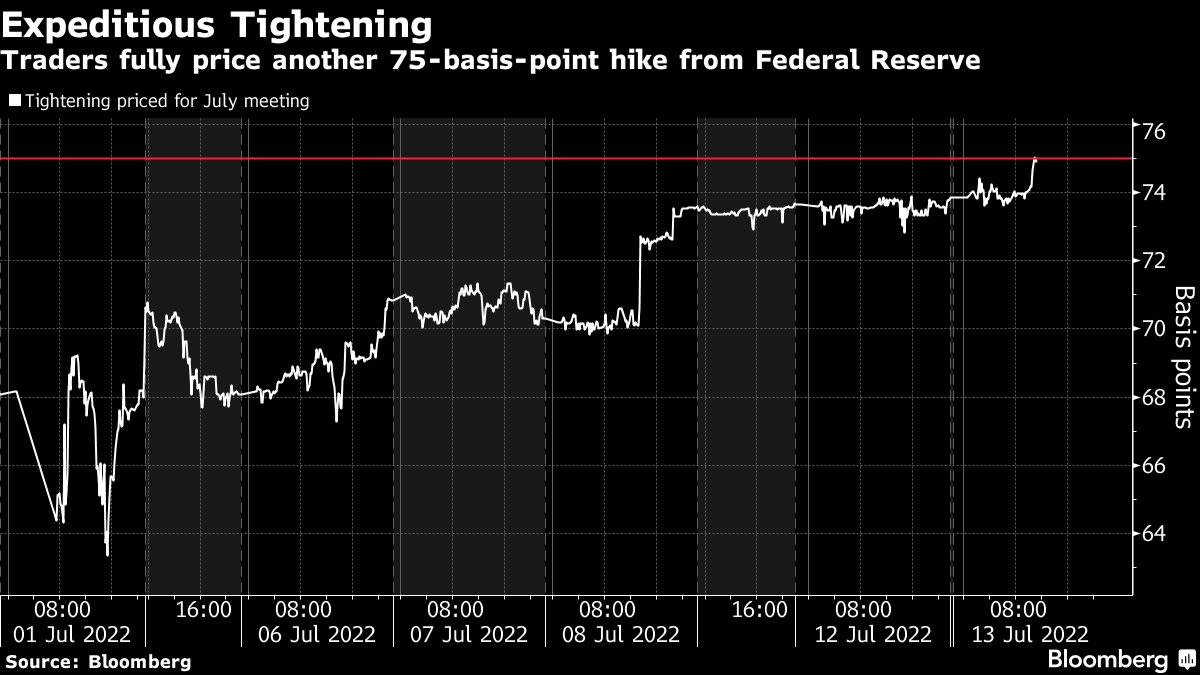

(Bloomberg) — Money markets are betting on a three-quarter percentage-point hike by Federal Reserve officials later this month, wagering the US will need to ramp up the pace of monetary tightening to tame inflation.

The repricing comes ahead of a key inflation report due Wednesday. The headline figure for June is set to accelerate to 8.8% year over year, the highest since 1981, according to the median estimate of analysts surveyed by Bloomberg.

“I believe a 75-basis-point hike in July is a fait accompli,” said Kristina Hooper, chief global market strategist at Invesco. “The Fed needs to stay aggressive now so it can assess the situation in September and possibly take a less aggressive path of tightening in the fourth quarter.”

Tightening expectations were pared to as low as 63 basis points two weeks ago amid concerns that excessive rate hikes might tip the US toward a recession. Still, few doubt the Fed’s resolve to tighten rapidly in the short-term with price pressures remaining hot. A 75-basis-point increase would be the second in a row of that magnitude.

The Fed boosted the target to a range of 1.5% to 1.75% in June, the largest hike since 1994. Fed Chair Jerome Powell said after last month’s meeting that either a move of 50 or 75 basis points was on the table when policy makers gather July 26-27.

“There could be room for the 75bp expectations at the July meeting to squeeze a bit higher, in case the Fed feels the need to slam the brakes on more quickly,” said Peter Chatwell, head of global macro strategies trading at Mizuho International Plc, pointing to the risk of a higher-than-expected inflation reading.

©2022 Bloomberg L.P.