(Bloomberg) — Investors are losing one of their few places of refuge in this year’s stock market plunge, as the selloff in energy shares that started last month is leaving them with nowhere to hide.

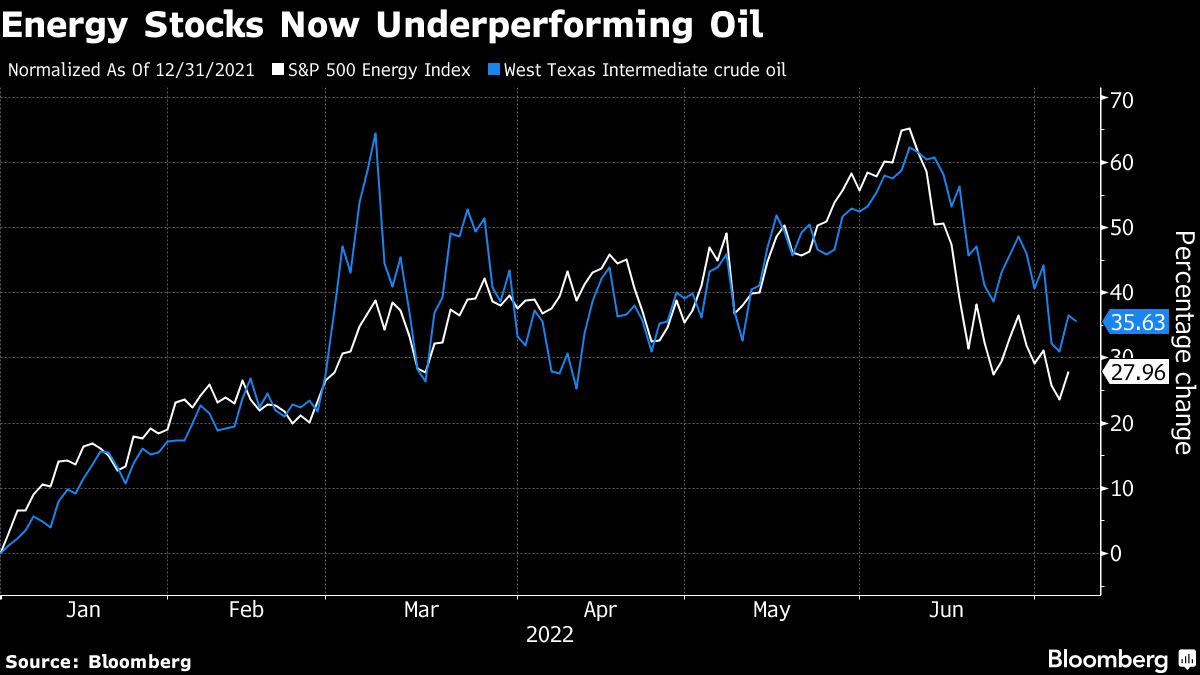

Energy is the worst performing group in the S&P 500 Index over the past five sessions and is in the red again Friday. The S&P 500 Energy Sector index is down 18% since the start of last month, compared with a 6% decline in the S&P 500. The stocks are even underperforming the 9% drop in West Texas Intermediate crude.

That said, energy remains the lone S&P sector to rise this year after beating the broader market for 20 months through May.

However, the troubling news has been coming in waves. Just this week, the US Energy Information Administration released crude oil storage data that was “negative for the oil complex,” showing an unexpected build of 8.2 million barrels, MKM Partners analyst Leo Mariani wrote in a note. The figures are “bearish for crude over the longer term” because they imply “that the market is oversupplied,” he wrote.

That’s a change from the spring, when energy stocks were among the most attractive options for both value and momentum traders, said Stifel portfolio strategist James Hodgins. The problem is a handful of factors that propelled energy’s rise — such as economies reopening after the pandemic and Russia’s invasion of Ukraine depleting global supplies — have dissipated.

The other factor weighing on the group is the prospect of a recession, the severity of which will affect oil prices and, by extension, energy stocks. That said, crude also could get a lift from the reopening of China’s economy from severe Covid restrictions and its massive stimulus spending plan.

“I think we’ve got a few choppy months, but China is re-flating,” Hodgins said. He sees energy reaching a “bottom by the fall.”

The sector could also benefit from valuations, which remain relatively low. “I do think it got too hot, too fast, but these companies are still really, really cheap,” said Brompton Group chief investment officer Laura Lau.

Wall Street remains bullish on energy shares despite a wave of price target cuts on oil stocks. Two-thirds of the companies in the S&P 500 Energy Index have buy rating, according to data compiled by Bloomberg. It’s one of the best-rated industries in the market, behind information technology and real estate. Analysts see an average 31% return for stocks in the energy index, compared with 26% for the broader S&P 500.

“The correction was swift and it was damaging,” said Cole Smead, president and portfolio manager at Phoenix-based Smead Capital Management. The recent volatility is likely to push generalists and retail investors out of the sector, he said. However, that same volatility makes the sector more attractive to investors looking at a tight physical oil market.

Smead believes the recent decline in oil prices is driven by speculation rather than fundamentals. Oil and gas companies are hedging less of their production and therefore aren’t as active in oil futures trading, leaving the market more prone to speculative swings, he said.

Still, oil and gas stocks should continue their outperformance in light of the tight crude supplies and high inflation, Smead said.

©2022 Bloomberg L.P.