(Bloomberg) — US equity futures fluctuated with stocks Wednesday amid rising concern that Europe will lose access to Russian gas, sending the region into a recession that could have global repercussions.

Contracts on the Nasdaq 100 and the S&P 500 erased early gains to trade slightly lower, along with the Stoxx 600 Index. In the premarket, Netflix rose 7.5% after it reported better-than-feared earnings late on Tuesday and said it expects to return to subscriber growth before the end of the year.

Treasuries rose with the dollar, pushing the 10-year yield below 3%. The euro held its ground near a two-week high against the dollar on the possibility of a bigger-than-expected European Central Bank interest-rate hike Thursday.

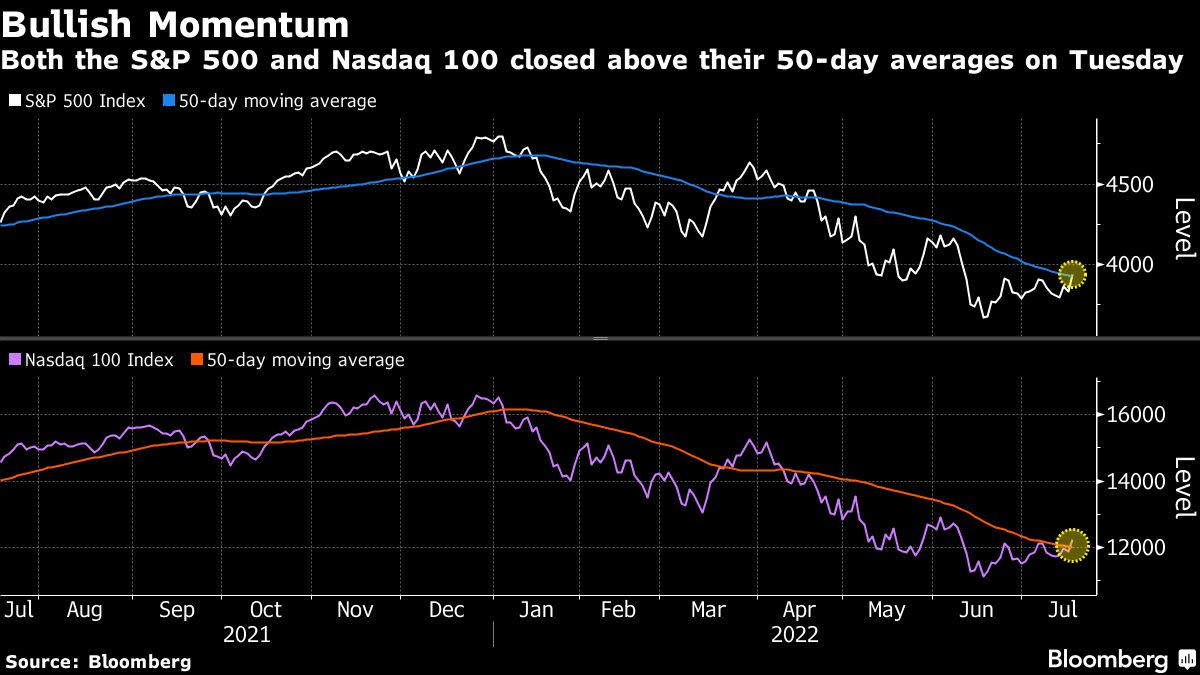

Speculation that company earnings will hold up and that the Federal Reserve will avoid very aggressive monetary tightening is giving investors some hope.

Yet the risk of a global downturn and Europe’s energy crisis is keeping investors on edge.

The European Union is preparing for a scenario in which Russia halts gas exports to retaliate against sanctions over its invasion of Ukraine. The EU proposed that the bloc cut its natural gas consumption by 15% over the next eight months to ensure that any full Russian cutoff of natural gas supplies won’t disrupt industries over the winter.

Read more: EU Proposes 15% Cut in Gas Consumption on Russian Supply Concern

Pessimism is hard for investors to shake after they endured the worst combined first-half losses on stocks and bonds around the world on record, with $8 trillion wiped off the S&P 500 alone.

West Texas Intermediate crude oil slipped below $103 a barrel. Bitcoin hovered above $23,000 after climbing out of a one-month-old trading range.

How far will the Fed go in this hiking cycle? It takes one minute to participate in the confidential MLIV Pulse survey, so please click here to get involved.

Key events to watch this week:

- Earnings this week include Tesla

- Bank of Japan, European Central Bank rate decisions. Thursday

- Nord Stream 1 pipeline scheduled to reopen following maintenance. Thursday

©2022 Bloomberg L.P.