, and it is why being a successful investor requires discipline as well as patience. It also means that stocks that have been going up, and that are attractive to growth investors usually draw no more than a shrug from value seekers.

Over the last three and a half years, I’ve used economic uncertainty – first from a year-long trade war through 2019, and then of course the COVID-19 pandemic starting in 2020, and certainly 2022’s focus on inflation, interest rates, and war – as the basis for a defensive approach to a lot of the analysis, I’ve done. I think that when economic conditions become more difficult, defensive positioning by focusing on industries that are traditionally less sensitive to the cyclicality of economic health makes sense. It’s a strategy that has helped me make a number of useful investments since 2018. I also believe that, with global inflation being compounded by the Russia-Ukraine war and forcing interest rates higher, the need to remain conservative, and defensive will continue to be a smart approach for the rest of the year. I also think that means that stocks in the Food Products industry will also be a useful way to keep your money working for you.

The caveat to looking for investments in Food Products stocks is that not all stocks are created equal. Not only do not all companies share the same kind of fundamental strength, it’s also true that not all Food Products might offer a good value. That’s an important distinction to make, because just as a stock in a new, long-term upward trend typically outpaces the underlying company’s fundamental strength, stocks in downward trends aren’t categorically driven by fundamental weakness.

Kroger Company (KR) is the largest traditional food retailer in the United States, and a company that I’ve kept an eye on for some time. This is a stock that followed a strong upward trend through 2021 to a peak in April at almost $63 per share. The stock is down about -23% from that high, putting the stock with a lot of the rest of the market and in its own respective bear market drawdown. KR has been among the most proactive innovators in the entire Consumer Staples industry over the past few years, investing heavily in alternative revenues streams like Kroger Personal Finance and Kroger Precision Marketing, building localized, automated warehouse facilities throughout the U.S. and online shopping and curbside delivery that is now in place in 95% of its coverage area. Many of these initiatives have yielded positive results on the company’s earnings reports, and have enhanced the company’s ability to compete against larger rivals like Wal-Mart and Target Stores, but also represent significant capital investments that have only just begun and are expected to continue for at least the next couple of years. I think the stock’s fundamentals could give a bullish investor good reason to add KR to a diversified portfolio; but that begs the question, has the stock’s latest drop also make it a good value? Let’s dive in and take a look.

Fundamental and Value Profile

The Kroger Co. (KR) manufactures and processes food for sale in its supermarkets. The Company operates supermarkets, multi-department stores, jewelry stores and convenience stores throughout the United States. As of February 3, 2018, it had operated approximately 3,900 owned or leased supermarkets, convenience stores, fine jewelry stores, distribution warehouses and food production plants through divisions, subsidiaries or affiliates. These facilities are located throughout the United States. As of February 3, 2018, Kroger operated, either directly or through its subsidiaries, 2,782 supermarkets under a range of local banner names, of which 2,268 had pharmacies and 1,489 had fuel centers. As of February 3, 2018, the Company offered ClickList and Harris Teeter ExpressLane, personalized, order online, pick up at the store services at 1,056 of its supermarkets. P$$T, Check This Out and Heritage Farm are the three brands. Its other brands include Simple Truth and Simple Truth Organic. KR has a market cap of $33.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 21.85%, while sales improved by 8%. In the last quarter, earnings increased more than 59% while revenues were improved by almost 35%. Like most Food retailers, KR operates with razor-thin margins, as Net Income was about 1.54% of Revenues for the last twelve months, and weakened slightly in the most recent quarter to 1.49%.

Free Cash Flow: KR’s free cash flow is healthy, at $2.65 billion over the last twelve months. That marks a big improvement from $1.9 billion a year ago, but a sizable drop from $3.7 billion in the quarter prior. The current number translates to a free cash flow yield of 7.66%.

Debt to Equity: KR has a debt/equity ratio of 1.39. This is higher than I usually prefer to see, but also isn’t unusual for Food Retailing stocks. The company’s balance sheet indicates that operating profits are more than adequate to repay their debt, and is a sign of strength, with about $2.5 billion in cash and liquid assets (versus $2.9 billion in the quarter prior), against $13 billion in long-term debt. Their long-term debt is a reflection of the capital-intensive investments in itself the company has made to streamline its operations, modernize and automate its own supply chain, and to stay competitive in its market. I take the decline in Free Cash Flow and cash as a reflection of cost increases that KR has actively chosen not to fully pass to their customers, and that some analysts are pointing at as a potential headwind to profitability into the end of this year and into 2023.

Dividend: KR pays an annual dividend of $1.04, which marks an increase from $.64 per share in early 2020, $.72 per share at the beginning of 2021 and $.84 prior to the last earnings report. The current payout translates to a yield of about 2.16% at the stock’s current price. The increasing dividend over the last two years should be taken as a sign of management’s confidence in their operating model and ability to keep the business growing in the long term.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $43 per share. That means that even with the stock’s drop over the last two months, KR is overvalued, with -10% downside from its current price, and a practical bargain price at around $34.50. It is worth nothing that prior to the company’s latest earnings data, this analysis yielded a fair value target at around $56.

Technical Profile

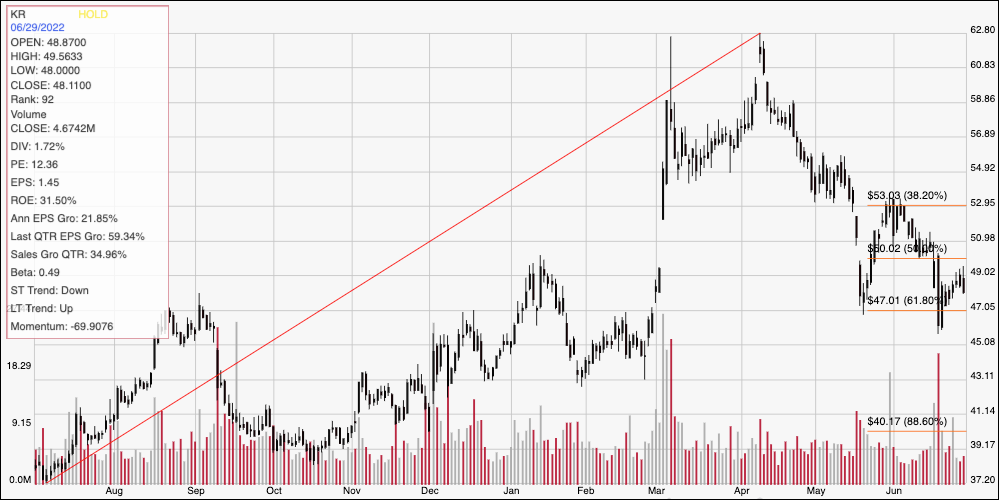

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price movement for KR. The red diagonal line marks the stock’s upward trend from a low point at around $37 in July of last year to its April peak at around $63; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock dropped off of that high and hit a downward trend low point at around $47 to mark current support at that level. Immediate resistance is at around $49. A push above $49 should have upside to about $53 to next resistance where the 38.2% retracement line sits, while a drop below $47 could see the stock fall to somewhere between $43 and $45.

Near-term Keys: Even with it’s recent slide off of its 52-week high and into bear market territory, KR still doesn’t offer a useful value proposition. That means that the best opportunities to work with this stock lie in short-term trading opportunities. A push above $49 could provide a signal to think about buying the stock or working with call options, with a useful, near-term profit target around $53 per share. If the stock drops below $47, you could also consider shorting the stock or buying put options, using $45 as a practical profit target on a bearish trade.