(Bloomberg) — A pall of gloom descended on global markets as former Japanese Prime Minister Shinzo Abe was shot to death.

The news was a further blow to investors already reeling under the worst economic challenges since the 2008 financial crisis. They sent US stock-index futures European equities lower as they awaited employment data to gauge whether the world’s largest economy can avoid a recession. The dollar found haven demand.

Contracts on the S&P 500 and Nasdaq 100 gauges fell at least 0.4% each, signaling US stocks will pare weekly gains. The Stoxx Europe 600 Index halted a two-day rally. Treasuries rose, with the 10-year yield shedding 2 basis points. The Bloomberg Commodity Index headed for the longest streak of weekly losses since March 2020.

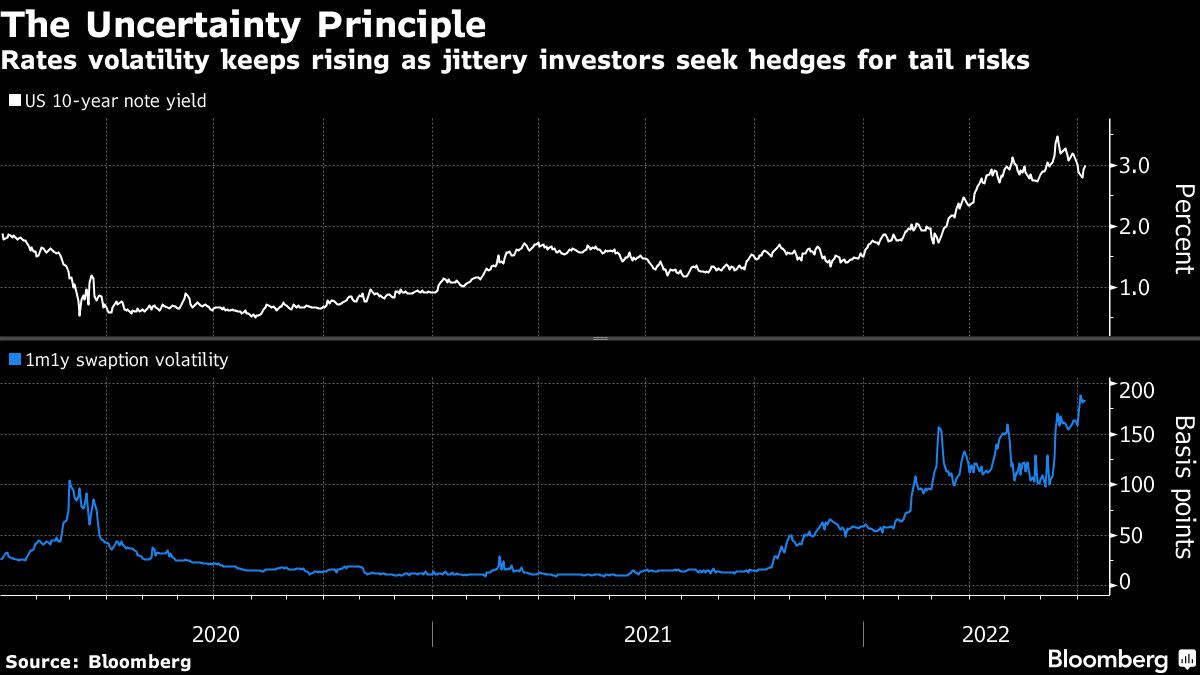

Global markets are repositioning for the possibility of a US recession as the Federal Reserve delivers successive rate hikes to tame elevated inflation. Two of the Fed’s most hawkish policy makers backed raising interest rates another 75 basis points this month, while playing down recession fears. Investors suspended their judgment on the question, keeping portions of the US yield curve inverted and awaiting Friday’s nonfarm payrolls report.

“With the recession talk taking centerstage, investors are increasingly focused on the jobs figures,” Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, wrote in a note. “A strong read could bring forward the idea that the US economy could soft-land despite tighter Fed policy, or that the Fed would allow itself to get more aggressive to fight inflation.”

As investors received the shocking news from Japan, Asian stocks pared an increase and the yen, a haven asset, strengthened. Before the shooting, the possibility of 1.5 trillion yuan ($220 billion) of stimulus in China, mostly for infrastructure, had aided sentiment.

On Thursday, Governor Christopher Waller and James Bullard, president of the St. Louis Fed, both stressed the need to get policy into restrictive territory to confront the hottest price pressures in 40 years, even if this meant slowing growth. Both are voting members of the Federal Open Market Committee this year.

Treasuries rose on Friday, with the two- and 10-year yield curve remaining inverted for a fourth day. Slowdown fears dogged Europe too, where the keenly watched yield spread between Italy and Germany narrowed 4 basis points, even as the region’s central bank was expected to begin monetary tightening.

The Bloomberg commodity gauge was on course for its fourth weekly loss. West Texas Intermediate oil futures traded below $103 a barrel, putting the US benchmark on course for a weekly drop of more than 5%.

Bitcoin versus Ether? Stablecoins versus central bank digital currencies? What are NFTs really? What is the next shoe to drop in the crypto washout and where will the next bubble inflate? Click here to participate in this week’s MLIV Pulse survey, which takes only one minute and is anonymous.

Some of the main moves in markets:

Stocks

- The Stoxx Europe 600 fell 0.1% as of 9:57 a.m. London time

- Futures on the S&P 500 fell 0.4%

- Futures on the Nasdaq 100 fell 0.5%

- Futures on the Dow Jones Industrial Average fell 0.3%

- The MSCI Asia Pacific Index rose 0.4%

- The MSCI Emerging Markets Index rose 0.4%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro fell 0.5% to $1.0112

- The Japanese yen rose 0.2% to 135.76 per dollar

- The offshore yuan fell 0.2% to 6.7045 per dollar

- The British pound fell 0.7% to $1.1937

Bonds

- The yield on 10-year Treasuries declined two basis points to 2.98%

- Germany’s 10-year yield declined five basis points to 1.27%

- Britain’s 10-year yield was little changed at 2.13%

Commodities

- Brent crude fell 0.1% to $104.50 a barrel

- Spot gold fell 0.1% to $1,737.82 an ounce

©2022 Bloomberg L.P.