(Bloomberg) — Tuesday’s broad, strong stock-market bounce has raised hopes for a sustainable US equity rally, but some money managers are urging caution about investors getting ahead of themselves.

JPMorgan Asset Management continues to see downside risk to corporate earnings which could weigh on stocks, while American Century Investment is waiting for more visibility on the US economy, not least confirmation that a peak in core inflation has been reached.

“It’s a risky bet to pile into stocks right now,” said Richard Weiss, American Century’s chief investment officer of multi-asset strategies. “We agree the stock market tends to peer out maybe six, 12 months ahead. But we don’t even have a sight of how deep or prolonged this slowdown, if not recession, is gonna be.”

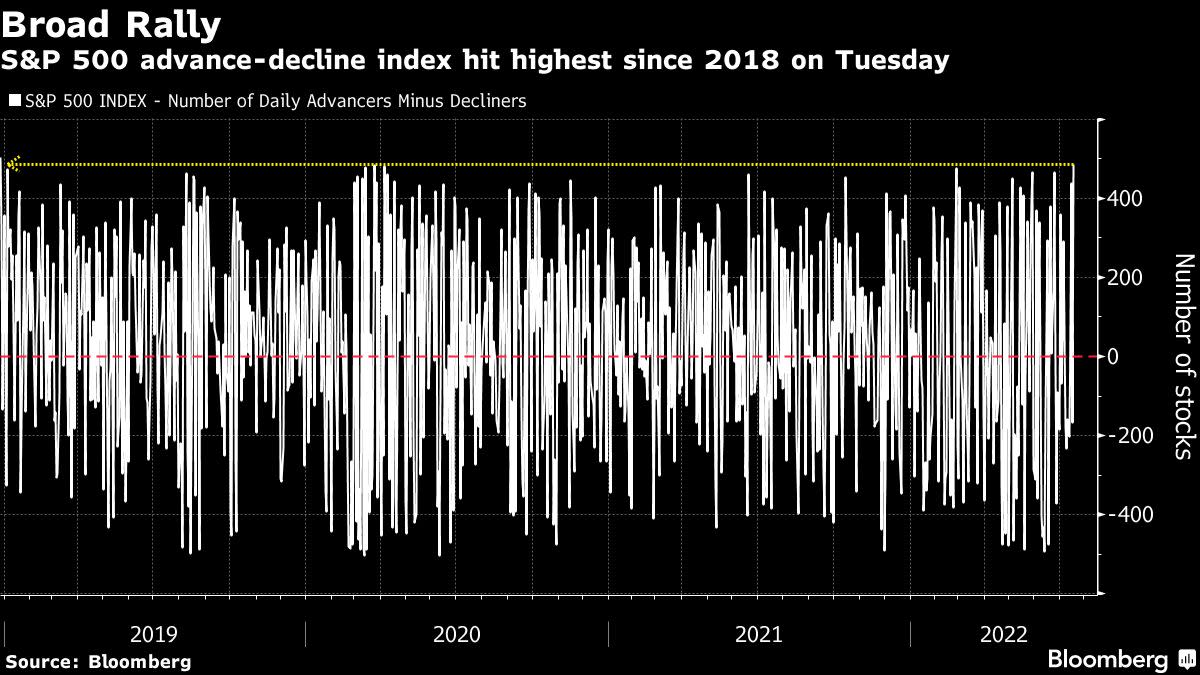

Every sector in the S&P 500 advanced Tuesday, with seven rising by more than 3%, and only nine stocks in the entire benchmark declined. A positive run of corporate earnings and contrarian signs that investors have already capitulated via the latest Bank of America fund manager survey, helped boost risk sentiment.

US futures pointed to further gains Wednesday.

But traders can’t gauge where the economy is going in the future from today’s earnings reports, argued Weiss.

“Remember, corporate earnings are a coincident indicator at best,” he said. “They tell you where you are, maybe even at worst where you’ve been, it’s like looking in the rear-view mirror almost.”

For Jin Yuejue, multi-asset solutions investment specialist at JPMorgan Asset Management, investors have to brace for an extended period of sub-trend growth. That means for her team a defensive positioning across their portfolio, she said.

“Our view right now is actually continue to be quite cautious on the market,” Hong Kong-based Jin said on Bloomberg Radio Wednesday. “We are underweight in equities, we do think there’s downside risk to margins and revenues in the next six to 12 months.”

Still, not every investor is expected to play the market defensively

“Everyone is underweight equities and overweight cash, ‘everyone’ expects earnings season to be terrible, but ‘everyone’ is waiting for the earnings reset to begin buying equities,” wrote Christopher Murphy, co-head of derivatives strategy at Susquehanna International Group in a note. “Given all that, some investors may be figuring ‘why wait’?”

©2022 Bloomberg L.P.