(Bloomberg) — As if another inflation shock and earnings drama at big banks weren’t enough for stock investors, Friday brings a critical moment where many option traders must decide their next move on hedging.

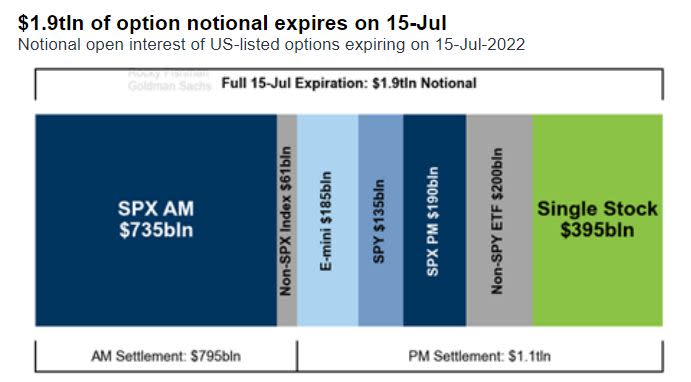

About $1.9 trillion of options are set to expire, obliging investors to either roll over existing positions or start new ones. The monthly event includes $925 billion of S&P 500-linked contracts and $395 billion of derivatives across single stocks scheduled to run out, Goldman Sachs Group Inc. estimates.

With the S&P 500 down more than 20% from its January peak, a question looming large is how much insurance a long investor actually needs. Intraday volatility has whipped up this week — though that included two straight sessions in which the Nasdaq 100 reversed major dips. The decision of whether to renew hedges is a complicated one for professional speculators.

“A lot of investors and traders have been in cash, or higher cash than they were at the beginning of year and so have less of a need to hedge,” said Michael Purves, founder of Tallbacken Capital Advisors. “A lot has been priced in.”

With daily options volume heading for an annual record, the expiration is a widely watched event on Wall Street. Moves in the derivative market have the capacity to spur gyrations in underlying securities. There are signs that demand for options hedging is waning as money managers have cut their equity exposure and some opted for other ways such as index shorting for protection during the rout.

Stocks fell for a fifth day as disappointing results from JPMorgan Chase & Co. and Morgan Stanley added to growth worries. Earlier this week, a hotter-than-expected inflation reading prompted traders to bet on faster rate hikes from the Federal Reserve, driving the spread over 2-year and 10-year Treasury yields deeper into an inversion, a widely followed signal for a potential recession.

The S&P 500 dropped 2.1% earlier Thursday before erasing most of the loss to close at 3,790.38. Since reaching its 2022 low of 3,666.77 in mid-June, the index has been fluctuating within a 250-point band.

Unlike the Treasury market, where option activity has shown heightened angst not seen since the pandemic crisis, the mood in equities is more sanguine. The Cboe Volatility Index, or VIX, has yet to take out its March peak even as stock losses kept worsening, a sign that many market watchers consider as a lack of panic.

“There is some existential sense that VIX should be sharply higher because investor sentiment is bad and getting worse,” said Steven Sears, president of Options Solutions. “Options expiration always intrigues market watchers like reading tea leaves fascinates fortune tellers.”

Among expiring options contracts linked to the S&P 500, the strike price of 4,000 has garnered the highest open interest, based on data compiled by Bloomberg. Yet to Brent Kochuba, founder of analytic service SpotGamma, the level of 3,800 is more significant, as it’s closer to where the index sits. Right now, 24,195 calls and 35,528 puts are set to run out at that strike.

By one measure, the cost of hedging is rather suppressed. The skew for the S&P 500, which compare the relative costs of puts versus calls, has hovered around a three-year low, data compiled by Bloomberg show.

“We remain of the opinion that markets won’t bounce until there is more clear guidance in terms of rates, and the earliest that could be offered is FOMC,” Kochuba said, referring to the Fed’s next policy meeting on July 27. “If markets do wade lower here, it could force a rather nasty put buying (both long & cover) which could compound volatility.”

©2022 Bloomberg L.P.