(Bloomberg) — Investors slashed their exposure to risk assets to levels not seen even during the global financial crisis in a sign of full capitulation amid a “dire” economic outlook, according to Bank of America Corp.’s monthly fund manager survey.

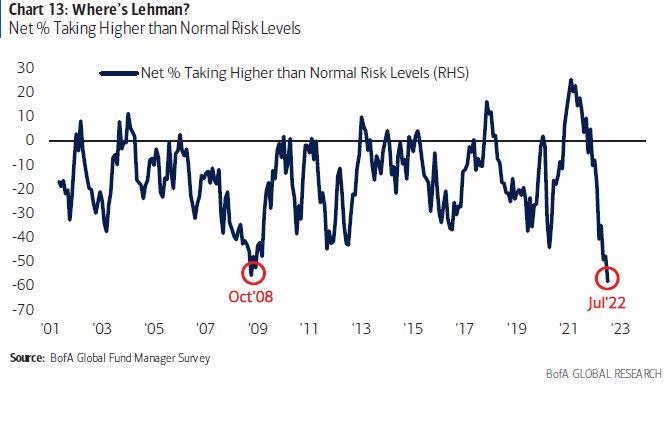

Global growth and profit expectations sank to an all-time low, while recession expectations were at their highest since the pandemic-fueled slowdown in May 2020, strategists led by Michael Hartnett wrote in the note. Investor allocation to stocks plunged to levels last seen in October 2008 while exposure to cash surged to the highest since 2001, according to the survey. A net 58% of fund managers said they’re taking lower than normal risks, a record that surpassed the survey’s global financial crisis levels.

Bank of America’s survey, which included 259 participants with $722 billion under management in the week through July 15, said high inflation is now seen as the biggest tail risk, followed by a global recession, hawkish central banks and systemic credit events. At the same time, the most investors since the global financial crisis are betting that inflation will be lower in the next year, which means lower interest rates, according to the poll.

The survey’s findings highlight this year’s flight from risk assets, which has sent the S&P 500 Index into a bear market and led European stocks to their worst six-month drop since 2008. Although optimism is brewing again that US inflation could be nearing a peak, sentiment remains subdued with risks around a potential economic contraction remaining high. A looming energy crisis in Europe has also added to the uncertainty.

Bank of America strategists said their custom bull & bear indicator remains “max bearish,” which could be a contrarian signal for a short-term rally.

“Second half 2022 fundamentals are poor but sentiment says stocks/credit rally in coming weeks,” strategists wrote.

US stocks have been trying to rebound in July after the S&P 500’s worst first-half since 1970 and the benchmark’s futures were up 0.9% by 6:31 a.m. in New York, setting up stocks to resume gains after they declined on Monday. Thin volumes after the selloff this year have left the market prone to quick swings, with one measure showing the S&P 500 is on course for its most volatile year since the global financial crisis.

Other survey highlights include:

- Investors are very long cash and defensives like staples, utilities, health care, and very short stocks, particularly EU, banks, tech and consumer, while they have also cut exposure to resources

- Most crowded trades are long US dollar, long oil and commodities, long ESG assets, long cash and short US Treasuries

- Among equity regions, investors are most bearish on Eurozone and Japan

- Investors are most bullish cash and most bearish on equities

- In past 4 weeks, investors increased their exposure to bonds, staples, utilities, healthcare, while slashing exposure to equities, Eurozone, materials and banks

©2022 Bloomberg L.P.